Www Taxformfinder Orgcaliforniaform 100 SCalifornia Shareholder's Share of Income, Deductions, Credits 2021

What is the Www taxformfinder orgcaliforniaform 100 sCalifornia Shareholder's Share Of Income, Deductions, Credits

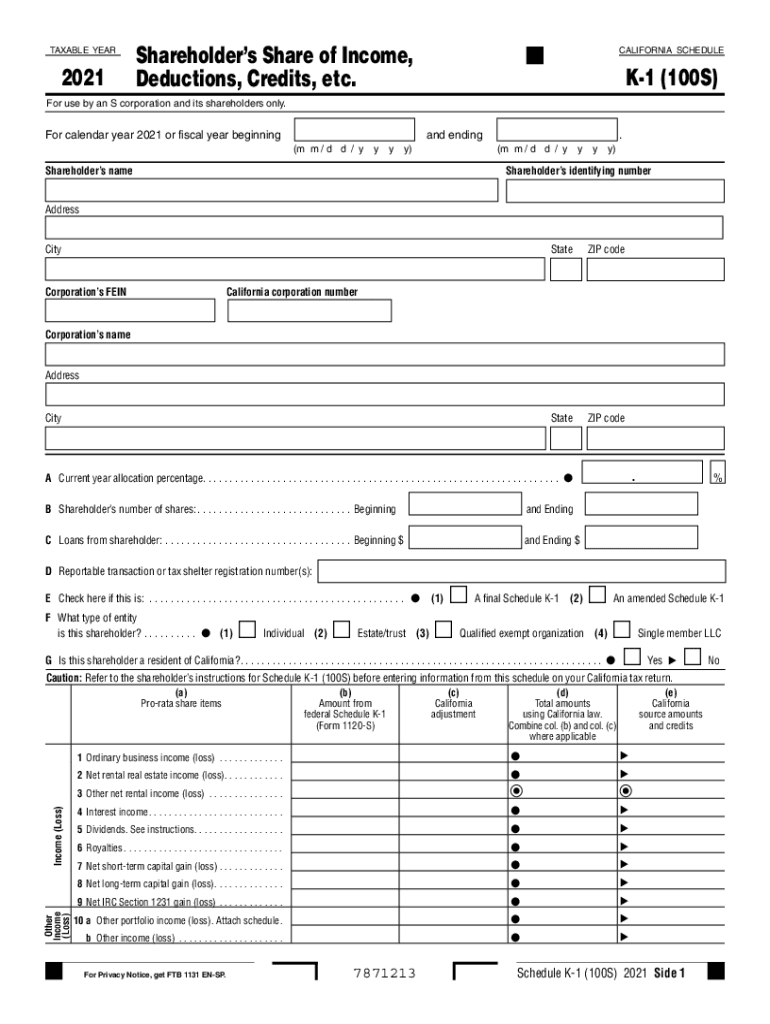

The California Form 100 S, also known as the California Shareholder's Share of Income, Deductions, and Credits, is a tax form used by S corporations in California. This form is essential for reporting the income, deductions, and credits that are allocated to shareholders. It ensures that shareholders can accurately report their share of the corporation's tax obligations on their personal tax returns. The form provides a breakdown of each shareholder's share of income, which is crucial for tax compliance and accurate financial reporting.

Steps to complete the Www taxformfinder orgcaliforniaform 100 sCalifornia Shareholder's Share Of Income, Deductions, Credits

Completing the California Form 100 S involves several key steps:

- Gather Required Information: Collect all necessary financial documents, including income statements, deduction records, and any applicable credits.

- Fill Out the Form: Input the relevant information for each shareholder, including their share of income, deductions, and credits. Ensure accuracy to avoid penalties.

- Review and Verify: Double-check all entries for correctness. It's important to ensure that all calculations are accurate and that no information is omitted.

- Submit the Form: Choose your submission method, whether online, by mail, or in person, and ensure that it is sent before the deadline.

Legal use of the Www taxformfinder orgcaliforniaform 100 sCalifornia Shareholder's Share Of Income, Deductions, Credits

The California Form 100 S is legally binding when completed and submitted according to state regulations. To ensure its legal validity, it must be signed by an authorized representative of the S corporation. Additionally, compliance with eSignature laws is critical if the form is submitted electronically. The use of a secure digital signature platform can enhance the legal standing of the document, ensuring that it meets all necessary legal requirements.

Key elements of the Www taxformfinder orgcaliforniaform 100 sCalifornia Shareholder's Share Of Income, Deductions, Credits

Key elements of the California Form 100 S include:

- Shareholder Information: Details about each shareholder, including names, addresses, and identification numbers.

- Income Reporting: A breakdown of the income earned by the S corporation and how it is allocated to each shareholder.

- Deductions and Credits: Information on deductions and credits available to shareholders, which can reduce their taxable income.

- Signature Section: A designated area for the authorized representative's signature, affirming the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the California Form 100 S are crucial for compliance. Typically, the form must be filed by the 15th day of the third month following the close of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is March 15. It is important to stay informed about any changes to these dates, as late submissions may result in penalties.

Form Submission Methods (Online / Mail / In-Person)

The California Form 100 S can be submitted through various methods:

- Online Submission: Many corporations opt to file electronically through the California Franchise Tax Board's online portal, which can expedite processing.

- Mail Submission: The form can be printed and mailed to the appropriate address provided by the California Franchise Tax Board.

- In-Person Submission: Corporations may also choose to deliver the form in person at designated tax offices, ensuring immediate receipt.

Quick guide on how to complete wwwtaxformfinderorgcaliforniaform 100 scalifornia shareholders share of income deductions credits

Prepare Www taxformfinder orgcaliforniaform 100 sCalifornia Shareholder's Share Of Income, Deductions, Credits effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed forms, allowing you to locate the appropriate template and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly and without interruptions. Manage Www taxformfinder orgcaliforniaform 100 sCalifornia Shareholder's Share Of Income, Deductions, Credits on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to alter and eSign Www taxformfinder orgcaliforniaform 100 sCalifornia Shareholder's Share Of Income, Deductions, Credits with ease

- Find Www taxformfinder orgcaliforniaform 100 sCalifornia Shareholder's Share Of Income, Deductions, Credits and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that use.

- Generate your signature using the Sign feature, which takes mere moments and carries the same legal validity as a conventional wet ink signature.

- Verify the details and then click the Done button to save your changes.

- Choose how you would like to share your form, via email, text message (SMS), or a sharing link, or download it to your computer.

Eliminate the hassle of lost or misplaced papers, tedious document searches, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Www taxformfinder orgcaliforniaform 100 sCalifornia Shareholder's Share Of Income, Deductions, Credits to ensure superior communication throughout the document preparation procedure with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwtaxformfinderorgcaliforniaform 100 scalifornia shareholders share of income deductions credits

Create this form in 5 minutes!

People also ask

-

What is Www taxformfinder orgcaliforniaform 100 sCalifornia Shareholder's Share Of Income, Deductions, Credits?

Www taxformfinder orgcaliforniaform 100 sCalifornia Shareholder's Share Of Income, Deductions, Credits refers to a specific tax form required for California shareholders. This form details the distribution of income, deductions, and credits among shareholders in California corporations. Understanding this form is crucial for accurate tax reporting and compliance.

-

How can airSlate SignNow assist with the completion of the California Form 100?

airSlate SignNow simplifies the process of completing the California Form 100 by providing digital tools that allow you to easily fill out and eSign documents. With intuitive features, you can collaborate with stakeholders and ensure all necessary information is included. This helps streamline your tax filing process involving Www taxformfinder orgcaliforniaform 100 sCalifornia Shareholder's Share Of Income, Deductions, Credits.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers various pricing plans to accommodate different business needs, starting from a basic plan to more advanced options. Each plan provides features suited for document management, including the handling of forms like Www taxformfinder orgcaliforniaform 100 sCalifornia Shareholder's Share Of Income, Deductions, Credits. You can choose a plan that best fits your volume of transactions and required functionalities.

-

Are there any integrations available with airSlate SignNow for tax preparation software?

Yes, airSlate SignNow offers seamless integrations with popular tax preparation software, making it easier to manage forms like Www taxformfinder orgcaliforniaform 100 sCalifornia Shareholder's Share Of Income, Deductions, Credits. This interoperability ensures that your data flows smoothly between platforms, enhancing your efficiency during tax season.

-

What features does airSlate SignNow provide to manage tax documents effectively?

airSlate SignNow includes features such as electronic signatures, document templates, and real-time collaboration, which are essential for managing tax documents. Specifically, when dealing with Www taxformfinder orgcaliforniaform 100 sCalifornia Shareholder's Share Of Income, Deductions, Credits, these features ensure accuracy and save time in the filing process.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Absolutely, airSlate SignNow prioritizes security with bank-grade encryption and compliance with various regulations, ensuring that your documents, including Www taxformfinder orgcaliforniaform 100 sCalifornia Shareholder's Share Of Income, Deductions, Credits, are safe. You can confidently manage your sensitive tax information knowing it’s protected against unauthorized access.

-

Can I track the status of documents sent through airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of documents you send for signing, which is especially useful for important tax forms like Www taxformfinder orgcaliforniaform 100 sCalifornia Shareholder's Share Of Income, Deductions, Credits. You receive notifications when recipients view and sign your documents, granting you peace of mind throughout the process.

Get more for Www taxformfinder orgcaliforniaform 100 sCalifornia Shareholder's Share Of Income, Deductions, Credits

Find out other Www taxformfinder orgcaliforniaform 100 sCalifornia Shareholder's Share Of Income, Deductions, Credits

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile