Underpayment of Estimated Tax by Individuals REV 1630 FormsPublications 2023-2026

Understanding the 2023 REV 1630 Form

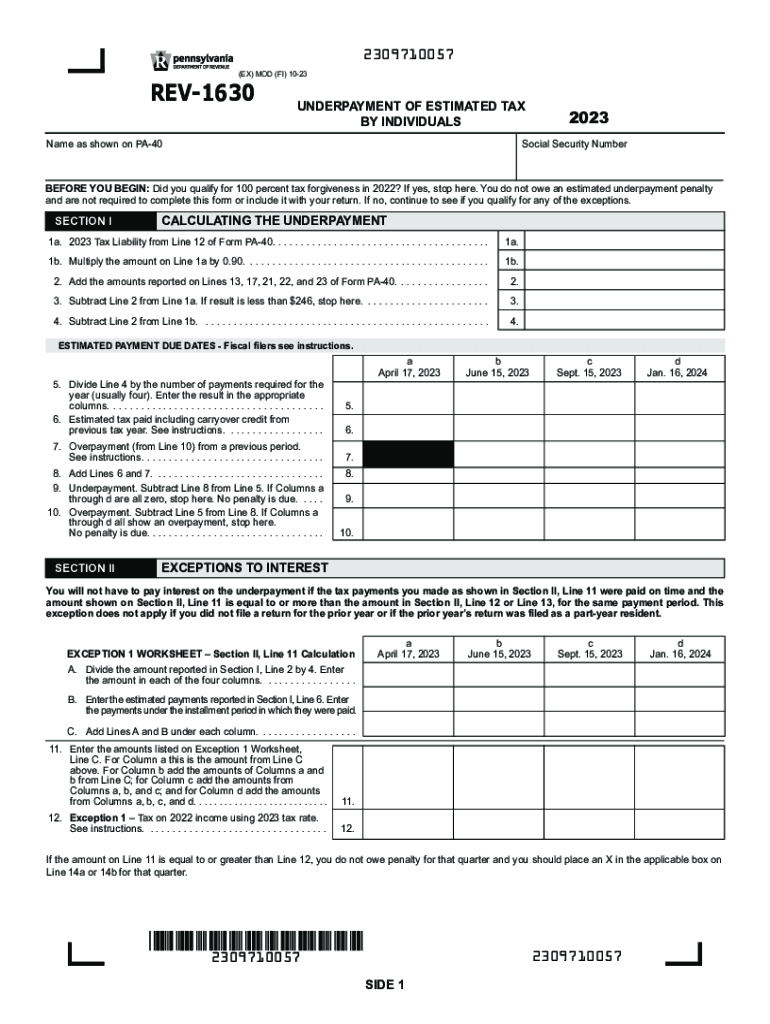

The 2023 REV 1630 form, officially known as the Underpayment of Estimated Tax by Individuals, is a crucial document for taxpayers in Pennsylvania. This form is specifically designed for individuals who may not have paid enough estimated tax throughout the year. It allows taxpayers to calculate any potential underpayment and assess penalties that may apply. Understanding this form is essential for ensuring compliance with state tax regulations and avoiding unnecessary penalties.

Steps to Complete the 2023 REV 1630 Form

Completing the 2023 REV 1630 form involves several key steps:

- Gather your financial documents, including income statements and previous tax returns.

- Calculate your total income for the year and estimate your tax liability.

- Determine the amount of tax you have already paid through withholding or estimated payments.

- Use the form to compare your estimated tax liability with the amount paid to identify any underpayment.

- Follow the instructions on the form to report your findings and calculate any penalties, if applicable.

Legal Use of the 2023 REV 1630 Form

The 2023 REV 1630 form is legally required for Pennsylvania residents who have underpaid their estimated taxes. Filing this form ensures that taxpayers comply with state tax laws and helps avoid further penalties. It is important to submit the form accurately and on time to maintain good standing with the Pennsylvania Department of Revenue.

Filing Deadlines for the 2023 REV 1630 Form

Timely filing of the 2023 REV 1630 form is essential to avoid penalties. The deadlines typically align with the state tax filing schedule. Taxpayers should be aware of the specific dates for submitting their estimated taxes and the REV 1630 form to ensure compliance. Missing these deadlines could result in additional fees or interest on unpaid taxes.

Key Elements of the 2023 REV 1630 Form

The 2023 REV 1630 form includes several important sections that taxpayers must complete:

- Personal information, including name, address, and Social Security number.

- Calculation of total income and estimated tax liability.

- Details on payments made towards estimated taxes.

- Penalties for underpayment, if applicable.

Each section must be filled out accurately to ensure proper processing by the Pennsylvania Department of Revenue.

Examples of Using the 2023 REV 1630 Form

Taxpayers may find themselves needing to use the 2023 REV 1630 form in various scenarios, such as:

- A self-employed individual who has not paid enough estimated taxes throughout the year.

- A retiree with fluctuating income who fails to meet the estimated tax payment thresholds.

- Individuals with significant investment income that was not accounted for in their regular withholding.

Each of these scenarios highlights the importance of accurately assessing tax obligations and using the REV 1630 form to address any underpayment issues.

Create this form in 5 minutes or less

Find and fill out the correct underpayment of estimated tax by individuals rev 1630 formspublications

Create this form in 5 minutes!

How to create an eSignature for the underpayment of estimated tax by individuals rev 1630 formspublications

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2023 rev 1630 version of airSlate SignNow?

The 2023 rev 1630 version of airSlate SignNow introduces enhanced features for document management and eSigning. This update focuses on improving user experience and streamlining workflows, making it easier for businesses to manage their documents efficiently.

-

How does airSlate SignNow's pricing structure work for the 2023 rev 1630?

The pricing for the 2023 rev 1630 version of airSlate SignNow is designed to be cost-effective, catering to businesses of all sizes. Users can choose from various plans that offer different features, ensuring they only pay for what they need.

-

What are the key features of the 2023 rev 1630 update?

The 2023 rev 1630 update includes advanced eSigning capabilities, customizable templates, and improved integration options. These features are aimed at enhancing productivity and ensuring a seamless document workflow for users.

-

What benefits does the 2023 rev 1630 version provide for businesses?

Businesses using the 2023 rev 1630 version of airSlate SignNow can expect increased efficiency and reduced turnaround times for document signing. The user-friendly interface and robust features help teams collaborate more effectively.

-

Can I integrate airSlate SignNow with other software in the 2023 rev 1630 version?

Yes, the 2023 rev 1630 version of airSlate SignNow supports integrations with various third-party applications. This allows businesses to streamline their workflows by connecting their existing tools with airSlate SignNow.

-

Is there a free trial available for the 2023 rev 1630 version?

Yes, airSlate SignNow offers a free trial for the 2023 rev 1630 version, allowing prospective customers to explore its features without any commitment. This trial helps users understand how the solution can meet their document management needs.

-

How secure is the 2023 rev 1630 version of airSlate SignNow?

The 2023 rev 1630 version of airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. Businesses can trust that their documents and sensitive information are protected throughout the signing process.

Get more for Underpayment Of Estimated Tax By Individuals REV 1630 FormsPublications

- Papa murphys application pdf form

- Open pdf file 969 13 kb forpetition for order of complete settlement conservator mpc 860 form

- How do you complete the nnps school administrative transfer application form

- Form 27 immigration kenya

- Bank refund format

- Clearance certificate form

- 5500 irs form

- Osha respiratory medical evaluation questionnaire form

Find out other Underpayment Of Estimated Tax By Individuals REV 1630 FormsPublications

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy