Printable Pennsylvania Form REV 1630 Underpayment of Estimated Tax by Individuals 2020

What is the Printable Pennsylvania Form REV 1630 Underpayment Of Estimated Tax By Individuals

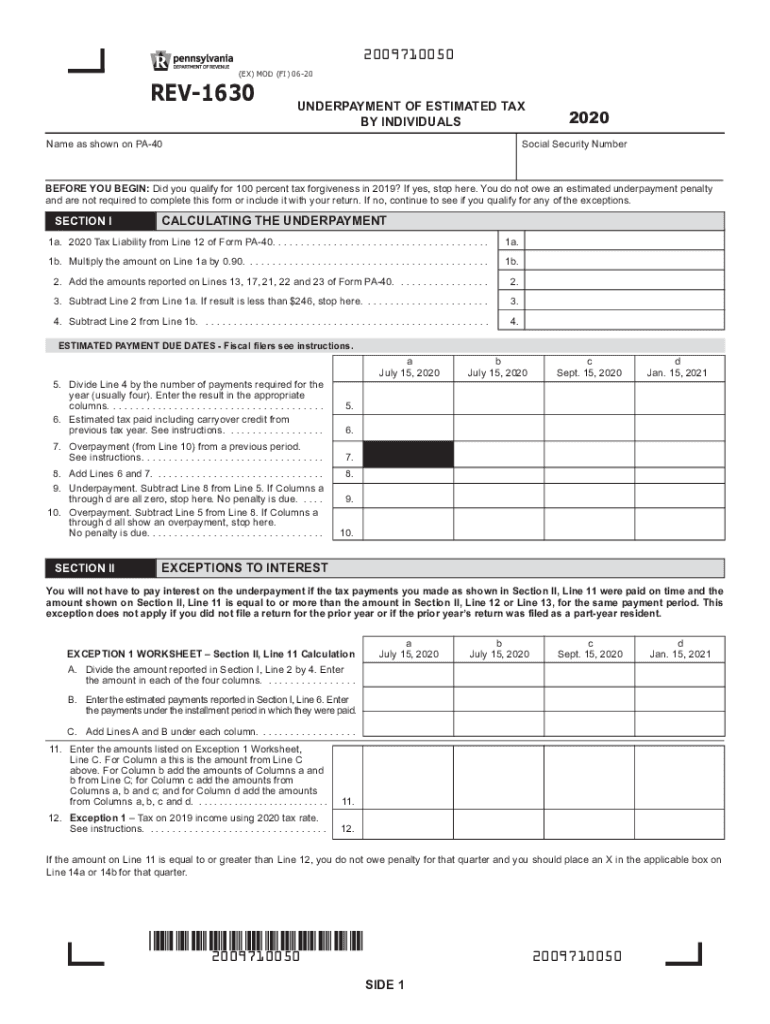

The Pennsylvania Form REV 1630 is utilized by individuals to report underpayment of estimated tax. This form is essential for taxpayers who may not have paid enough tax throughout the year, either through withholding or estimated payments. The form helps calculate any potential penalties due to underpayment, ensuring compliance with Pennsylvania tax laws. Understanding the purpose of this form is crucial for maintaining accurate tax records and avoiding unnecessary penalties.

How to use the Printable Pennsylvania Form REV 1630 Underpayment Of Estimated Tax By Individuals

To use the REV 1630 form effectively, individuals should first gather their income information and any previous tax payments made. The form requires taxpayers to provide details about their total income, tax liability, and any payments already made. After completing the form, it should be submitted to the Pennsylvania Department of Revenue. Utilizing this form ensures that taxpayers are aware of their obligations and can rectify any underpayment issues promptly.

Steps to complete the Printable Pennsylvania Form REV 1630 Underpayment Of Estimated Tax By Individuals

Completing the REV 1630 involves several key steps:

- Gather all necessary financial documents, including income statements and previous tax returns.

- Calculate your total income and estimated tax liability for the year.

- Determine any payments already made towards your tax liability.

- Fill out the form with accurate figures, ensuring all sections are completed.

- Review the form for any errors before submission.

- Submit the completed form to the Pennsylvania Department of Revenue by the specified deadline.

Key elements of the Printable Pennsylvania Form REV 1630 Underpayment Of Estimated Tax By Individuals

The REV 1630 form includes several key elements that are essential for accurate reporting. These elements comprise:

- Personal identification information, including name and Social Security number.

- Details of total income and tax liability for the year.

- Information on estimated tax payments made throughout the year.

- Calculation of any underpayment and potential penalties.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the REV 1630 form. Typically, the form must be filed by the due date of the tax return for the year in which the underpayment occurred. Taxpayers should also keep in mind any quarterly estimated tax payment deadlines to avoid further penalties. Staying informed about these dates helps ensure compliance with Pennsylvania tax regulations.

Penalties for Non-Compliance

Failing to file the REV 1630 form or underpaying estimated taxes can result in significant penalties. The Pennsylvania Department of Revenue may impose fines based on the amount of underpayment and the duration of non-compliance. Understanding these penalties is essential for taxpayers to avoid unexpected financial burdens and to ensure that they meet their tax obligations in a timely manner.

Quick guide on how to complete printable 2020 pennsylvania form rev 1630 underpayment of estimated tax by individuals

Effortlessly prepare Printable Pennsylvania Form REV 1630 Underpayment Of Estimated Tax By Individuals on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to easily find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to swiftly create, modify, and eSign your documents without delays. Manage Printable Pennsylvania Form REV 1630 Underpayment Of Estimated Tax By Individuals on any device using the airSlate SignNow apps for Android or iOS and enhance your document-related tasks today.

Edit and eSign Printable Pennsylvania Form REV 1630 Underpayment Of Estimated Tax By Individuals effortlessly

- Obtain Printable Pennsylvania Form REV 1630 Underpayment Of Estimated Tax By Individuals and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature with the Sign tool, which takes only moments and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, text (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Printable Pennsylvania Form REV 1630 Underpayment Of Estimated Tax By Individuals to ensure effective communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct printable 2020 pennsylvania form rev 1630 underpayment of estimated tax by individuals

Create this form in 5 minutes!

How to create an eSignature for the printable 2020 pennsylvania form rev 1630 underpayment of estimated tax by individuals

How to create an electronic signature for a PDF document in the online mode

How to create an electronic signature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The best way to create an eSignature from your mobile device

How to create an eSignature for a PDF document on iOS devices

The best way to create an eSignature for a PDF file on Android devices

People also ask

-

What is rev 1630 in the context of airSlate SignNow?

The term 'rev 1630' refers to the latest version update of the airSlate SignNow platform, which introduces enhanced features and improved security measures for eSigning documents. This upgrade provides users with a more efficient workflow and better user experience. Businesses can leverage these enhancements to streamline their document management processes.

-

How does rev 1630 improve the eSigning experience?

Rev 1630 focuses on optimizing the eSigning process by introducing new features such as advanced templates and customizable workflows. This upgrade allows users to create more dynamic documents and track their status in real time. As a result, businesses can save time and reduce errors in their signing processes.

-

What pricing plans are available for rev 1630 on airSlate SignNow?

airSlate SignNow offers competitive pricing plans that cater to different business needs, especially with the rev 1630 update. Whether you are a small startup or a large enterprise, there are plans available for everyone, enabling organizations to choose what fits their budget while utilizing the latest features. Be sure to check the pricing page for detailed options.

-

What benefits does rev 1630 offer to businesses?

Rev 1630 provides numerous benefits, including enhanced security, better document tracking, and a user-friendly interface. Businesses can enjoy streamlined document handling, ensuring that notes and signatures are always accurate and easily accessible. Such features signNowly boost productivity and decrease the turnaround time for contracts and agreements.

-

Can I integrate rev 1630 with other software tools?

Yes, rev 1630 supports integration with various third-party software tools to enhance functionality. Users can sync their favorite CRM, project management, or cloud storage applications seamlessly with airSlate SignNow. This integration capability helps in creating a more unified workflow for document handling across different platforms.

-

Is rev 1630 suitable for remote teams?

Absolutely, rev 1630 is designed to cater to the needs of remote teams by allowing users to send and sign documents from anywhere. The cloud-based nature of the platform means that team members can collaborate effectively regardless of their location. This flexibility is essential for businesses adapting to modern work environments.

-

What security measures are included in rev 1630?

Rev 1630 includes robust security measures such as advanced encryption and secure access protocols to protect sensitive documents. Users can have peace of mind knowing that their eSigned documents are safeguarded against unauthorized access. With airSlate SignNow, security is a top priority to ensure compliance and data integrity.

Get more for Printable Pennsylvania Form REV 1630 Underpayment Of Estimated Tax By Individuals

- Nevada peo registration form

- Ndep 0 report date incident date incident state of nevada ndep nv form

- Employee leasing company peo registration application form

- Form 580 state of ohio agent notification form for unincorported nonprofit association

- City of delaware contractor registration form

- Ohio secretary of state certificate of limited partnership cancellation limited partnership cancellation amendment form

- Form 563

- Statement of loans made form 31 k ohio secretary of state

Find out other Printable Pennsylvania Form REV 1630 Underpayment Of Estimated Tax By Individuals

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template

- eSign Arkansas IT Consulting Agreement Computer

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template

- How To eSign Louisiana Joint Venture Agreement Template

- eSign Hawaii Web Hosting Agreement Now

- eSign New Jersey Joint Venture Agreement Template Online

- eSign Missouri Web Hosting Agreement Now

- eSign New Jersey Web Hosting Agreement Now

- eSign Texas Deposit Receipt Template Online

- Help Me With eSign Nebraska Budget Proposal Template

- eSign New Mexico Budget Proposal Template Now

- eSign New York Budget Proposal Template Easy

- eSign Indiana Debt Settlement Agreement Template Later

- eSign New York Financial Funding Proposal Template Now