Underpayment of Estimated Tax by Individuals REV 1630 FormsPublications 2022

Understanding the REV 1630 Form

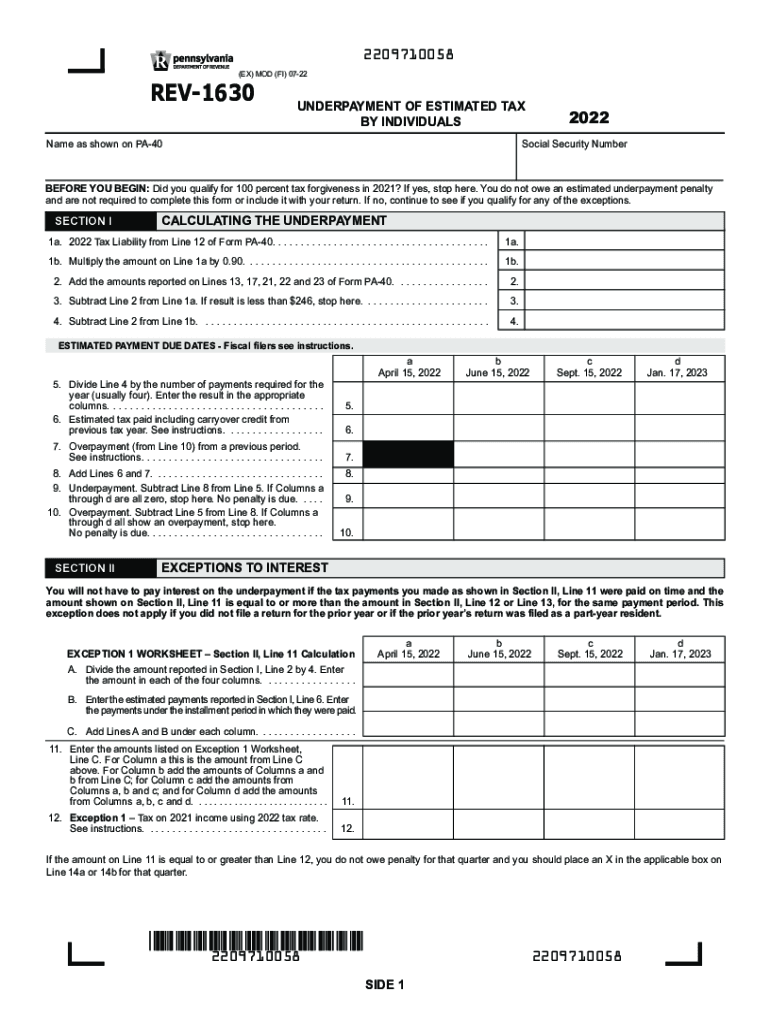

The REV 1630 form, also known as the Underpayment of Estimated Tax By Individuals, is a crucial document for taxpayers in Pennsylvania. It is specifically designed for individuals who may not have paid enough tax throughout the year, leading to potential underpayment penalties. This form helps assess whether the estimated tax payments made are sufficient to cover the tax liability for the year. Taxpayers should be aware of their income and any changes in tax law that may affect their estimated tax calculations.

Steps to Complete the REV 1630 Form

Completing the REV 1630 form involves several key steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Calculate your total estimated tax liability for the year based on your income.

- Determine the amount you have already paid in estimated taxes.

- Fill out the form with the required information, including your personal details and tax calculations.

- Review the form for accuracy before submission.

Legal Use of the REV 1630 Form

The REV 1630 form is legally recognized in Pennsylvania for addressing underpayment of estimated taxes. To ensure its validity, taxpayers must comply with state tax laws and guidelines. Proper completion and submission of the form can help avoid penalties and ensure that the taxpayer meets their obligations. It is important to understand the legal implications of underpayment and how this form can assist in rectifying any discrepancies.

Filing Deadlines for the REV 1630 Form

Timely filing of the REV 1630 form is essential to avoid penalties. The form typically must be submitted by specific deadlines, which align with the state’s tax calendar. Taxpayers should be aware of these dates to ensure they submit their forms on time. Missing the deadline may result in additional fees or interest on the unpaid tax amount.

Key Elements of the REV 1630 Form

Key elements of the REV 1630 form include:

- Taxpayer identification information, such as name and Social Security number.

- Calculation of total estimated tax liability.

- Details of estimated payments made throughout the year.

- Signature and date to validate the submission.

Examples of Using the REV 1630 Form

Taxpayers may find the REV 1630 form useful in various scenarios. For example, self-employed individuals who do not have taxes withheld from their income can use this form to report underpayment. Additionally, retirees with fluctuating income may also need to file this form if their estimated payments do not meet their tax obligations. Understanding these examples can help taxpayers recognize when to utilize this important document.

Quick guide on how to complete 2022 underpayment of estimated tax by individuals rev 1630 formspublications

Complete Underpayment Of Estimated Tax By Individuals REV 1630 FormsPublications effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, alter, and eSign your documents swiftly without delays. Manage Underpayment Of Estimated Tax By Individuals REV 1630 FormsPublications on any platform using airSlate SignNow apps for Android or iOS and streamline any document-related task today.

The easiest way to alter and eSign Underpayment Of Estimated Tax By Individuals REV 1630 FormsPublications without hassle

- Find Underpayment Of Estimated Tax By Individuals REV 1630 FormsPublications and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information using tools specifically designed for this purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing out new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign Underpayment Of Estimated Tax By Individuals REV 1630 FormsPublications and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 underpayment of estimated tax by individuals rev 1630 formspublications

Create this form in 5 minutes!

How to create an eSignature for the 2022 underpayment of estimated tax by individuals rev 1630 formspublications

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the rev 1630 form and how can airSlate SignNow help?

The rev 1630 form is a crucial document for various business transactions. airSlate SignNow simplifies the process of completing and signing the rev 1630 form, allowing users to send and eSign it securely online. With our user-friendly interface, you can easily manage your documents and streamline your workflow.

-

Is there a cost associated with using airSlate SignNow for the rev 1630 form?

Yes, airSlate SignNow offers a flexible pricing structure depending on your needs. Our plans are tailored to provide a cost-effective solution for managing and eSigning documents like the rev 1630 form. We encourage you to check our website for detailed pricing options to find the ideal plan for your business.

-

What features does airSlate SignNow offer for the rev 1630 form?

airSlate SignNow provides a range of features specifically designed for the rev 1630 form. These include customizable templates, secure eSigning, and real-time tracking of document status. Our platform ensures that you have everything you need to manage the rev 1630 form efficiently.

-

Can I integrate airSlate SignNow with other applications for managing the rev 1630 form?

Absolutely! airSlate SignNow supports integrations with various applications to enhance your experience with the rev 1630 form. Seamlessly connect with tools like Google Drive, Salesforce, and more to streamline your document management processes.

-

How does airSlate SignNow ensure the security of the rev 1630 form?

Security is a top priority at airSlate SignNow. When working with the rev 1630 form, our platform employs advanced encryption and secure cloud storage to protect your sensitive information. Rest assured that your documents remain safe and compliant with industry standards.

-

Can I track the status of the rev 1630 form once it's sent for eSignature?

Yes, airSlate SignNow allows you to easily track the status of the rev 1630 form after sending it for eSignature. You will receive notifications and updates regarding who has viewed and signed your document, making it simple to manage your workflow.

-

Is it easy to get started with airSlate SignNow for the rev 1630 form?

Getting started with airSlate SignNow and the rev 1630 form is very straightforward. Our intuitive platform guides you through the entire process, allowing you to create, send, and sign documents with ease. You can sign up for a free trial to explore the functionalities without commitment.

Get more for Underpayment Of Estimated Tax By Individuals REV 1630 FormsPublications

Find out other Underpayment Of Estimated Tax By Individuals REV 1630 FormsPublications

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template