Form 14157 2017

What is the Form 14157

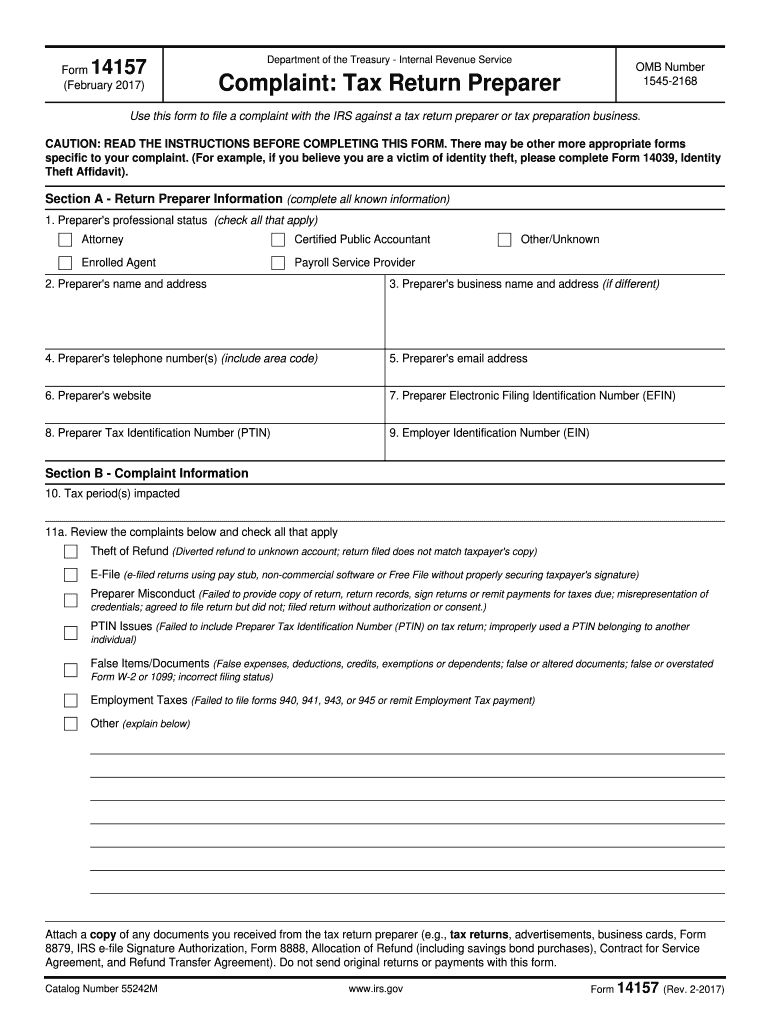

The Form 14157 is a document used by taxpayers to report suspected misconduct by tax preparers. This form is essential for individuals who believe they have been victims of fraudulent or unethical practices related to tax preparation. By submitting this form, taxpayers can alert the Internal Revenue Service (IRS) about potential violations, which helps maintain the integrity of the tax system.

How to use the Form 14157

Using the Form 14157 involves several key steps. First, gather all relevant information regarding the tax preparer and the specific issues encountered. This may include details about the services provided, any discrepancies in tax filings, and communication records with the preparer. Next, accurately fill out the form, ensuring that all required fields are completed. After filling out the form, submit it to the IRS, either electronically or by mail, depending on the submission methods allowed. It is crucial to keep a copy of the completed form for your records.

Steps to complete the Form 14157

Completing the Form 14157 requires careful attention to detail. Follow these steps:

- Begin by downloading the form from the IRS website or obtaining a physical copy.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details about the tax preparer, including their name, address, and any identifying information you have.

- Describe the misconduct you suspect, including specific examples and any supporting documentation.

- Review the form for accuracy and completeness before submission.

Legal use of the Form 14157

The Form 14157 is legally recognized as a means for taxpayers to report issues with tax preparers. When completed accurately and submitted to the IRS, it serves as a formal complaint. The information provided can initiate an investigation into the tax preparer's practices. It is important to ensure that all claims made on the form are truthful and substantiated, as false reporting can lead to legal consequences.

Form Submission Methods

There are various methods for submitting the Form 14157 to the IRS. Taxpayers can choose to file the form electronically through the IRS website if this option is available. Alternatively, the form can be mailed to the appropriate IRS address specified in the form instructions. For those who prefer in-person submission, visiting a local IRS office may also be an option. Regardless of the method chosen, it is advisable to keep a record of the submission for future reference.

Key elements of the Form 14157

The Form 14157 includes several key elements that are crucial for effective reporting. These elements consist of:

- Taxpayer's identification information.

- Details about the tax preparer, including their contact information.

- A clear description of the alleged misconduct.

- Any supporting documentation or evidence that substantiates the claims.

Ensuring that all these elements are included will enhance the effectiveness of the report and facilitate the IRS's investigation process.

Quick guide on how to complete form 14157 2017

Discover the most efficient method to complete and sign your Form 14157

Are you still spending time preparing your official documents on paper instead of doing it digitally? airSlate SignNow presents a superior way to complete and sign your Form 14157 and similar forms for public services. Our advanced eSignature solution equips you with everything needed to handle paperwork swiftly and in line with official standards - robust PDF editing, management, protection, signing, and sharing tools readily available in a user-friendly interface.

There are just a few steps required to complete and sign your Form 14157:

- Insert the fillable template into the editor using the Get Form button.

- Review what details you need to include in your Form 14157.

- Move between the fields using the Next choice to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to populate the blanks with your information.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what is truly signNow or Obscure sections that are no longer relevant.

- Select Sign to create a legally enforceable eSignature using any preferred method.

- Insert the Date alongside your signature and conclude your task with the Done button.

Store your completed Form 14157 in the Documents folder of your profile, download it, or transfer it to your preferred cloud storage. Our solution also provides adaptable file sharing options. There's no need to print your templates when you need to submit them to the appropriate public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it out today!

Create this form in 5 minutes or less

Find and fill out the correct form 14157 2017

FAQs

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

How do I fill out the UPSEAT 2017 application forms?

UPESEAT is a placement test directed by the University of Petroleum and Energy Studies. This inclination examination is called as the University of Petroleum and Energy Studies Engineering Entrance Test (UPESEAT). It is essentially an essential sort examination which permits the possibility to apply for the different designing projects on the web. visit - HOW TO FILL THE UPSEAT 2017 APPLICATION FORMS

-

How do I fill out the JEE Advanced 2017 application form?

JEE Advanced Application Form 2017 is now available for all eligible candidates from April 28 to May 2, 2017 (5 PM). Registrations with late fee will be open from May 3 to May 4, 2017. The application form of JEE Advanced 2017 has been released only in online mode. visit - http://www.entrancezone.com/engi...

-

How can I fill out an improvement form of the CBSE 2017?

IN the month of August the application form will be available on cbse official website which you have to fill online then it will ask in which you subject you want to apply for improvement…you can select all subjects and additional subjects also then you have to pay the amount for improvement exam which you have to pay at bank. take the print out of the acknowledgement and the e-challan and deposit the fees at bank… you also have to change your region when you type the pin code then according to that you will get your centre as well as new region means you region will change. it don't effect anything. after all these thing you have to send a xerox copy of your marksheet e-challan acknowledgement to the regional office which you get. the address will be returned on the acknowledgement after that you have to wait to get your admit card which you will get online on month of February…and improvement marksheet will be send to you address which you fill at time of applications form filling time. if you get less marks in improvement then old marksheet will be valid soAll The Best

Create this form in 5 minutes!

How to create an eSignature for the form 14157 2017

How to create an electronic signature for the Form 14157 2017 in the online mode

How to make an eSignature for the Form 14157 2017 in Chrome

How to generate an electronic signature for putting it on the Form 14157 2017 in Gmail

How to make an eSignature for the Form 14157 2017 from your mobile device

How to generate an eSignature for the Form 14157 2017 on iOS

How to generate an electronic signature for the Form 14157 2017 on Android devices

People also ask

-

What is Form 14157 and why do I need it?

Form 14157 is a crucial document used by taxpayers to report misconduct or concerns related to tax return preparers. Utilizing airSlate SignNow to eSign this form streamlines the submission process, ensuring that your concerns signNow the IRS efficiently and securely.

-

How can I eSign Form 14157 using airSlate SignNow?

To eSign Form 14157 with airSlate SignNow, simply upload the document to our platform, add necessary signature fields, and invite others to sign if needed. Our user-friendly interface allows you to complete the process in minutes, making it easy to fulfill your reporting obligations.

-

Is there a cost associated with signing Form 14157 via airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. However, the cost is often outweighed by the time saved and the convenience of eSigning important documents like Form 14157. Check our pricing page for detailed information.

-

What features does airSlate SignNow offer for managing Form 14157?

airSlate SignNow provides robust features for managing Form 14157, including template creation, automated reminders, and cloud storage. These features ensure that you can easily track the status of your document and manage your workflow efficiently.

-

Can I integrate airSlate SignNow with other applications for Form 14157?

Absolutely! airSlate SignNow seamlessly integrates with a variety of applications such as Google Drive, Salesforce, and more. This means you can easily manage and eSign Form 14157 alongside your existing tools for enhanced productivity.

-

How secure is the process of eSigning Form 14157 with airSlate SignNow?

Security is a top priority at airSlate SignNow. When eSigning Form 14157, your documents are protected with encryption and secure access protocols, ensuring that your sensitive information remains confidential and safe from unauthorized access.

-

What are the benefits of using airSlate SignNow for Form 14157?

Using airSlate SignNow for Form 14157 offers numerous benefits, including increased efficiency, reduced paper usage, and faster turnaround times. This electronic solution enhances your overall productivity while ensuring compliance and accuracy in your submissions.

Get more for Form 14157

- Trespass arrest authorization letter form

- Eisb form

- Rooming list template word form

- Conseco cancer claim form combined benefits group inc

- E form 73580 08

- Employee direct deposit authorization agreement paychex form

- Non disclosure for business agreement template form

- Non disclosure for business idea agreement template form

Find out other Form 14157

- How Can I Sign Nevada Agreement to Extend Debt Payment

- Sign South Dakota Consumer Credit Application Computer

- Sign Tennessee Agreement to Extend Debt Payment Free

- Sign Kentucky Outsourcing Services Contract Simple

- Sign Oklahoma Outsourcing Services Contract Fast

- How Can I Sign Rhode Island Outsourcing Services Contract

- Sign Vermont Outsourcing Services Contract Simple

- Sign Iowa Interview Non-Disclosure (NDA) Secure

- Sign Arkansas Resignation Letter Simple

- Sign California Resignation Letter Simple

- Sign Florida Leave of Absence Agreement Online

- Sign Florida Resignation Letter Easy

- Sign Maine Leave of Absence Agreement Safe

- Sign Massachusetts Leave of Absence Agreement Simple

- Sign Connecticut Acknowledgement of Resignation Fast

- How To Sign Massachusetts Resignation Letter

- Sign New Mexico Resignation Letter Now

- How Do I Sign Oklahoma Junior Employment Offer Letter

- Sign Oklahoma Resignation Letter Simple

- How Do I Sign Oklahoma Acknowledgement of Resignation