Form MO 1040ES Estimated Tax Declaration for Individuals 2025-2026

What is the Form MO 1040ES Estimated Tax Declaration For Individuals

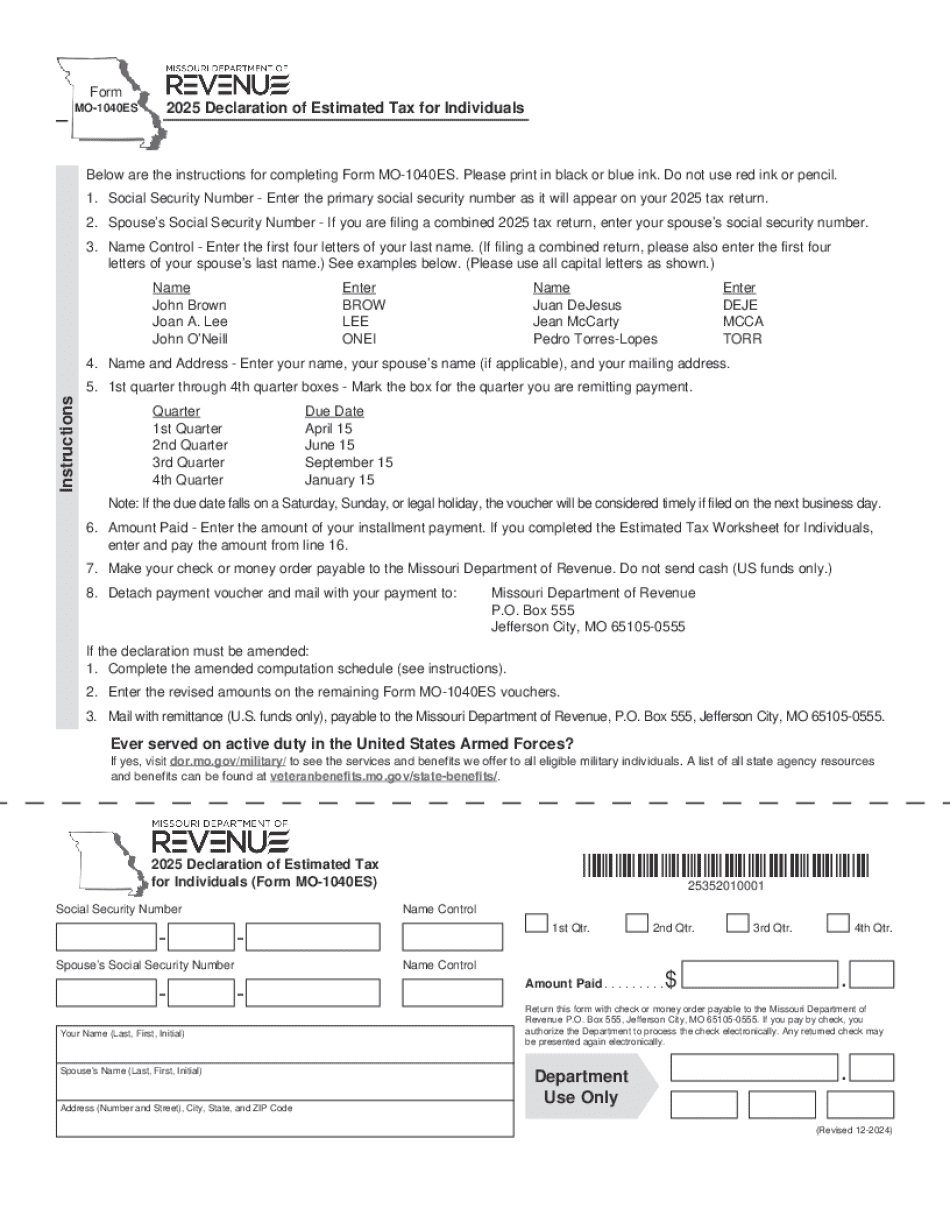

The Form MO 1040ES is used by individuals in Missouri to declare estimated tax payments for the current tax year. This form is essential for those who expect to owe tax of $500 or more when filing their annual return. It allows taxpayers to calculate and pay their estimated taxes in four installments throughout the year, ensuring compliance with state tax obligations.

How to use the Form MO 1040ES Estimated Tax Declaration For Individuals

To effectively use the Form MO 1040ES, individuals should first gather their financial information, including income sources and deductions. The form consists of several sections where taxpayers can input their estimated income, calculate their expected tax liability, and determine the amount to pay for each installment. It is important to follow the instructions carefully to ensure accurate calculations and timely payments.

Steps to complete the Form MO 1040ES Estimated Tax Declaration For Individuals

Completing the Form MO 1040ES involves several key steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Estimate your total income for the year, including wages, self-employment income, and any other sources.

- Calculate your expected tax liability using the current Missouri tax rates.

- Determine the amount to be paid for each of the four estimated tax payment periods.

- Fill out the form accurately, ensuring all calculations are correct.

- Submit the form along with your payment by the due dates specified by the state.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Form MO 1040ES is crucial for compliance. Estimated tax payments are typically due on the 15th of April, June, September, and January of the following year. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Keeping track of these dates helps avoid penalties and interest on late payments.

Penalties for Non-Compliance

Failing to file or pay estimated taxes on time can result in penalties imposed by the state of Missouri. The penalties may include a percentage of the unpaid tax amount, and interest may accrue on late payments. To avoid these consequences, it is important to adhere to the filing schedule and ensure that all estimated payments are made accurately and on time.

Eligibility Criteria

Eligibility to use the Form MO 1040ES generally applies to individuals who expect to owe Missouri state income tax of $500 or more when they file their annual tax return. This includes self-employed individuals, freelancers, and those with significant income from sources not subject to withholding. It is advisable to review specific eligibility criteria to ensure compliance with state regulations.

Create this form in 5 minutes or less

Find and fill out the correct form mo 1040es estimated tax declaration for individuals

Create this form in 5 minutes!

How to create an eSignature for the form mo 1040es estimated tax declaration for individuals

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Missouri estimated tax and how does it work?

Missouri estimated tax is a method for taxpayers to pay their income tax throughout the year, rather than in a lump sum at tax time. This system is designed for individuals and businesses that expect to owe a certain amount of tax. By making estimated tax payments, you can avoid penalties and manage your cash flow more effectively.

-

How can airSlate SignNow help with managing Missouri estimated tax documents?

airSlate SignNow provides a seamless way to send and eSign documents related to Missouri estimated tax. Our platform allows you to easily create, share, and sign tax forms electronically, ensuring that your documents are secure and accessible. This can save you time and reduce the stress associated with tax season.

-

What are the pricing options for airSlate SignNow when dealing with Missouri estimated tax?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including those related to Missouri estimated tax. Our plans are designed to be cost-effective, allowing you to choose the features that best suit your requirements. You can start with a free trial to explore how our solution can streamline your tax document processes.

-

Are there any integrations available for managing Missouri estimated tax with airSlate SignNow?

Yes, airSlate SignNow integrates with various accounting and tax software, making it easier to manage your Missouri estimated tax documents. These integrations allow for seamless data transfer and help you maintain accurate records. By connecting your tools, you can enhance your workflow and ensure compliance with tax regulations.

-

What features does airSlate SignNow offer for Missouri estimated tax management?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing Missouri estimated tax. These tools help you create professional documents quickly and ensure that all parties can sign them securely. Additionally, our platform provides reminders for important tax deadlines.

-

How does airSlate SignNow ensure the security of Missouri estimated tax documents?

Security is a top priority at airSlate SignNow, especially for sensitive documents like those related to Missouri estimated tax. We use advanced encryption and secure cloud storage to protect your data. Our compliance with industry standards ensures that your documents are safe from unauthorized access.

-

Can airSlate SignNow assist with filing Missouri estimated tax returns?

While airSlate SignNow does not file Missouri estimated tax returns directly, it simplifies the process by allowing you to prepare and eSign necessary documents. You can easily gather signatures and share completed forms with your tax preparer or file them electronically. This streamlines your workflow and helps ensure timely submissions.

Get more for Form MO 1040ES Estimated Tax Declaration For Individuals

Find out other Form MO 1040ES Estimated Tax Declaration For Individuals

- Sign Washington Amendment to an LLC Operating Agreement Now

- Can I Sign Wyoming Amendment to an LLC Operating Agreement

- How To Sign California Stock Certificate

- Sign Louisiana Stock Certificate Free

- Sign Maine Stock Certificate Simple

- Sign Oregon Stock Certificate Myself

- Sign Pennsylvania Stock Certificate Simple

- How Do I Sign South Carolina Stock Certificate

- Sign New Hampshire Terms of Use Agreement Easy

- Sign Wisconsin Terms of Use Agreement Secure

- Sign Alabama Affidavit of Identity Myself

- Sign Colorado Trademark Assignment Agreement Online

- Can I Sign Connecticut Affidavit of Identity

- Can I Sign Delaware Trademark Assignment Agreement

- How To Sign Missouri Affidavit of Identity

- Can I Sign Nebraska Affidavit of Identity

- Sign New York Affidavit of Identity Now

- How Can I Sign North Dakota Affidavit of Identity

- Sign Oklahoma Affidavit of Identity Myself

- Sign Texas Affidavit of Identity Online