Form MO 1040ES Declaration of Estimated Tax for Individuals 2023

Understanding the MO 1040ES Declaration of Estimated Tax for Individuals

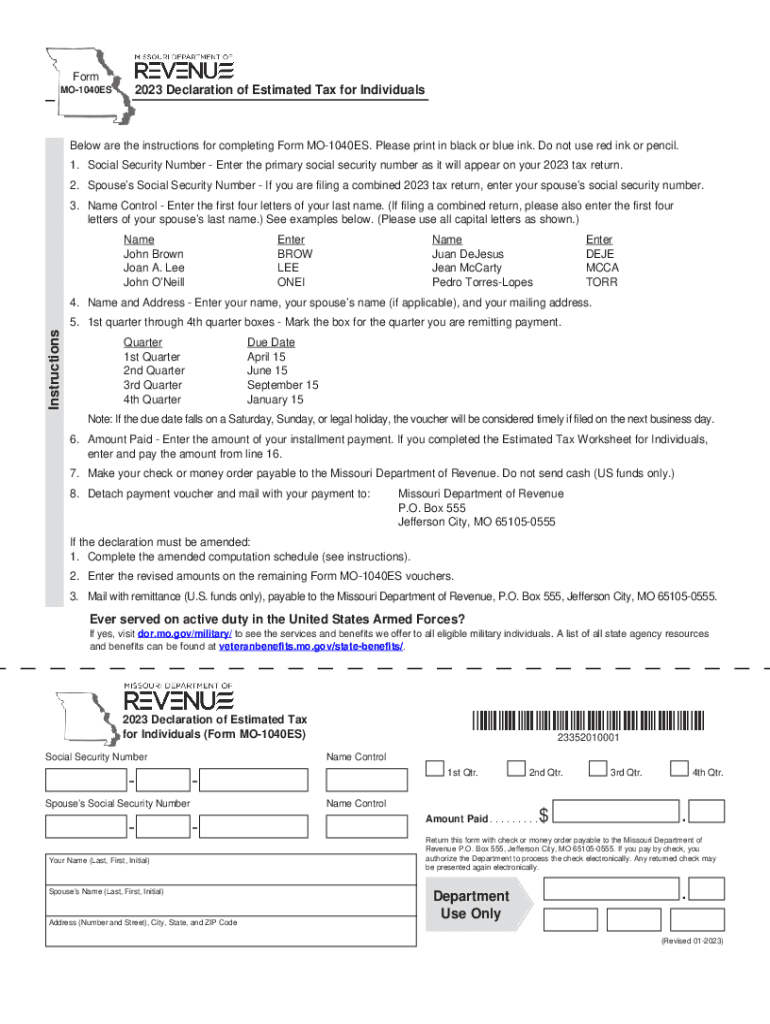

The MO 1040ES is the official form used by individuals in Missouri to declare estimated tax payments. This form is essential for taxpayers who expect to owe tax of $500 or more when filing their annual return. It helps ensure that individuals pay their tax obligations throughout the year rather than in a lump sum at tax time. The form is specifically designed for those who have income that is not subject to withholding, such as self-employment income, rental income, or investment earnings.

Steps to Complete the MO 1040ES Declaration of Estimated Tax

Completing the MO 1040ES involves several key steps:

- Gather your financial information, including income sources and deductions.

- Calculate your expected taxable income for the year.

- Determine your estimated tax liability using the Missouri tax tables or tax rate schedules.

- Complete the form by providing your personal information and estimated tax amounts for each quarter.

- Review the form for accuracy before submission.

Filing Deadlines for the MO 1040ES

It is important to adhere to the filing deadlines for the MO 1040ES to avoid penalties. Estimated tax payments are typically due on the 15th of April, June, September, and January of the following year. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Keeping track of these dates can help ensure compliance with state tax regulations.

Submission Methods for the MO 1040ES

The MO 1040ES can be submitted in several ways:

- Online through the Missouri Department of Revenue's e-filing system.

- By mail, sending the completed form to the appropriate address provided by the Missouri Department of Revenue.

- In-person at local tax offices, where assistance may be available.

Key Elements of the MO 1040ES Declaration

When completing the MO 1040ES, certain key elements must be included:

- Your name, address, and Social Security number.

- The estimated income for the year, along with any applicable deductions.

- The total estimated tax liability and the amounts due for each payment period.

Legal Use of the MO 1040ES Declaration

The MO 1040ES is legally recognized as a method for individuals to report and pay their estimated taxes. Proper use of this form helps taxpayers meet their obligations under Missouri tax law, reducing the risk of penalties for underpayment. It is advisable to keep copies of submitted forms for personal records and future reference.

Quick guide on how to complete form mo 1040es declaration of estimated tax for individuals

Effortlessly Prepare Form MO 1040ES Declaration Of Estimated Tax For Individuals on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to access the required form and safely store it online. airSlate SignNow equips you with all the tools necessary to craft, modify, and eSign your documents promptly without any holdups. Handle Form MO 1040ES Declaration Of Estimated Tax For Individuals on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The Easiest Way to Modify and eSign Form MO 1040ES Declaration Of Estimated Tax For Individuals Effortlessly

- Obtain Form MO 1040ES Declaration Of Estimated Tax For Individuals and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you prefer to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searching, or mistakes that require new printouts. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Form MO 1040ES Declaration Of Estimated Tax For Individuals to ensure effective communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form mo 1040es declaration of estimated tax for individuals

Create this form in 5 minutes!

How to create an eSignature for the form mo 1040es declaration of estimated tax for individuals

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Missouri estimated tax and how is it calculated?

Missouri estimated tax is a method for taxpayers to pay their income tax throughout the year instead of in a lump sum during tax season. It’s typically calculated based on your expected taxable income, tax credits, and deductions for the year. Many residents and businesses in Missouri use estimated tax to avoid penalties for underpayment.

-

Who is required to pay Missouri estimated tax?

Individuals and businesses in Missouri who expect to owe $100 or more in state income tax typically need to pay Missouri estimated tax. This includes self-employed individuals, freelancers, and those with other non-wage income. It’s essential to evaluate your income sources to determine if you need to make estimated tax payments.

-

How can airSlate SignNow assist with managing Missouri estimated tax documents?

airSlate SignNow provides a streamlined solution for sending and signing documents related to Missouri estimated tax. With our easy-to-use platform, users can quickly eSign tax forms and agreements. This helps ensure that all necessary documents are completed accurately and submitted on time.

-

What features does airSlate SignNow offer for handling tax documents?

airSlate SignNow offers features such as customizable templates, secure cloud storage, and real-time notifications for document tracking. These features simplify managing your Missouri estimated tax documents, allowing you to focus on your finances instead of paperwork. Additionally, our integration capabilities help you connect with other essential tax tools.

-

Is airSlate SignNow cost-effective for managing Missouri estimated tax?

Yes, airSlate SignNow provides a cost-effective solution for managing your Missouri estimated tax documents. Our pricing plans are designed to cater to various budgets while ensuring you have access to essential eSigning features. This helps small businesses and individuals streamline their tax processes without breaking the bank.

-

Can I integrate airSlate SignNow with other accounting software for Missouri estimated tax?

Absolutely! airSlate SignNow allows seamless integration with various accounting and tax software. This can enhance your workflow when dealing with Missouri estimated tax, enabling you to transfer information efficiently and keep all documents organized within one system.

-

What are the benefits of using airSlate SignNow for tax purposes?

Using airSlate SignNow for your Missouri estimated tax processes offers numerous benefits, including enhanced efficiency and reduced paperwork. Our platform helps you eSign documents quickly, minimizing delays and ensuring compliance. This means you can confidently manage your tax responsibilities and focus more on your business growth.

Get more for Form MO 1040ES Declaration Of Estimated Tax For Individuals

- Company policies procedures 481376052 form

- New york sale of a business package form

- New york contract for deed package form

- Ny employment form

- New york mortgage form

- New york satisfaction cancellation or release of mortgage package form

- New york prenuptial form

- New york roofing contractor package form

Find out other Form MO 1040ES Declaration Of Estimated Tax For Individuals

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF