Form Mo 1040es Declaration of Estimated Tax for 2024

Understanding the Missouri Estimated Tax Form (MO 1040ES)

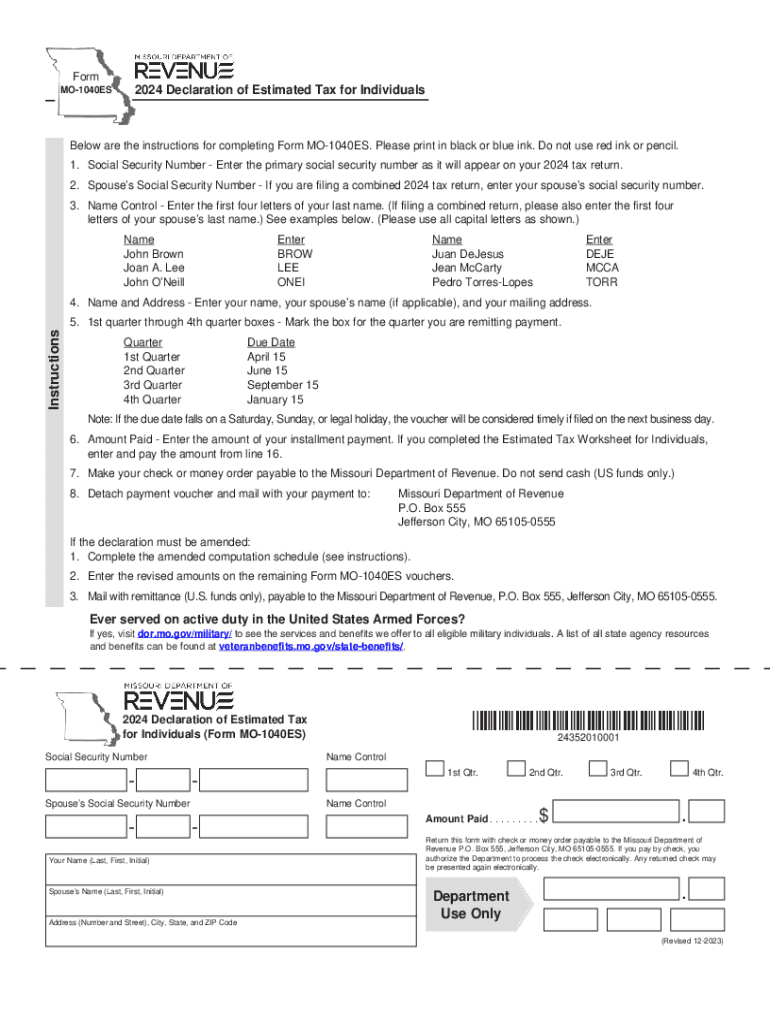

The Missouri Estimated Tax Form, known as MO 1040ES, is a crucial document for taxpayers who expect to owe tax of $100 or more when filing their annual return. This form is designed for individuals, including self-employed individuals, who need to make estimated tax payments throughout the year. It helps ensure that taxpayers meet their tax obligations and avoid penalties for underpayment. The form allows for the calculation of estimated tax based on expected income, deductions, and credits.

How to Complete the Missouri Estimated Tax Form

Filling out the MO 1040ES involves several key steps:

- Gather necessary financial information, including income sources, deductions, and credits.

- Use the worksheet provided with the form to estimate your total income and calculate your expected tax liability.

- Determine the amount of estimated tax due for each payment period, typically four times a year.

- Complete the form by entering your estimated tax amounts and personal information.

It is essential to review the completed form for accuracy before submission to avoid any potential issues with the IRS or the Missouri Department of Revenue.

Obtaining the Missouri Estimated Tax Form

The MO 1040ES form can be easily obtained through various channels. Taxpayers can download the form directly from the Missouri Department of Revenue's website. Alternatively, physical copies may be available at local tax offices or public libraries. It is advisable to ensure you are using the most current version of the form, especially as tax laws may change annually.

Filing Deadlines for Estimated Tax Payments

Timely filing of the MO 1040ES is crucial to avoid penalties. Estimated tax payments are generally due on the 15th of April, June, September, and January of the following year. If these dates fall on a weekend or holiday, the due date is extended to the next business day. Taxpayers should mark their calendars and plan accordingly to ensure all payments are submitted on time.

Submission Methods for the Missouri Estimated Tax Form

Taxpayers have several options for submitting the MO 1040ES. The form can be filed online through the Missouri Department of Revenue's e-filing system, allowing for a quick and secure submission. Alternatively, individuals may choose to mail the completed form to the appropriate address listed on the form's instructions. In-person submissions may also be possible at local tax offices, providing another avenue for filing.

Penalties for Non-Compliance with Estimated Tax Requirements

Failing to submit the MO 1040ES or underpaying estimated taxes can result in penalties. The Missouri Department of Revenue may impose a penalty for late payments or insufficient payments, which can accumulate over time. It is important for taxpayers to understand their obligations and ensure compliance to avoid these additional costs.

Eligibility Criteria for Using the Missouri Estimated Tax Form

To use the MO 1040ES, taxpayers must meet specific eligibility criteria. This form is primarily for individuals who expect to owe at least $100 in tax for the year. Additionally, those who are self-employed, have significant investment income, or receive income not subject to withholding may find this form particularly relevant. Understanding these criteria helps taxpayers determine if they need to file estimated taxes or if their tax situation allows for a different approach.

Create this form in 5 minutes or less

Find and fill out the correct form mo 1040es declaration of estimated tax for

Create this form in 5 minutes!

How to create an eSignature for the form mo 1040es declaration of estimated tax for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Missouri estimated tax form?

The Missouri estimated tax form is a document used by individuals and businesses to report and pay estimated taxes throughout the year. This form helps taxpayers avoid penalties by ensuring they meet their tax obligations on time. Understanding how to fill out the Missouri estimated tax form is crucial for effective tax planning.

-

How can airSlate SignNow help with the Missouri estimated tax form?

airSlate SignNow simplifies the process of completing and submitting the Missouri estimated tax form by allowing users to eSign documents securely and efficiently. Our platform provides templates and tools that streamline the preparation of tax forms, making it easier for users to manage their tax responsibilities. With airSlate SignNow, you can focus on your business while we handle the paperwork.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including those who need to manage the Missouri estimated tax form. Our plans are designed to be cost-effective, ensuring that you only pay for the features you need. You can choose from monthly or annual subscriptions, making it easy to find a plan that fits your budget.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive documents like the Missouri estimated tax form. Our platform uses advanced encryption and security protocols to protect your data. You can confidently eSign and share your tax forms, knowing that your information is secure.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow offers integrations with various accounting software, allowing you to streamline your workflow when managing the Missouri estimated tax form. This integration ensures that your tax documents are easily accessible and can be processed alongside your financial records. Check our integration options to see how we can enhance your tax preparation process.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow provides a range of features designed for efficient tax document management, including customizable templates for the Missouri estimated tax form, automated reminders, and secure eSigning capabilities. These features help you stay organized and ensure that you never miss a deadline. Our user-friendly interface makes it easy to navigate and manage your tax documents.

-

How do I get started with airSlate SignNow for my Missouri estimated tax form?

Getting started with airSlate SignNow is simple! You can sign up for a free trial to explore our features and see how we can assist you with the Missouri estimated tax form. Once registered, you can access templates, eSign documents, and manage your tax forms efficiently. Our support team is also available to help you with any questions.

Get more for Form Mo 1040es Declaration Of Estimated Tax For

Find out other Form Mo 1040es Declaration Of Estimated Tax For

- eSign California Sublease Agreement Template Safe

- How To eSign Colorado Sublease Agreement Template

- How Do I eSign Colorado Sublease Agreement Template

- eSign Florida Sublease Agreement Template Free

- How Do I eSign Hawaii Lodger Agreement Template

- eSign Arkansas Storage Rental Agreement Now

- How Can I eSign Texas Sublease Agreement Template

- eSign Texas Lodger Agreement Template Free

- eSign Utah Lodger Agreement Template Online

- eSign Hawaii Rent to Own Agreement Mobile

- How To eSignature Colorado Postnuptial Agreement Template

- How Do I eSignature Colorado Postnuptial Agreement Template

- Help Me With eSignature Colorado Postnuptial Agreement Template

- eSignature Illinois Postnuptial Agreement Template Easy

- eSignature Kentucky Postnuptial Agreement Template Computer

- How To eSign California Home Loan Application

- How To eSign Florida Home Loan Application

- eSign Hawaii Home Loan Application Free

- How To eSign Hawaii Home Loan Application

- How To eSign New York Home Loan Application