Estimated Tax Individuals 2021

What is the Estimated Tax Individuals

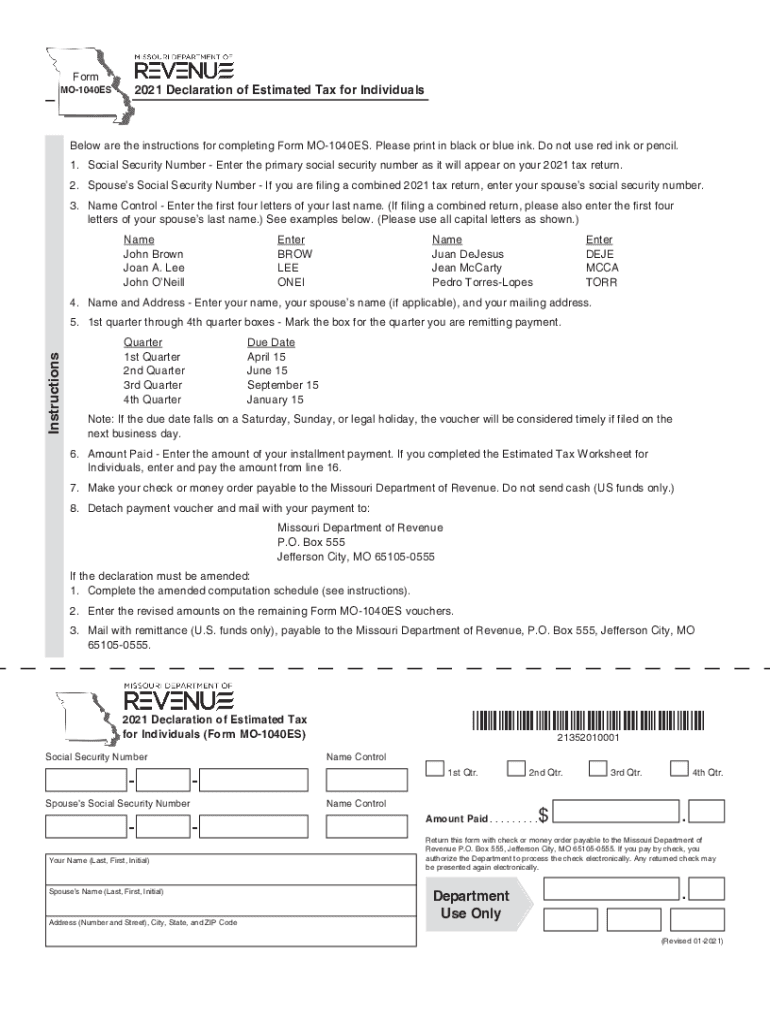

The Estimated Tax Individuals form, specifically the mo 1040es, is designed for taxpayers in Missouri who expect to owe tax of $500 or more when filing their annual tax return. This form allows individuals to calculate and pay their estimated tax liability throughout the year, ensuring compliance with state tax regulations. It is particularly relevant for self-employed individuals, freelancers, and those with significant income not subject to withholding.

Steps to Complete the Estimated Tax Individuals

Completing the mo 1040es blank involves several key steps:

- Gather your financial information, including income sources and deductions.

- Use the previous year’s tax return as a reference to estimate your current year’s income.

- Calculate your expected tax liability using the tax rates applicable for the current year.

- Divide your total estimated tax by four to determine quarterly payments.

- Fill out the mo 1040es form with your calculated amounts.

- Submit the form and make your payment by the due date.

Legal Use of the Estimated Tax Individuals

The mo 1040es is legally binding when completed and submitted according to Missouri tax laws. It is essential to ensure that all calculations are accurate and that the form is filed on time to avoid penalties. Electronic submission through a secure platform can enhance the validity of the document, as it complies with legal standards for electronic signatures.

Filing Deadlines / Important Dates

For the mo 1040es, estimated tax payments are typically due on the 15th of April, June, September, and January of the following year. It is crucial to adhere to these deadlines to avoid interest and penalties. Keeping track of these dates helps ensure that your tax obligations are met in a timely manner.

Required Documents

To complete the mo 1040es form, you will need the following documents:

- Your previous year’s tax return for reference.

- Documentation of all income sources, including wages, self-employment income, and investment earnings.

- Records of any deductions or credits you plan to claim.

Form Submission Methods (Online / Mail / In-Person)

The mo 1040es can be submitted in various ways. Taxpayers have the option to file online through a secure platform, which is often the most efficient method. Alternatively, forms can be mailed to the appropriate state tax office or submitted in person. Each submission method has its own advantages, such as convenience or immediate confirmation of receipt.

Quick guide on how to complete 2021 estimated tax individuals

Complete Estimated Tax Individuals effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documentation, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools you require to create, edit, and eSign your documents promptly without delays. Manage Estimated Tax Individuals on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and eSign Estimated Tax Individuals with ease

- Locate Estimated Tax Individuals and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight necessary sections of the documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of missing or lost files, cumbersome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Estimated Tax Individuals and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 estimated tax individuals

Create this form in 5 minutes!

People also ask

-

What is an MO 1040ES blank form?

The MO 1040ES blank form is used for Missouri taxpayers to estimate and pay their state income taxes. This form is essential for those who expect to owe $100 or more in taxes at the end of the year. Using an MO 1040ES blank enables you to keep your finances organized and avoid penalties.

-

How can airSlate SignNow help with completing the MO 1040ES blank?

airSlate SignNow offers an intuitive platform for filling out the MO 1040ES blank electronically. By using SignNow, users can easily upload their information, track changes, and ensure that all fields are correctly filled. This functionality streamlines the process and reduces the chances of errors.

-

Is there a cost associated with using airSlate SignNow for the MO 1040ES blank?

airSlate SignNow provides a variety of pricing plans to cater to different user needs, ensuring cost-effectiveness for anyone needing to work with the MO 1040ES blank. The plans include features that make document signing and management efficient without breaking the bank. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for the MO 1040ES blank?

With airSlate SignNow, you can effortlessly eSign, share, and manage your MO 1040ES blank form. The platform includes features such as document templates, team collaboration tools, and real-time notifications. These features enhance productivity and ensure a seamless document management experience.

-

Can I store my completed MO 1040ES blank forms in airSlate SignNow?

Yes, airSlate SignNow allows users to securely store completed MO 1040ES blank forms in the cloud. This ensures that your documents are safe and easily accessible whenever needed. The ability to organize and retrieve your forms helps maintain your financial records effectively.

-

Does airSlate SignNow integrate with other software for managing the MO 1040ES blank?

Absolutely! airSlate SignNow offers integrations with various software solutions, enabling efficient management of your MO 1040ES blank. By connecting with tools like CRM systems and accounting software, users can streamline their workflows and enhance productivity.

-

How does airSlate SignNow ensure the security of my MO 1040ES blank information?

airSlate SignNow prioritizes security, implementing robust encryption protocols to protect your MO 1040ES blank information. The platform adheres to strict compliance standards, ensuring that your sensitive data remains private and secure. This commitment to security gives users peace of mind.

Get more for Estimated Tax Individuals

- Gillespie county texas hotel occupancy tax return taxpayer information

- Bureau of internal revenue department of finance form

- Voluntary work request for organisation approval form su461free request for approval template and best practicesvoluntary work

- Nb 12 rev 35 r applicationdocx form

- Has the child a sibling or a parent had a seizure has the child had brain or other form

- Application to withdraw of vested benefits rendita stiftungen form

- Form jv 438 ampquottwelve month permanency attachment

- Notice and acknowledgement of pay rate and payday notice for employees paid a weekly rate or a salary for a fixed number of form

Find out other Estimated Tax Individuals

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online