Form 1040 ES OTC Easy to Fill and DownloadCocoDoc 2022

Understanding the Missouri Estimated Tax Form

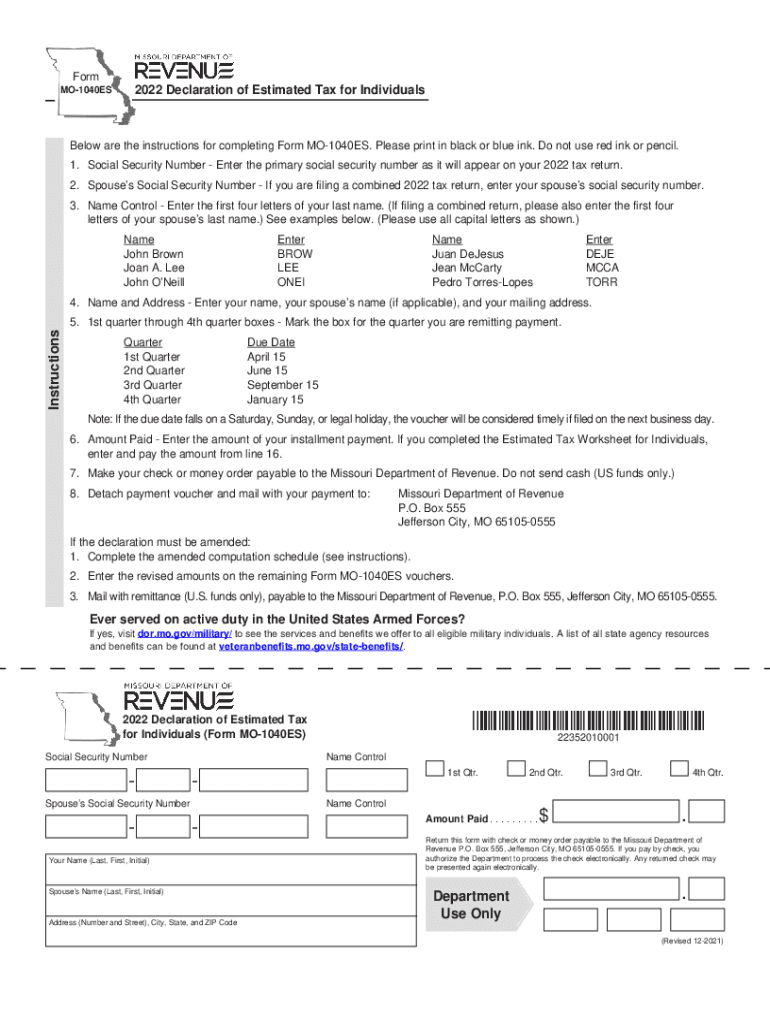

The Missouri estimated tax form, also known as the MO-1040ES, is essential for individuals who expect to owe tax of $500 or more when filing their annual return. This form allows taxpayers to make quarterly estimated tax payments based on their expected income for the year. Understanding how to accurately complete this form can help avoid penalties and ensure compliance with state tax regulations.

Steps to Complete the Missouri Estimated Tax Form

Filling out the Missouri estimated tax form involves several key steps:

- Determine your expected income: Estimate your total income for the year, including wages, interest, dividends, and other sources.

- Calculate your expected tax liability: Use the current Missouri tax rates to determine how much tax you will owe based on your estimated income.

- Complete the form: Fill out the MO-1040ES with your personal information, estimated income, and calculated tax liability.

- Submit your payments: Make your quarterly payments by the due dates specified on the form to avoid penalties.

Filing Deadlines for Estimated Tax Payments

It is crucial to adhere to the filing deadlines for estimated tax payments in Missouri. Payments are typically due on the 15th of April, June, September, and January of the following year. Missing these deadlines can result in interest and penalties, so keeping track of these dates is essential for compliance.

Legal Use of the Missouri Estimated Tax Form

The Missouri estimated tax form is legally binding when filled out correctly and submitted on time. It is important to ensure that all information is accurate to avoid issues with the Missouri Department of Revenue. Additionally, eSignatures can be used to validate the submission of this form electronically, provided that the signing process complies with relevant eSignature laws.

Required Documents for Filing

When preparing to file your Missouri estimated tax, you will need several documents, including:

- Your previous year's tax return for reference.

- Documentation of any income sources, such as W-2s or 1099s.

- Records of any deductions you plan to claim.

Penalties for Non-Compliance

Failing to file or pay estimated taxes on time can lead to significant penalties. Missouri imposes interest on late payments and may charge a penalty for underpayment. Understanding these penalties can motivate timely and accurate submissions, ensuring that you remain in good standing with the state tax authorities.

Quick guide on how to complete form 1040 es otc easy to fill and downloadcocodoc

Complete Form 1040 ES OTC Easy To Fill And DownloadCocoDoc effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents rapidly without delays. Handle Form 1040 ES OTC Easy To Fill And DownloadCocoDoc on any device using airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

The simplest way to modify and eSign Form 1040 ES OTC Easy To Fill And DownloadCocoDoc with ease

- Obtain Form 1040 ES OTC Easy To Fill And DownloadCocoDoc and click on Get Form to begin.

- Utilize the tools available to fill out your document.

- Mark important sections of your documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choice. Modify and eSign Form 1040 ES OTC Easy To Fill And DownloadCocoDoc while ensuring excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1040 es otc easy to fill and downloadcocodoc

Create this form in 5 minutes!

People also ask

-

What is Missouri estimated tax online, and why is it important?

Missouri estimated tax online refers to the process of calculating and submitting your estimated taxes via the internet. It's crucial for ensuring compliance with state tax laws and avoiding penalties. By handling your estimated taxes online, you can efficiently manage your payments and keep your financial records up to date.

-

How does airSlate SignNow help with Missouri estimated tax online?

airSlate SignNow streamlines the process of submitting your Missouri estimated tax online by allowing you to securely send and eSign necessary documents. This eliminates the traditional hassles of paperwork and helps you maintain an organized digital record. It's an easy-to-use solution that empowers you to focus on your business rather than being bogged down in tax filings.

-

Can I track my Missouri estimated tax online payments with airSlate SignNow?

Yes, airSlate SignNow provides tools to track your Missouri estimated tax online payments. You can access your documents and verify submission statuses anytime, ensuring you stay on top of your tax responsibilities. This feature promotes transparency and reduces the likelihood of missed deadlines or payments.

-

What are the pricing options for using airSlate SignNow for estimated tax documents?

airSlate SignNow offers cost-effective pricing plans that cater to various business needs, including those related to Missouri estimated tax online. Plans are designed to be budget-friendly while providing robust features to manage your documents effectively. For detailed pricing, it's best to visit the airSlate SignNow website and choose a plan that suits your specific requirements.

-

Is airSlate SignNow compliant with Missouri tax regulations for estimated tax submissions?

Absolutely. airSlate SignNow is designed with compliance in mind and adheres to Missouri tax regulations for estimated tax online submissions. Using this solution ensures that your documents meet state requirements, providing you peace of mind during the filing process.

-

What features does airSlate SignNow offer for managing my Missouri estimated tax online?

airSlate SignNow offers a variety of features for managing your Missouri estimated tax online, including secure eSigning, document templates, and cloud storage. These tools allow easy collaboration with tax professionals and keep your documents organized. The user-friendly interface also simplifies the tracking and management of your tax documents.

-

Can I integrate airSlate SignNow with other accounting software for my estimated taxes?

Yes, airSlate SignNow boasts several integrations with leading accounting software, making it easier to manage your Missouri estimated tax online seamlessly. This ensures that all financial data is synchronized, reducing manual entry and potential errors. The integration facilitates a more efficient workflow for handling your taxes and other financial documents.

Get more for Form 1040 ES OTC Easy To Fill And DownloadCocoDoc

Find out other Form 1040 ES OTC Easy To Fill And DownloadCocoDoc

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement