MO MS Corporation Allocation and Apportionment of Income Schedule 2024-2026

What is the MO MS Corporation Allocation And Apportionment Of Income Schedule

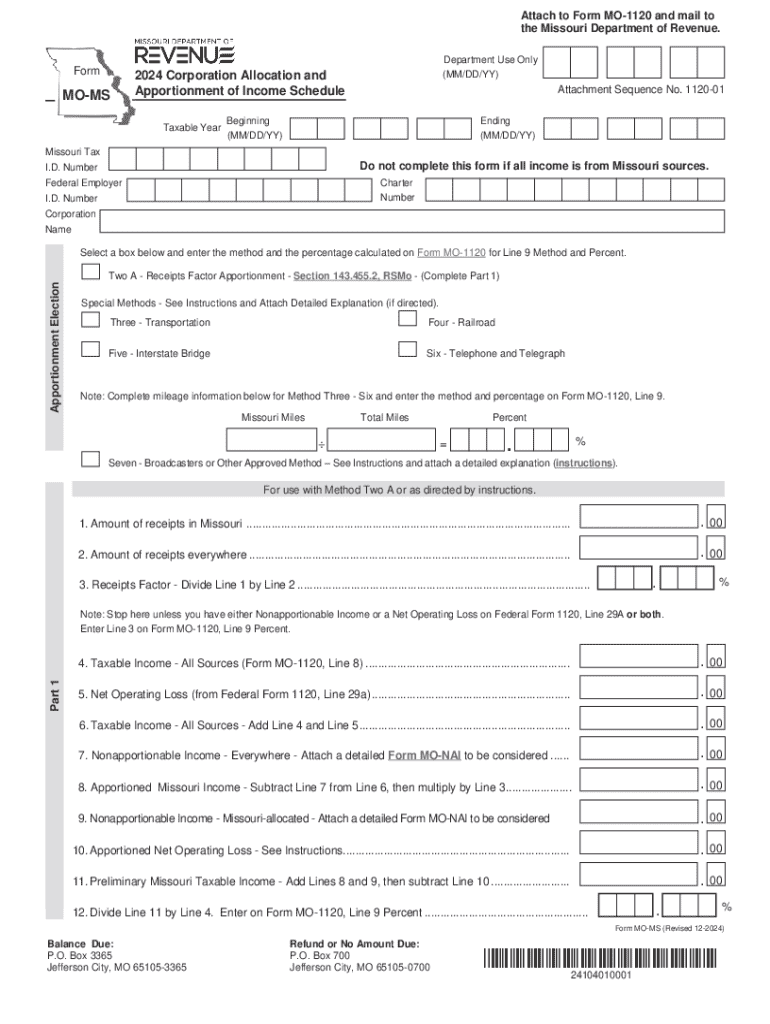

The MO MS Corporation Allocation and Apportionment of Income Schedule is a crucial form used by corporations operating in Missouri. It is designed to determine how much of a corporation's income is subject to Missouri state taxation. This form helps allocate income from various sources, ensuring compliance with state tax laws. It is essential for corporations to accurately report their income to avoid penalties and ensure proper tax assessments.

How to use the MO MS Corporation Allocation And Apportionment Of Income Schedule

To effectively use the MO MS Corporation Allocation and Apportionment of Income Schedule, corporations need to follow specific guidelines. First, gather all relevant financial data, including income from both in-state and out-of-state sources. Next, complete the schedule by entering the appropriate figures in designated sections, ensuring that all calculations are accurate. Finally, attach the completed schedule to the corporation's tax return when filing with the Missouri Department of Revenue.

Steps to complete the MO MS Corporation Allocation And Apportionment Of Income Schedule

Completing the MO MS Corporation Allocation and Apportionment of Income Schedule involves several steps:

- Collect financial statements and records of all income sources.

- Identify the total income earned by the corporation.

- Determine the income attributable to Missouri using the appropriate allocation methods.

- Fill out the schedule by entering the calculated figures in the correct sections.

- Review the completed schedule for accuracy before submission.

Key elements of the MO MS Corporation Allocation And Apportionment Of Income Schedule

The key elements of the MO MS Corporation Allocation and Apportionment of Income Schedule include sections for reporting total income, deductions, and specific adjustments related to Missouri operations. It typically requires details on sales, property, and payroll, which are used to calculate the apportionment percentage. Understanding these elements is vital for ensuring the form is filled out correctly and in compliance with state regulations.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines for the MO MS Corporation Allocation and Apportionment of Income Schedule. Generally, the form is due on the same date as the corporation's income tax return. It is advisable to check the Missouri Department of Revenue's website for any updates on deadlines or changes in filing requirements to avoid late penalties.

Penalties for Non-Compliance

Failure to comply with the requirements of the MO MS Corporation Allocation and Apportionment of Income Schedule can result in significant penalties. These may include fines, interest on unpaid taxes, and potential audits. Corporations are encouraged to ensure accurate and timely submissions to mitigate the risk of non-compliance and associated penalties.

Create this form in 5 minutes or less

Find and fill out the correct mo ms corporation allocation and apportionment of income schedule 772045260

Create this form in 5 minutes!

How to create an eSignature for the mo ms corporation allocation and apportionment of income schedule 772045260

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MO MS Corporation Allocation And Apportionment Of Income Schedule?

The MO MS Corporation Allocation And Apportionment Of Income Schedule is a crucial document for corporations operating in Missouri and Mississippi. It helps businesses allocate and apportion their income accurately for tax purposes, ensuring compliance with state regulations. Understanding this schedule is essential for effective tax planning and reporting.

-

How can airSlate SignNow assist with the MO MS Corporation Allocation And Apportionment Of Income Schedule?

airSlate SignNow provides an efficient platform for businesses to prepare and eSign the MO MS Corporation Allocation And Apportionment Of Income Schedule. With its user-friendly interface, companies can easily manage their documents and ensure they are completed accurately and on time. This streamlines the process, reducing the risk of errors.

-

What are the pricing options for using airSlate SignNow for the MO MS Corporation Allocation And Apportionment Of Income Schedule?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Whether you are a small business or a large corporation, you can find a plan that fits your budget while providing access to essential features for managing the MO MS Corporation Allocation And Apportionment Of Income Schedule. Contact us for a detailed pricing breakdown.

-

What features does airSlate SignNow offer for managing the MO MS Corporation Allocation And Apportionment Of Income Schedule?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure cloud storage, all designed to simplify the management of the MO MS Corporation Allocation And Apportionment Of Income Schedule. These tools enhance collaboration and ensure that all stakeholders can access and sign documents easily, improving overall efficiency.

-

Are there any integrations available with airSlate SignNow for the MO MS Corporation Allocation And Apportionment Of Income Schedule?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage the MO MS Corporation Allocation And Apportionment Of Income Schedule. These integrations allow for automatic data transfer, reducing manual entry and minimizing errors. This ensures that your financial data is always up-to-date and accurate.

-

What are the benefits of using airSlate SignNow for the MO MS Corporation Allocation And Apportionment Of Income Schedule?

Using airSlate SignNow for the MO MS Corporation Allocation And Apportionment Of Income Schedule offers numerous benefits, including time savings, enhanced accuracy, and improved compliance. The platform's intuitive design allows users to complete documents quickly, while its security features protect sensitive information. This results in a more efficient workflow for your business.

-

Is airSlate SignNow secure for handling the MO MS Corporation Allocation And Apportionment Of Income Schedule?

Absolutely, airSlate SignNow prioritizes security and compliance, ensuring that your MO MS Corporation Allocation And Apportionment Of Income Schedule is handled with the utmost care. The platform employs advanced encryption and security protocols to protect your documents and data. You can trust that your information is safe while using our services.

Get more for MO MS Corporation Allocation And Apportionment Of Income Schedule

Find out other MO MS Corporation Allocation And Apportionment Of Income Schedule

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document