Form MO MS Corporation Allocation and Apportionment of Income Schedule 2017

What is the Form MO MS Corporation Allocation And Apportionment Of Income Schedule

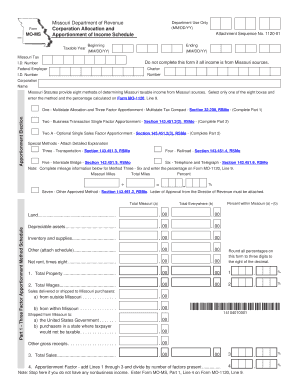

The Form MO MS Corporation Allocation And Apportionment Of Income Schedule is a tax document used by corporations operating in Missouri. This form is essential for determining how a corporation's income is allocated and apportioned among different jurisdictions. It helps ensure that income is reported accurately for state tax purposes, reflecting the corporation's business activities within and outside Missouri.

This schedule is particularly relevant for multi-state corporations, as it provides a systematic approach to dividing income based on various factors such as property, payroll, and sales. Understanding this form is crucial for compliance with Missouri tax regulations and for optimizing tax liabilities.

How to use the Form MO MS Corporation Allocation And Apportionment Of Income Schedule

Using the Form MO MS Corporation Allocation And Apportionment Of Income Schedule involves several steps to ensure accurate reporting of income. First, gather all necessary financial information, including total income, expenses, and details about business operations in various states. Next, determine the allocation factors, which typically include property, payroll, and sales.

Once the data is collected, fill out the form by entering the relevant figures in the appropriate sections. It is important to follow the instructions carefully to avoid errors that could lead to penalties. After completing the form, review it for accuracy before submission to the Missouri Department of Revenue.

Steps to complete the Form MO MS Corporation Allocation And Apportionment Of Income Schedule

Completing the Form MO MS Corporation Allocation And Apportionment Of Income Schedule requires a methodical approach:

- Collect financial statements and records for the tax year.

- Identify the jurisdictions where the corporation operates.

- Calculate the total income earned in each jurisdiction.

- Determine the allocation factors based on property, payroll, and sales.

- Fill in the form with the calculated figures, ensuring all sections are completed.

- Double-check the form for accuracy and completeness.

- Submit the form to the appropriate tax authority by the deadline.

Key elements of the Form MO MS Corporation Allocation And Apportionment Of Income Schedule

The Form MO MS Corporation Allocation And Apportionment Of Income Schedule includes several key elements that are essential for accurate reporting:

- Income Reporting: Details of total income earned by the corporation.

- Allocation Factors: Sections for property, payroll, and sales used to apportion income.

- Jurisdiction Information: Areas where the corporation conducts business activities.

- Signature Section: Required signatures to validate the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the Form MO MS Corporation Allocation And Apportionment Of Income Schedule typically align with the corporate income tax return deadlines. Corporations must submit their forms by the due date of the Missouri corporate income tax return, which is generally the fifteenth day of the fourth month following the end of the tax year. It is important to stay informed about any changes to these deadlines to avoid penalties.

Penalties for Non-Compliance

Failure to file the Form MO MS Corporation Allocation And Apportionment Of Income Schedule on time or inaccuracies in the form can result in significant penalties. These may include fines, interest on unpaid taxes, and potential audits by the Missouri Department of Revenue. It is crucial for corporations to ensure compliance with all filing requirements to avoid these consequences.

Quick guide on how to complete form mo ms corporation allocation and apportionment of income schedule

Complete Form MO MS Corporation Allocation And Apportionment Of Income Schedule effortlessly on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers a perfect eco-friendly substitute for traditional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Handle Form MO MS Corporation Allocation And Apportionment Of Income Schedule on any platform using airSlate SignNow's Android or iOS apps and simplify any document-related task today.

The easiest way to modify and eSign Form MO MS Corporation Allocation And Apportionment Of Income Schedule with ease

- Obtain Form MO MS Corporation Allocation And Apportionment Of Income Schedule and click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to store your changes.

- Choose how you wish to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Put an end to lost or misplaced files, laborious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign Form MO MS Corporation Allocation And Apportionment Of Income Schedule and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form mo ms corporation allocation and apportionment of income schedule

Create this form in 5 minutes!

How to create an eSignature for the form mo ms corporation allocation and apportionment of income schedule

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form MO MS Corporation Allocation And Apportionment Of Income Schedule?

The Form MO MS Corporation Allocation And Apportionment Of Income Schedule is a tax form used by corporations in Missouri to allocate and apportion their income for state tax purposes. This form helps ensure that businesses report their income accurately based on their operations within the state.

-

How can airSlate SignNow assist with the Form MO MS Corporation Allocation And Apportionment Of Income Schedule?

airSlate SignNow provides a streamlined platform for businesses to prepare, send, and eSign the Form MO MS Corporation Allocation And Apportionment Of Income Schedule. Our solution simplifies document management, ensuring that your tax forms are completed accurately and efficiently.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our cost-effective solution allows you to manage the Form MO MS Corporation Allocation And Apportionment Of Income Schedule and other documents without breaking the bank.

-

Are there any features specifically designed for tax document management?

Yes, airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSigning, all of which are beneficial for managing the Form MO MS Corporation Allocation And Apportionment Of Income Schedule. These features enhance efficiency and accuracy in your tax documentation process.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and tax software, allowing you to easily manage the Form MO MS Corporation Allocation And Apportionment Of Income Schedule alongside your other financial documents. This integration helps streamline your workflow and reduces the risk of errors.

-

What are the benefits of using airSlate SignNow for my corporation's tax forms?

Using airSlate SignNow for your corporation's tax forms, including the Form MO MS Corporation Allocation And Apportionment Of Income Schedule, offers numerous benefits. These include enhanced security, improved collaboration, and faster turnaround times, ensuring that your tax submissions are timely and accurate.

-

Is airSlate SignNow user-friendly for those unfamiliar with eSigning?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it accessible even for those unfamiliar with eSigning. Our intuitive interface allows users to easily navigate and complete the Form MO MS Corporation Allocation And Apportionment Of Income Schedule without any technical expertise.

Get more for Form MO MS Corporation Allocation And Apportionment Of Income Schedule

Find out other Form MO MS Corporation Allocation And Apportionment Of Income Schedule

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors