MO MS Corporation Allocation and Apportionment of Income Schedule 2023

Understanding the MO MS Corporation Allocation And Apportionment Of Income Schedule

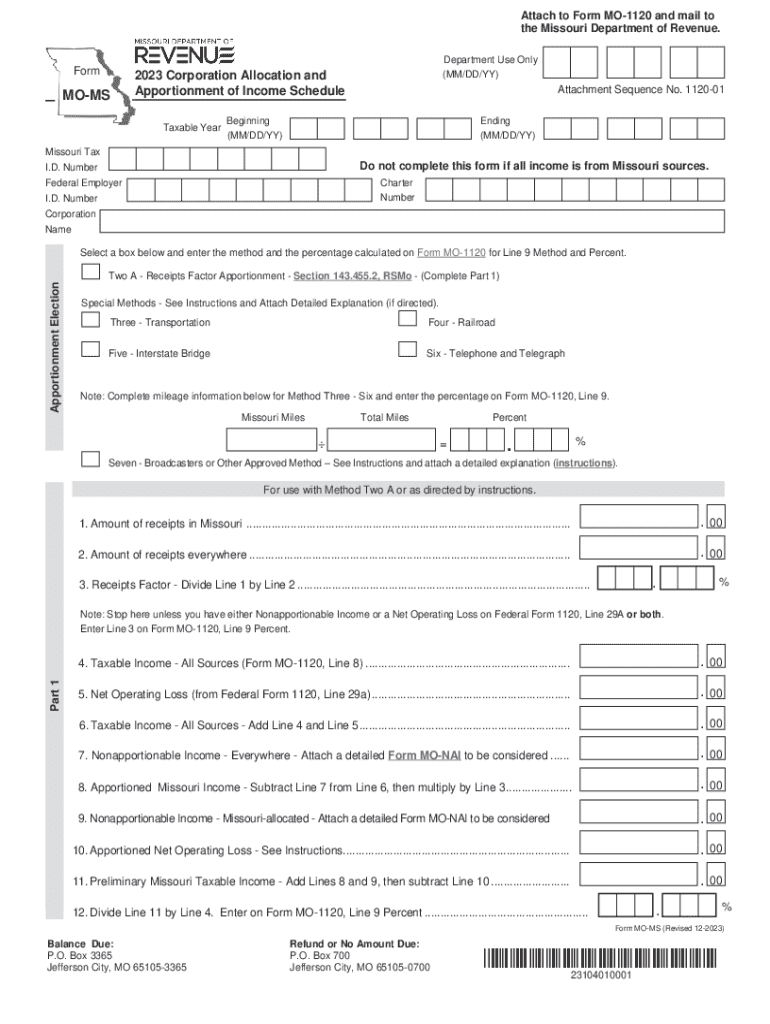

The MO MS Corporation Allocation And Apportionment Of Income Schedule is a crucial document for corporations operating in Missouri. This schedule is used to determine how much of a corporation's income is subject to Missouri state taxation. It helps in allocating income among various states where the corporation operates, ensuring compliance with state tax regulations.

This form is essential for corporations that have activities both within and outside of Missouri, as it provides a clear method for calculating the portion of income that is taxable in Missouri. Understanding this schedule is vital for accurate tax reporting and to avoid potential penalties.

Steps to Complete the MO MS Corporation Allocation And Apportionment Of Income Schedule

Completing the MO MS Corporation Allocation And Apportionment Of Income Schedule involves several key steps:

- Gather Financial Information: Collect all necessary financial documents, including income statements and balance sheets.

- Identify Apportionment Factors: Determine the relevant factors for apportionment, such as property, payroll, and sales, which will be used to allocate income.

- Calculate Apportionment Ratios: Use the identified factors to calculate the apportionment ratios, which will help in determining the taxable income in Missouri.

- Complete the Schedule: Fill out the MO MS schedule accurately, ensuring all calculations are correct and all necessary information is included.

- Review and Submit: Review the completed schedule for accuracy before submitting it with your tax return.

Legal Use of the MO MS Corporation Allocation And Apportionment Of Income Schedule

The legal use of the MO MS Corporation Allocation And Apportionment Of Income Schedule is mandated by Missouri tax law. Corporations must use this schedule to report their income accurately to ensure compliance with state tax obligations. Failure to use this schedule appropriately can result in legal repercussions, including fines and penalties.

It is essential for corporations to understand the legal requirements surrounding this schedule, including deadlines for submission and the necessity of maintaining accurate records to support the figures reported on the schedule.

Key Elements of the MO MS Corporation Allocation And Apportionment Of Income Schedule

Several key elements make up the MO MS Corporation Allocation And Apportionment Of Income Schedule:

- Income Reporting: A section for reporting total income earned by the corporation.

- Apportionment Factors: Details on the property, payroll, and sales factors used for income allocation.

- Calculation of Missouri Income: A clear method for arriving at the portion of income taxable in Missouri.

- Signature Section: A place for authorized representatives to sign, confirming the accuracy of the information provided.

Filing Deadlines and Important Dates

Filing deadlines for the MO MS Corporation Allocation And Apportionment Of Income Schedule are critical to ensure compliance. Corporations must submit this schedule along with their annual tax return, typically due on the fifteenth day of the fourth month following the end of their fiscal year.

It is advisable for corporations to mark their calendars with these important dates to avoid late filing penalties. Additionally, any changes in tax law or filing requirements should be monitored closely to ensure timely compliance.

Examples of Using the MO MS Corporation Allocation And Apportionment Of Income Schedule

Understanding how to use the MO MS Corporation Allocation And Apportionment Of Income Schedule can be enhanced through practical examples:

For instance, a corporation with operations in Missouri and Illinois would calculate its apportionment factors based on its property, payroll, and sales in each state. If the corporation has fifty percent of its total sales in Missouri, it would allocate fifty percent of its income to Missouri for tax purposes.

These examples illustrate the importance of accurate calculations and the impact they have on tax liabilities. Corporations should consider various scenarios to ensure they are applying the schedule correctly.

Quick guide on how to complete mo ms corporation allocation and apportionment of income schedule 733567663

Effortlessly Complete MO MS Corporation Allocation And Apportionment Of Income Schedule on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it on the web. airSlate SignNow provides all the tools required to create, edit, and eSign your documents quickly and efficiently. Manage MO MS Corporation Allocation And Apportionment Of Income Schedule on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Edit and eSign MO MS Corporation Allocation And Apportionment Of Income Schedule with Ease

- Find MO MS Corporation Allocation And Apportionment Of Income Schedule and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you’d like to send your form, whether via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or errors that require printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device of your choice. Edit and eSign MO MS Corporation Allocation And Apportionment Of Income Schedule and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mo ms corporation allocation and apportionment of income schedule 733567663

Create this form in 5 minutes!

How to create an eSignature for the mo ms corporation allocation and apportionment of income schedule 733567663

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to mo ms?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and sign documents electronically. It streamlines the signing process, making it easier and more efficient for users. With its focus on mo ms, airSlate SignNow ensures that your document management is both effective and user-friendly.

-

How much does airSlate SignNow cost for mo ms users?

airSlate SignNow offers competitive pricing plans tailored for mo ms users. Depending on your business needs, you can choose from various subscription options that provide flexibility and value. Each plan is designed to accommodate different levels of usage, ensuring that you get the best return on your investment.

-

What features does airSlate SignNow offer for mo ms?

airSlate SignNow includes a range of features specifically designed for mo ms, such as customizable templates, real-time tracking, and secure cloud storage. These features enhance the signing experience and improve document workflow efficiency. Users can also benefit from advanced security measures to protect sensitive information.

-

Can airSlate SignNow integrate with other tools for mo ms?

Yes, airSlate SignNow offers seamless integrations with various applications that are essential for mo ms. This includes popular tools like Google Drive, Salesforce, and Microsoft Office. These integrations help streamline your workflow and ensure that all your documents are easily accessible.

-

What are the benefits of using airSlate SignNow for mo ms?

Using airSlate SignNow for mo ms provides numerous benefits, including increased efficiency, reduced turnaround time, and enhanced document security. The platform simplifies the signing process, allowing users to focus on their core business activities. Additionally, it helps in reducing paper usage, contributing to a more sustainable business model.

-

Is airSlate SignNow user-friendly for mo ms?

Absolutely! airSlate SignNow is designed with user experience in mind, making it highly user-friendly for mo ms. The intuitive interface allows users to navigate easily and complete tasks without extensive training. This ensures that even those with minimal technical skills can utilize the platform effectively.

-

How does airSlate SignNow ensure document security for mo ms?

airSlate SignNow prioritizes document security for mo ms by implementing advanced encryption and authentication measures. This ensures that all signed documents are protected from unauthorized access. Additionally, the platform complies with industry standards and regulations, providing peace of mind for users.

Get more for MO MS Corporation Allocation And Apportionment Of Income Schedule

- Letter to lienholder to notify of trust tennessee form

- Tennessee sale contract form

- Tennessee sale contract 497326945 form

- Assumption agreement of deed of trust and release of original mortgagors tennessee form

- Tennessee estate form

- Notices eviction form

- Real estate home sales package with offer to purchase contract of sale disclosure statements and more for residential house 497326949 form

- Tn workers compensation 497326950 form

Find out other MO MS Corporation Allocation And Apportionment Of Income Schedule

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure