AV 9 Application for Property Tax Relief 2025-2026

What is the AV 9 Application for Property Tax Relief

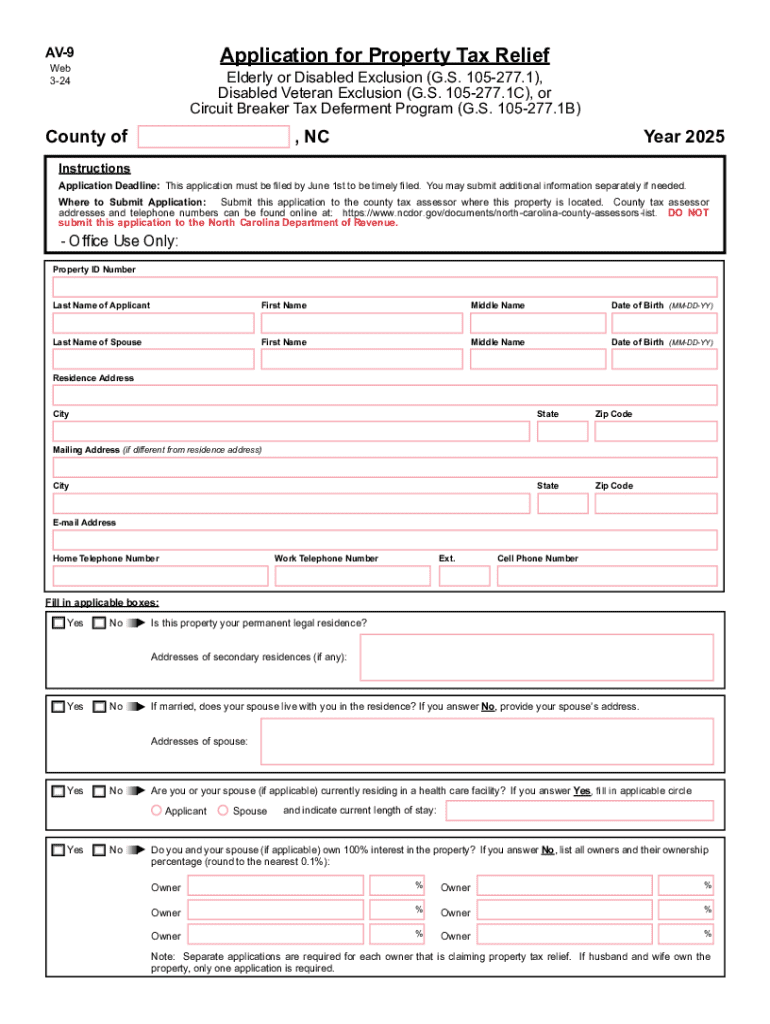

The AV 9 application is a crucial document used in North Carolina for individuals seeking property tax relief. This form is specifically designed for homeowners who may qualify for various tax relief programs, including the homestead exclusion and the circuit breaker tax deferment. By submitting the AV 9 application, eligible applicants can potentially reduce their property tax burden, making homeownership more affordable.

How to Use the AV 9 Application for Property Tax Relief

To effectively use the AV 9 application, individuals should first determine their eligibility based on the specific criteria outlined by the state. Once eligibility is confirmed, applicants can obtain the form from their local tax office or download it from the North Carolina Department of Revenue website. After filling out the application, it should be submitted to the appropriate county tax office for processing. It is essential to follow all instructions carefully to ensure a smooth application process.

Steps to Complete the AV 9 Application for Property Tax Relief

Completing the AV 9 application involves several key steps:

- Gather necessary information, including proof of age, income, and residency.

- Fill out the AV 9 form accurately, ensuring all required fields are completed.

- Review the application for any errors or missing information.

- Submit the completed form to your local county tax office by the specified deadline.

Following these steps will help ensure that your application is processed efficiently.

Eligibility Criteria for the AV 9 Application for Property Tax Relief

Eligibility for the AV 9 application is primarily based on age, income, and residency status. Typically, applicants must be at least sixty-five years old or permanently disabled. Additionally, there are income limits that must not be exceeded to qualify for property tax relief. Residency requirements stipulate that the property in question must be the applicant's primary residence. It is important for applicants to review these criteria thoroughly to confirm their eligibility before applying.

Required Documents for the AV 9 Application for Property Tax Relief

When completing the AV 9 application, certain documents are required to support your claim. These may include:

- Proof of age (such as a birth certificate or driver's license).

- Documentation of income (such as tax returns or Social Security statements).

- Proof of residency (such as utility bills or lease agreements).

Having these documents ready will streamline the application process and help avoid delays.

Form Submission Methods for the AV 9 Application

The AV 9 application can be submitted through various methods, depending on the preferences of the applicant and the regulations of the local tax office. Common submission methods include:

- Online submission through the county tax office's website, if available.

- Mailing the completed form to the appropriate county tax office address.

- In-person submission at the local tax office during business hours.

Choosing the most convenient submission method can help ensure timely processing of your application.

Create this form in 5 minutes or less

Find and fill out the correct av 9 application for property tax relief

Create this form in 5 minutes!

How to create an eSignature for the av 9 application for property tax relief

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form av 9 and how can airSlate SignNow help?

Form av 9 is a specific document used for various administrative purposes. With airSlate SignNow, you can easily create, send, and eSign form av 9, streamlining your workflow and ensuring compliance with legal requirements.

-

How much does it cost to use airSlate SignNow for form av 9?

airSlate SignNow offers competitive pricing plans that cater to different business needs. You can choose a plan that fits your budget while efficiently managing your form av 9 and other documents.

-

What features does airSlate SignNow provide for managing form av 9?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking specifically for form av 9. These tools enhance your document management process and improve overall efficiency.

-

Can I integrate airSlate SignNow with other applications for form av 9?

Yes, airSlate SignNow offers seamless integrations with various applications, allowing you to manage form av 9 alongside your existing tools. This integration capability enhances your workflow and saves time.

-

Is airSlate SignNow secure for handling sensitive form av 9 documents?

Absolutely! airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. You can confidently manage sensitive form av 9 documents without compromising data integrity.

-

How does airSlate SignNow improve the efficiency of processing form av 9?

By using airSlate SignNow, you can automate the sending and signing process for form av 9, signNowly reducing turnaround times. This efficiency allows your team to focus on more critical tasks while ensuring timely document completion.

-

What support options are available for users of form av 9 in airSlate SignNow?

airSlate SignNow provides comprehensive support options, including live chat, email assistance, and a detailed knowledge base. Whether you have questions about form av 9 or need technical help, our team is here to assist you.

Get more for AV 9 Application For Property Tax Relief

Find out other AV 9 Application For Property Tax Relief

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT