Application for Property Tax Relief 2018

What is the Application For Property Tax Relief

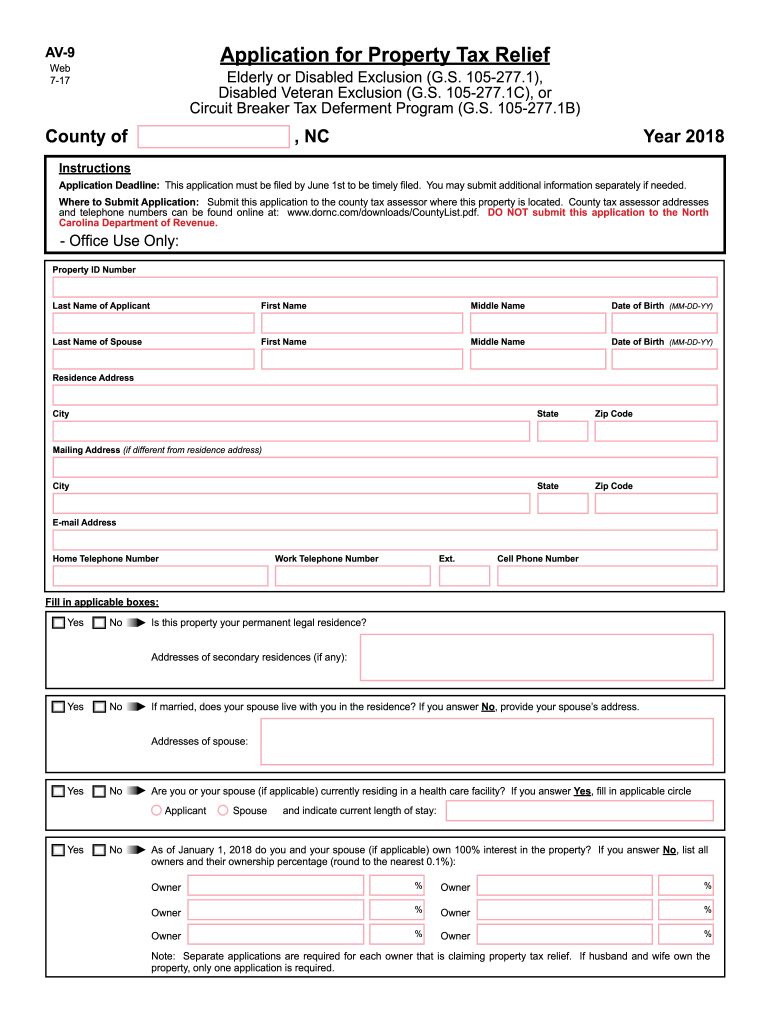

The Application For Property Tax Relief is a formal request submitted by property owners to reduce their property tax burden. This application typically outlines the reasons for seeking relief, which may include financial hardship, disability, or other qualifying circumstances. Each state has its own guidelines and criteria for eligibility, making it essential for applicants to understand their specific local requirements.

Steps to complete the Application For Property Tax Relief

Completing the Application For Property Tax Relief involves several key steps:

- Gather necessary documents, such as proof of income, property ownership details, and any relevant financial statements.

- Obtain the application form from your local tax authority or online through their official website.

- Fill out the application accurately, ensuring all required fields are completed and supporting documents are attached.

- Review the application for completeness and accuracy before submission.

- Submit the application before the specified deadline, either online, by mail, or in person, depending on local regulations.

Eligibility Criteria

Eligibility for the Application For Property Tax Relief varies by state but generally includes criteria such as:

- Income limits that determine financial need.

- Age or disability status, which may qualify certain individuals for additional relief.

- Ownership and occupancy of the property for which relief is being requested.

- Specific local or state regulations that must be met to qualify for tax relief.

Required Documents

When applying for property tax relief, applicants typically need to provide several documents, including:

- Proof of income, such as recent pay stubs or tax returns.

- Documentation of property ownership, like a deed or mortgage statement.

- Any relevant medical records or documentation that support claims of disability or financial hardship.

- Previous tax statements or assessments related to the property.

Legal use of the Application For Property Tax Relief

The Application For Property Tax Relief must be completed and submitted in compliance with local laws and regulations. Each state has specific legal frameworks governing the application process, including deadlines and required forms. Understanding these legal requirements is crucial to ensure that the application is processed correctly and that the relief is granted if eligible.

Form Submission Methods

Applicants can submit the Application For Property Tax Relief through various methods, depending on their local tax authority's guidelines. Common submission methods include:

- Online submission through the local tax authority's website, which may offer a secure portal for electronic filing.

- Mailing the completed application to the designated address provided by the local tax office.

- In-person submission at the local tax office, allowing for immediate confirmation of receipt.

Quick guide on how to complete application for property tax relief

Effortlessly Complete Application For Property Tax Relief on Any Device

The management of online documents has gained traction among both organizations and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any holdups. Manage Application For Property Tax Relief on any device with airSlate SignNow's Android or iOS applications and simplify any document-centered process today.

How to Modify and eSign Application For Property Tax Relief with Ease

- Find Application For Property Tax Relief and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign feature, which only takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Application For Property Tax Relief and ensure excellent communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct application for property tax relief

Create this form in 5 minutes!

How to create an eSignature for the application for property tax relief

How to make an electronic signature for the Application For Property Tax Relief online

How to create an electronic signature for your Application For Property Tax Relief in Google Chrome

How to generate an eSignature for signing the Application For Property Tax Relief in Gmail

How to create an eSignature for the Application For Property Tax Relief from your smartphone

How to make an electronic signature for the Application For Property Tax Relief on iOS devices

How to make an electronic signature for the Application For Property Tax Relief on Android

People also ask

-

What is the Application For Property Tax Relief?

The Application For Property Tax Relief is a document designed to help taxpayers apply for reductions in their property tax obligations. By utilizing airSlate SignNow, users can easily complete and eSign this application from anywhere, ensuring a smooth and efficient submission process.

-

How does airSlate SignNow simplify the Application For Property Tax Relief process?

airSlate SignNow streamlines the Application For Property Tax Relief by providing an intuitive platform for filling out forms and collecting electronic signatures. Users can prepare, send, and track their applications in real-time, saving both time and effort compared to traditional paper methods.

-

Are there any costs associated with using airSlate SignNow for the Application For Property Tax Relief?

Yes, airSlate SignNow offers a variety of pricing plans to fit different business needs. Each plan allows users to efficiently manage their Application For Property Tax Relief and other document workflows, providing excellent value for its features and ease of use.

-

What features does airSlate SignNow offer for managing the Application For Property Tax Relief?

airSlate SignNow includes features like customizable templates, electronic signatures, and secure cloud storage, all of which are essential for managing the Application For Property Tax Relief. These tools ensure that users have everything they need to complete and track their applications effectively.

-

Can I integrate airSlate SignNow with other software to help with the Application For Property Tax Relief?

Absolutely! airSlate SignNow offers various integrations with popular software tools, enabling seamless workflows. This means you can connect your existing apps to streamline the Application For Property Tax Relief process, enhancing productivity and efficiency.

-

What are the benefits of using airSlate SignNow for the Application For Property Tax Relief?

Using airSlate SignNow for the Application For Property Tax Relief allows you to save time and reduce paperwork. The platform’s efficiency, along with its user-friendly interface, means users can focus more on their tax relief efforts rather than getting bogged down by administrative tasks.

-

How secure is my information when using airSlate SignNow for the Application For Property Tax Relief?

Security is a top priority at airSlate SignNow. When you use the platform for your Application For Property Tax Relief, your data is encrypted and stored securely, ensuring your personal information and documents remain safe throughout the signing process.

Get more for Application For Property Tax Relief

- Bratenahl police department application form

- Medical doctor wilkes honors college form

- Instructions for employment eligibility verification department of homeland security u form

- Ladbs request for modification of building ordinances form

- Il482 0620 form

- San diego water conservation cert 2010 form

- Hydrant flow test form

- Hcd mp 532 form

Find out other Application For Property Tax Relief

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation