Application Relief 2018

What is the application for property tax relief?

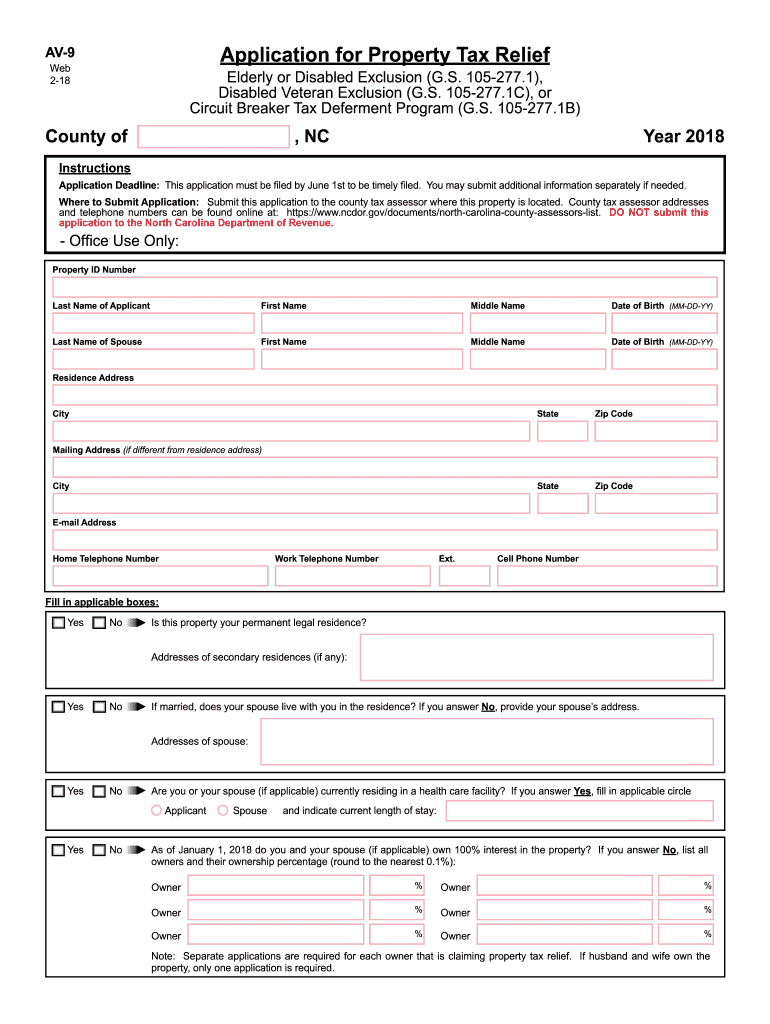

The application for property tax relief is a formal request submitted by property owners to reduce their property tax burden. This process allows eligible individuals, such as seniors, disabled persons, or low-income homeowners, to seek financial assistance through tax exemptions or reductions. Each state has specific criteria and guidelines that govern eligibility, ensuring that relief is provided to those who need it most. Understanding the purpose and function of this application is essential for homeowners looking to alleviate their tax responsibilities.

Steps to complete the application for property tax relief

Completing the application for property tax relief involves several key steps to ensure accuracy and compliance with state regulations. Follow these steps to navigate the process:

- Gather necessary documentation, including proof of income, age, or disability status.

- Obtain the correct form, often referred to as the AV-9 form in North Carolina, from your local tax authority.

- Fill out the form accurately, providing all requested information, including property details and personal identification.

- Review the completed application for any errors or omissions.

- Submit the application by the designated deadline, either online, by mail, or in person, depending on your state’s requirements.

Eligibility criteria for the application for property tax relief

Eligibility for property tax relief varies by state but generally includes specific criteria that applicants must meet. Common requirements often include:

- Homeownership status: Applicants must own and occupy the property for which they are seeking relief.

- Income limits: Many states impose income thresholds that applicants must not exceed to qualify for relief.

- Age or disability: Certain programs are designed for seniors or individuals with disabilities, requiring proof of status.

- Residency: Applicants must be residents of the state where they are applying for relief.

Reviewing these criteria carefully is crucial to ensure that you meet the necessary qualifications before applying.

Required documents for the application for property tax relief

When applying for property tax relief, it is important to prepare and submit the necessary documentation to support your application. Commonly required documents include:

- Proof of income, such as tax returns or pay stubs.

- Identification documents, including a driver's license or state ID.

- Proof of age or disability, if applicable, such as medical records or Social Security documentation.

- Property deed or mortgage documents to verify ownership.

Having these documents ready can streamline the application process and help ensure a successful outcome.

Form submission methods for the application for property tax relief

Submitting the application for property tax relief can be done through various methods, depending on state regulations. Common submission methods include:

- Online: Many states offer digital platforms where applicants can fill out and submit their forms electronically.

- By mail: Applicants can print the completed form and send it to their local tax authority via postal service.

- In person: Some individuals may prefer to deliver their application directly to the local tax office for immediate processing.

Choosing the appropriate submission method can help ensure that your application is received and processed in a timely manner.

Legal use of the application for property tax relief

The legal use of the application for property tax relief is governed by state laws and regulations. Each state has established legal frameworks that define how the application is processed and the rights of the applicants. It is essential to understand that submitting false information or failing to comply with the requirements can lead to penalties, including denial of the application or future tax liabilities. Ensuring that all information provided is accurate and truthful is crucial for the legal validity of the application.

Quick guide on how to complete application for property tax relief state of north carolina

Access Application Relief effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary forms and securely save them online. airSlate SignNow provides you with all the tools you require to create, modify, and eSign your documents quickly without delays. Handle Application Relief on any platform with airSlate SignNow's Android or iOS applications and streamline any document-centric task today.

How to modify and eSign Application Relief with ease

- Locate Application Relief and click on Get Form to begin.

- Utilize the tools at your disposal to fill out your form.

- Emphasize signNow parts of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review all information thoroughly and click on the Done button to save your changes.

- Choose your preferred delivery method for the form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Application Relief to ensure flawless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct application for property tax relief state of north carolina

Create this form in 5 minutes!

How to create an eSignature for the application for property tax relief state of north carolina

How to create an electronic signature for your Application For Property Tax Relief State Of North Carolina in the online mode

How to create an electronic signature for the Application For Property Tax Relief State Of North Carolina in Chrome

How to generate an electronic signature for signing the Application For Property Tax Relief State Of North Carolina in Gmail

How to generate an electronic signature for the Application For Property Tax Relief State Of North Carolina right from your smart phone

How to make an electronic signature for the Application For Property Tax Relief State Of North Carolina on iOS

How to make an eSignature for the Application For Property Tax Relief State Of North Carolina on Android

People also ask

-

What is the application for property tax relief?

The application for property tax relief is a formal request submitted to local tax authorities to reduce your property taxes based on specific criteria. This application often requires documentation that proves eligibility, such as income statements or proof of hardship.

-

How does airSlate SignNow facilitate the application for property tax relief?

AirSlate SignNow simplifies the application for property tax relief by allowing you to create, send, and eSign documents electronically. This streamlined process not only saves time but also ensures that your application is submitted accurately and securely.

-

What are the pricing options for airSlate SignNow for processing my application for property tax relief?

AirSlate SignNow offers various pricing tiers to fit different business needs, starting from a free basic plan to more comprehensive paid options. Each plan provides tools needed to manage your application for property tax relief efficiently, ensuring you get the best value for your investment.

-

Can I track the status of my application for property tax relief using airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your application for property tax relief. You will receive notifications when your documents are viewed, signed, and completed, keeping you informed throughout the process.

-

What features does airSlate SignNow offer to help with the application for property tax relief?

AirSlate SignNow includes features such as customizable templates, eSignature capabilities, and document management tools that are essential for the application for property tax relief. These tools enhance efficiency and reduce the likelihood of errors in your application submissions.

-

Are there any integrations available for airSlate SignNow when filing the application for property tax relief?

Absolutely! AirSlate SignNow integrates with various third-party applications that can complement the application for property tax relief. Whether you're using CRM software or document storage services, these integrations enhance your overall workflow.

-

How secure is my information when using airSlate SignNow for the application for property tax relief?

AirSlate SignNow prioritizes the security of your data, employing encryption and secure authentication methods. When you submit your application for property tax relief, your sensitive information is protected to provide you peace of mind.

Get more for Application Relief

- Affidavit for employment form

- Sample to fill a form at ul

- Dcsc form petition for permission to participate forms

- Iowa damage disclosure statement form

- Printable employee record form

- Navy southwest internal application form

- Dmepos medicare provider surety bond application suretec form

- Rental application amp information release form rentlinx

Find out other Application Relief

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA