Addresses and Telephone Numbers Can Be Found Online at Httpswww 2020

Eligibility Criteria for the AV-9 Application

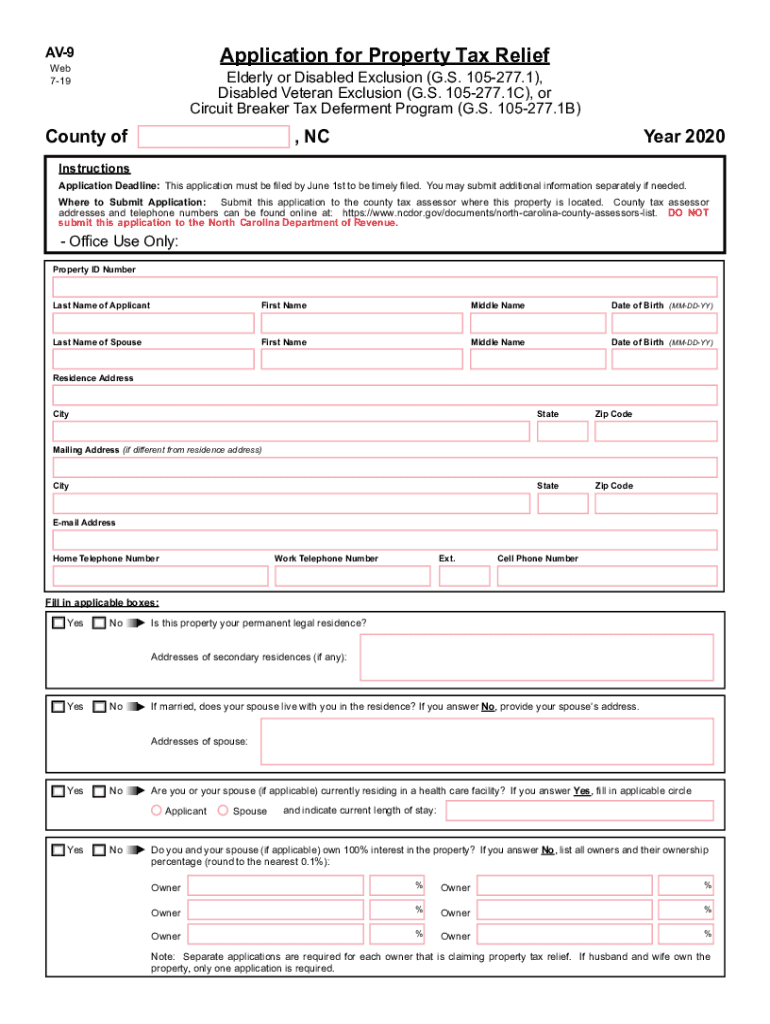

The AV-9 application for property tax relief in North Carolina is designed for specific groups of individuals. To qualify, applicants must meet certain criteria, which may include age, income level, and property ownership status. Common eligibility requirements include:

- Being a permanent resident of North Carolina.

- Owning the property for which relief is being sought.

- Meeting income limits set by the state.

- Being at least sixty-five years old or classified as totally and permanently disabled.

Understanding these criteria is essential for ensuring that your application is valid and increases your chances of approval.

Application Process & Approval Time

Filling out the AV-9 application involves several steps to ensure accurate submission. The process typically includes:

- Gathering necessary documentation, such as proof of income and identification.

- Completing the AV-9 form accurately, ensuring all required fields are filled.

- Submitting the application either online, by mail, or in person at the local tax office.

Once submitted, the approval time can vary. Generally, applicants can expect a response within a few weeks, depending on the volume of applications and the specific county's processing times.

Required Documents for Submission

When applying for property tax relief using the AV-9 application, certain documents are required to support your claim. These documents may include:

- A copy of your government-issued identification.

- Proof of income, such as tax returns or pay stubs.

- Documentation of property ownership, such as a deed or tax bill.

Ensuring that all required documents are included with your application can help facilitate a smoother review process.

Form Submission Methods

The AV-9 application can be submitted through various methods, providing flexibility for applicants. The available submission methods include:

- Online submission via the North Carolina Department of Revenue website.

- Mailing the completed form to the local tax office.

- In-person delivery at designated tax offices within your county.

Choosing the method that best suits your needs can help ensure timely processing of your application.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the AV-9 application can lead to penalties. Common consequences include:

- Loss of property tax relief benefits.

- Potential fines for providing false information.

- Legal action if the property tax obligations are not met.

Understanding these penalties emphasizes the importance of submitting accurate and truthful information on your application.

Digital vs. Paper Version of the AV-9 Form

Applicants have the option to complete the AV-9 application in either digital or paper format. The digital version offers advantages such as:

- Faster submission and processing times.

- Reduced risk of lost or misplaced documents.

- Convenience of completing the form from home.

The paper version may be preferred by those who are more comfortable with traditional methods. Regardless of the format chosen, ensuring that the application is filled out correctly is crucial for approval.

Quick guide on how to complete addresses and telephone numbers can be found online at httpswww

Easily Prepare Addresses And Telephone Numbers Can Be Found Online At Httpswww on Any Device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Manage Addresses And Telephone Numbers Can Be Found Online At Httpswww on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

Effortlessly Edit and eSign Addresses And Telephone Numbers Can Be Found Online At Httpswww

- Obtain Addresses And Telephone Numbers Can Be Found Online At Httpswww and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your papers or hide sensitive data with tools that airSlate SignNow specifically provides for this purpose.

- Create your electronic signature using the Sign feature, which takes only seconds and carries the same legal validity as a physical ink signature.

- Review all the information then click the Done button to finalize your changes.

- Choose your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Addresses And Telephone Numbers Can Be Found Online At Httpswww to ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct addresses and telephone numbers can be found online at httpswww

Create this form in 5 minutes!

How to create an eSignature for the addresses and telephone numbers can be found online at httpswww

The way to create an electronic signature for a PDF file in the online mode

The way to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

How to make an eSignature from your smartphone

The best way to create an eSignature for a PDF file on iOS devices

How to make an eSignature for a PDF file on Android

People also ask

-

What is the AV 9 application for property tax relief in North Carolina?

The AV 9 application for property tax relief in North Carolina is a form that property owners must complete to qualify for tax relief programs. It helps homeowners provide necessary information to the state for assessment purposes. By filing the AV 9 application, you can potentially lower your property tax burden.

-

How can I apply for the AV 9 application for property tax relief in North Carolina?

To apply for the AV 9 application for property tax relief in North Carolina, you can download the form from your local county's website or directly from the state’s property tax relief resources. Once completed, submit the application by the deadline to ensure eligibility for the program. airSlate SignNow can help streamline your document signing process for this application.

-

What are the eligibility requirements for the AV 9 application for property tax relief in North Carolina?

Eligibility for the AV 9 application for property tax relief in North Carolina typically includes being an owner of the property and meeting certain income criteria. Additional conditions may apply depending on specific local government guidelines. Always check your county’s rules to ensure compliance when submitting your application.

-

What benefits does the AV 9 application for property tax relief provide?

The AV 9 application for property tax relief provides signNow financial benefits by potentially reducing your property tax assessment. Homeowners who qualify may see decreased tax bills, which can ease financial burdens. It’s an essential step to secure tax savings for eligible residents in North Carolina.

-

Is there a fee associated with the AV 9 application for property tax relief in North Carolina?

There is no fee required to submit the AV 9 application for property tax relief in North Carolina. The application process is designed to be accessible to all homeowners who meet the eligibility criteria. Ensure all required information is provided accurately to avoid any delays in processing.

-

Can I submit the AV 9 application for property tax relief online?

Yes, many counties in North Carolina offer online submission options for the AV 9 application for property tax relief. This can simplify the process and help ensure timely delivery. Using services like airSlate SignNow can further enhance your experience by allowing easy eSigning and document management.

-

What documents do I need to include with my AV 9 application for property tax relief in North Carolina?

When filing the AV 9 application for property tax relief in North Carolina, you'll typically need to provide proof of ownership and any required income information. Check your local county guidelines for specific documentation requirements. Having all necessary documents ready can speed up the review process.

Get more for Addresses And Telephone Numbers Can Be Found Online At Httpswww

Find out other Addresses And Telephone Numbers Can Be Found Online At Httpswww

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later