Return of Organization Exempt from Income Tax It's Personal 2020

What is the Return of Organization Exempt From Income Tax It's Personal?

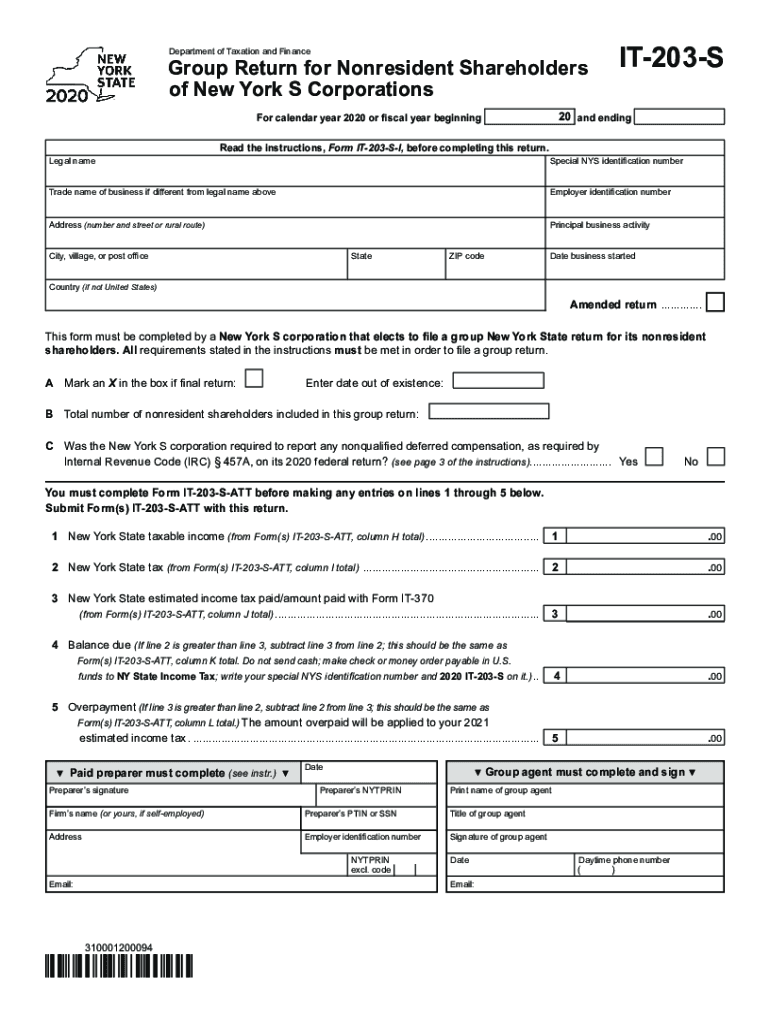

The Return of Organization Exempt From Income Tax It's Personal, commonly referred to as Form 203 S, is a tax form used by certain organizations to report their financial activities and maintain their tax-exempt status. This form is primarily utilized by organizations that are exempt from federal income tax under Section 501(c)(3) of the Internal Revenue Code. By filing this form, organizations confirm their compliance with IRS regulations and provide transparency regarding their income, expenses, and activities. It is crucial for maintaining the organization's tax-exempt status and ensuring that they adhere to the necessary legal requirements.

Steps to Complete the Return of Organization Exempt From Income Tax It's Personal

Completing the Return of Organization Exempt From Income Tax It's Personal involves several key steps to ensure accuracy and compliance. Here are the essential steps:

- Gather necessary documentation: Collect all financial records, including income statements, expense reports, and previous tax filings.

- Complete the form: Fill out Form 203 S with accurate information regarding the organization's financial activities.

- Review for accuracy: Double-check all entries for correctness to avoid errors that could lead to penalties or compliance issues.

- Submit the form: File the completed form with the IRS by the designated deadline, ensuring it is sent to the correct address.

Legal Use of the Return of Organization Exempt From Income Tax It's Personal

The legal use of the Return of Organization Exempt From Income Tax It's Personal is vital for organizations seeking to maintain their tax-exempt status. This form serves as a declaration to the IRS that the organization is operating within the guidelines set forth for tax-exempt entities. Failure to file this form or inaccuracies in the submission can result in penalties, loss of tax-exempt status, or increased scrutiny from the IRS. It is essential for organizations to understand the legal implications of this form and ensure compliance with all relevant regulations.

IRS Guidelines for Filing the Return of Organization Exempt From Income Tax It's Personal

The IRS provides specific guidelines for filing Form 203 S, which include detailed instructions on eligibility, required documentation, and submission methods. Organizations must adhere to these guidelines to ensure their form is accepted and processed correctly. Key points from the IRS guidelines include:

- Eligibility criteria for organizations that qualify to use Form 203 S.

- Detailed instructions on how to fill out each section of the form.

- Information on filing deadlines and potential penalties for late submissions.

Filing Deadlines for the Return of Organization Exempt From Income Tax It's Personal

Filing deadlines for the Return of Organization Exempt From Income Tax It's Personal are crucial for maintaining compliance. Typically, organizations must submit Form 203 S by the fifteenth day of the fifth month after the end of their fiscal year. For organizations operating on a calendar year, this means the form is due on May fifteenth. It is important to be aware of these deadlines to avoid penalties and ensure the organization remains in good standing with the IRS.

Required Documents for the Return of Organization Exempt From Income Tax It's Personal

To successfully complete the Return of Organization Exempt From Income Tax It's Personal, organizations must gather several required documents. These documents include:

- Financial statements detailing income and expenses for the reporting period.

- Previous tax filings, if applicable, to provide context and continuity.

- Supporting documentation for any deductions or credits claimed on the form.

Having these documents ready can streamline the filing process and help ensure accuracy in reporting.

Quick guide on how to complete return of organization exempt from income tax its personal

Complete Return Of Organization Exempt From Income Tax It's Personal effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents promptly without delays. Manage Return Of Organization Exempt From Income Tax It's Personal on any device using airSlate SignNow apps for Android or iOS and simplify any document-related process today.

The easiest way to modify and electronically sign Return Of Organization Exempt From Income Tax It's Personal effortlessly

- Obtain Return Of Organization Exempt From Income Tax It's Personal and click Get Form to begin.

- Utilize the tools available to complete your form.

- Mark important sections of the documents or obscure sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it onto your computer.

Put an end to lost or misfiled documents, tedious form hunting, or mistakes that necessitate printing additional copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Return Of Organization Exempt From Income Tax It's Personal and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct return of organization exempt from income tax its personal

Create this form in 5 minutes!

How to create an eSignature for the return of organization exempt from income tax its personal

The way to create an electronic signature for your PDF in the online mode

The way to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The way to make an eSignature straight from your smart phone

The best way to create an electronic signature for a PDF on iOS devices

The way to make an eSignature for a PDF document on Android OS

People also ask

-

What is airSlate SignNow and how does it work with 203 s?

airSlate SignNow is an electronic signature solution that allows businesses to send, sign, and manage documents seamlessly. With the 203 s plan, you can easily create templates and automate your document workflows, improving efficiency in your operations.

-

What are the pricing options for the 203 s plan?

The 203 s plan offers flexible pricing tailored to meet different business needs. You can choose from monthly or annual billing options, allowing you to stay budget-friendly while accessing powerful features designed for document management.

-

What key features does the 203 s plan include?

With the 203 s plan, users have access to a range of features such as customizable templates, advanced analytics, and user-friendly signing workflows. These features are designed to expedite the signing process and enhance document security.

-

How can the 203 s plan benefit my business?

The 203 s plan enables businesses to save time and resources by streamlining the eSigning process. By choosing airSlate SignNow, you can enhance productivity, reduce turnaround times, and improve customer satisfaction through efficient document handling.

-

Are there integrations available with the 203 s plan?

Yes, the 203 s plan offers numerous integrations with popular applications such as Google Drive, Dropbox, and Salesforce. These integrations allow you to manage your documents across different platforms seamlessly, enhancing your workflow.

-

Is the 203 s plan secure for handling sensitive documents?

Absolutely. The 203 s plan includes industry-standard security measures, such as advanced encryption and two-factor authentication. Your sensitive documents are stored securely, ensuring compliance with relevant regulations.

-

How do I get started with the 203 s plan?

Getting started with the 203 s plan is easy! Simply visit our website, select the 203 s option, and register for an account. You'll be guided through a straightforward setup process to start enjoying the benefits immediately.

Get more for Return Of Organization Exempt From Income Tax It's Personal

- Petition for name change of a minor child dc 6 form

- Clerk of the district court nebraska legislature form

- Notice to parent of hearing for the name change of a minor child dc 6 form

- Nebraska affidavit for transfer of real property without probate form

- Nebraska state court form defendants request for decree

- New hampshire revocable living trust form eforms

- New hampshire power of attorney forms pdf templates

- New hampshire acknowledgmentsindividualus legal forms

Find out other Return Of Organization Exempt From Income Tax It's Personal

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer