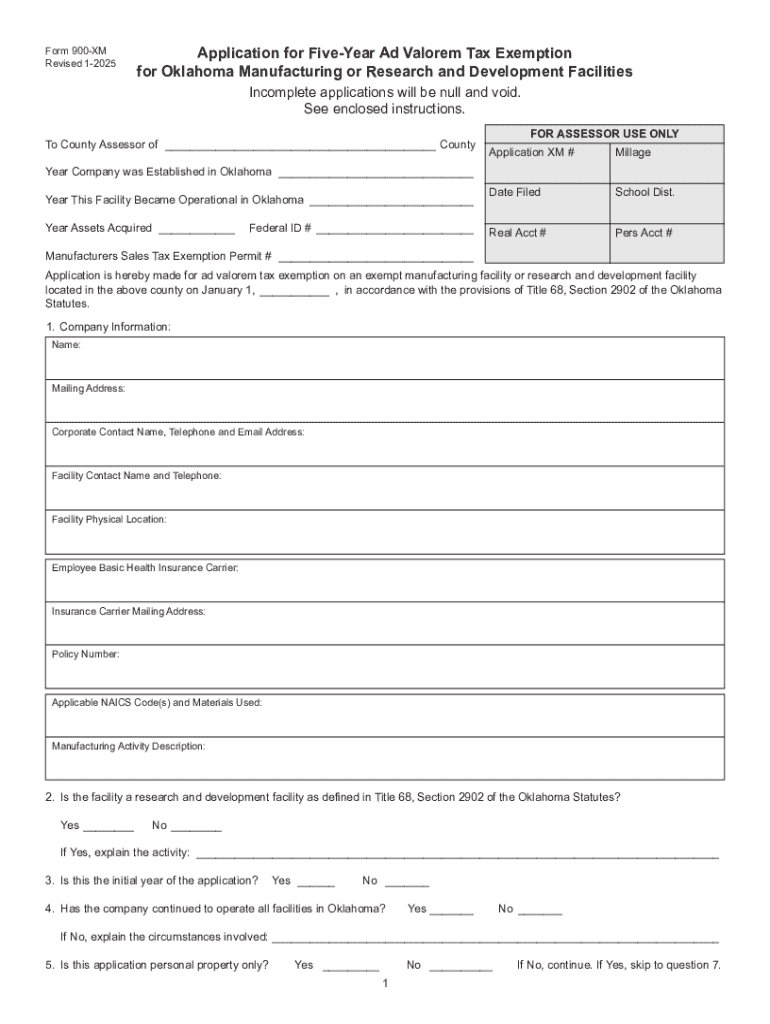

Form 900 XM Application for Five Year Ad Valorem Tax Exemption for Oklahoma Manufacturing or Research & Development Faciliti

Understanding the Oklahoma Exemption Certificate

The Oklahoma exemption certificate is a vital document for businesses seeking tax exemptions in the state. This certificate allows eligible entities to purchase goods and services without paying sales tax, provided they meet specific criteria. The exemption is particularly relevant for agricultural, manufacturing, and certain non-profit organizations. Understanding the requirements and proper usage of this certificate can significantly benefit businesses by reducing operational costs.

Eligibility Criteria for the Oklahoma Exemption Certificate

To qualify for the Oklahoma exemption certificate, applicants must meet certain criteria. Generally, the following categories are eligible:

- Manufacturers who produce goods for sale.

- Agricultural producers who utilize the certificate for farming supplies.

- Non-profit organizations that provide services to the community.

- Entities engaged in research and development activities.

Each category may have specific documentation requirements to demonstrate eligibility, so it is essential to review the guidelines carefully.

Steps to Complete the Oklahoma Exemption Certificate

Completing the Oklahoma exemption certificate involves several straightforward steps:

- Obtain the appropriate form from the Oklahoma Tax Commission.

- Fill in the required information, including business name, address, and tax identification number.

- Indicate the type of exemption being claimed, such as agricultural or manufacturing.

- Provide any necessary supporting documentation to validate your claim.

- Submit the completed form to the relevant tax authority.

Ensuring accuracy in the form is crucial to avoid delays in processing.

Required Documents for the Oklahoma Exemption Certificate

When applying for the Oklahoma exemption certificate, certain documents are typically required. These may include:

- Proof of business registration, such as a state-issued license.

- Tax identification number or employer identification number (EIN).

- Documentation supporting the claim for exemption, such as sales records or agricultural production evidence.

Having these documents prepared in advance can streamline the application process.

Form Submission Methods for the Oklahoma Exemption Certificate

The submission of the Oklahoma exemption certificate can be done through various methods, including:

- Online submission via the Oklahoma Tax Commission website.

- Mailing the completed form to the appropriate tax office.

- In-person submission at designated tax commission offices.

Each method has its own processing times, so consider your urgency when choosing how to submit.

Legal Use of the Oklahoma Exemption Certificate

Using the Oklahoma exemption certificate legally requires adherence to state regulations. Businesses must ensure that the certificate is only used for eligible purchases and that all information provided is accurate. Misuse of the exemption certificate can lead to penalties, including back taxes and fines. It is essential to maintain records of exempt purchases and be prepared for any audits by tax authorities.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 900 xm application for five year ad valorem tax exemption for oklahoma manufacturing or research development facilities

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Oklahoma exemption certificate?

An Oklahoma exemption certificate is a document that allows businesses to make tax-exempt purchases in the state of Oklahoma. This certificate is essential for qualifying organizations to avoid paying sales tax on eligible items. Understanding how to properly use an Oklahoma exemption certificate can save your business signNow costs.

-

How can airSlate SignNow help with Oklahoma exemption certificates?

airSlate SignNow provides a streamlined platform for businesses to create, send, and eSign Oklahoma exemption certificates efficiently. With our user-friendly interface, you can easily manage your documents and ensure compliance with state regulations. This simplifies the process of obtaining and utilizing exemption certificates for your business.

-

What are the pricing options for using airSlate SignNow for Oklahoma exemption certificates?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Our plans are designed to be cost-effective, ensuring that you can manage your Oklahoma exemption certificates without breaking the bank. You can choose a plan that fits your needs and budget, making it easy to get started.

-

Are there any features specifically for managing Oklahoma exemption certificates?

Yes, airSlate SignNow includes features tailored for managing Oklahoma exemption certificates, such as customizable templates and automated workflows. These features help you create and send exemption certificates quickly and efficiently. Additionally, our platform allows for easy tracking and management of all your documents.

-

What benefits does airSlate SignNow offer for businesses handling Oklahoma exemption certificates?

Using airSlate SignNow for Oklahoma exemption certificates provides numerous benefits, including increased efficiency and reduced paperwork. Our eSigning capabilities ensure that your documents are signed quickly, while our secure storage keeps them safe. This allows your business to focus on growth rather than administrative tasks.

-

Can airSlate SignNow integrate with other software for managing Oklahoma exemption certificates?

Absolutely! airSlate SignNow offers integrations with various software solutions, making it easy to manage your Oklahoma exemption certificates alongside your existing tools. Whether you use accounting software or CRM systems, our platform can seamlessly connect to enhance your workflow and document management.

-

How secure is the process of handling Oklahoma exemption certificates with airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect your Oklahoma exemption certificates and sensitive information. You can trust that your documents are safe and compliant with industry standards while using our platform.

Get more for Form 900 XM Application For Five Year Ad Valorem Tax Exemption For Oklahoma Manufacturing Or Research & Development Faciliti

- Lausd transcripts form

- My dietary supplement and medicine record form

- Glucometer quality control log template form

- Da 7652 form 100057134

- Number knowledge test form

- New headway elementary 4th edition tests pdf form

- Humana medical precertification request form

- Guide du candidat inscription aux examens et preuves form

Find out other Form 900 XM Application For Five Year Ad Valorem Tax Exemption For Oklahoma Manufacturing Or Research & Development Faciliti

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors