CA Form 3800 Child with Investment Income is Asking for 2024-2026

Understanding the California Form 3803 for Child With Investment Income

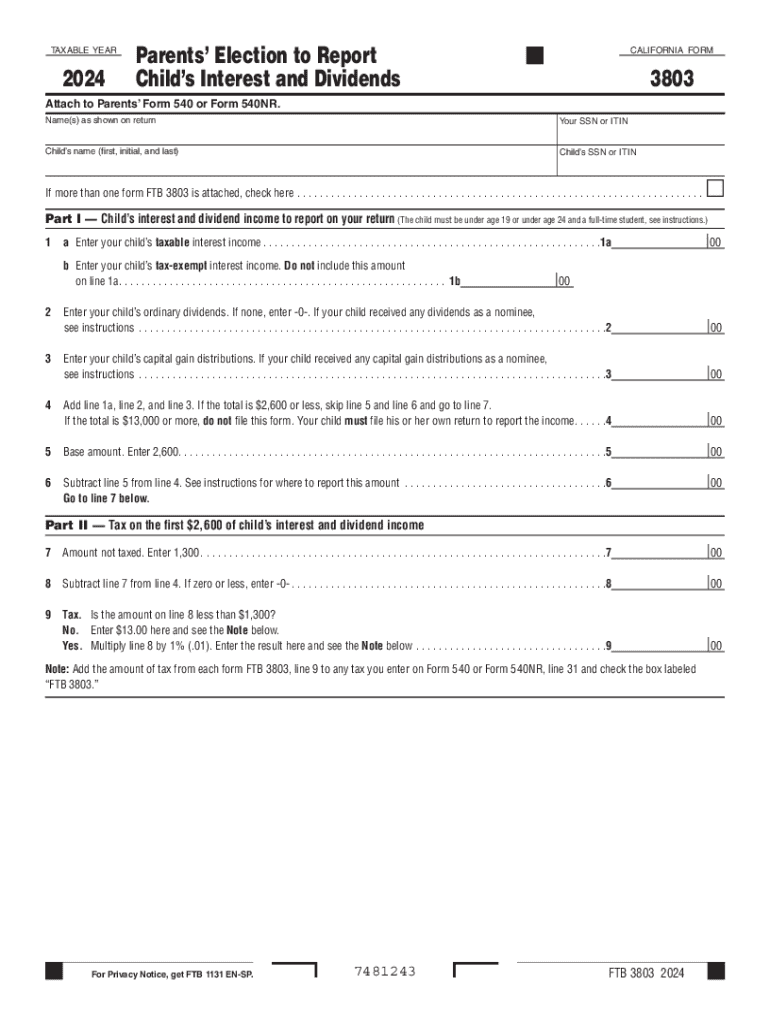

The California Form 3803 is designed for reporting income earned by children from investments. This form is essential for parents or guardians who need to report their child's unearned income, which may include interest, dividends, or capital gains. By filing this form, you ensure compliance with California tax regulations regarding the taxation of a child’s investment income.

Steps to Complete the California Form 3803

Completing the California Form 3803 involves several key steps:

- Gather necessary information about your child’s investment income, including all relevant financial documents.

- Fill out the form accurately, providing details such as the child’s name, Social Security number, and the total amount of unearned income.

- Calculate the tax owed based on the income reported, following the guidelines provided in the form instructions.

- Review the completed form for accuracy before submission to avoid any potential issues with the California Franchise Tax Board.

Legal Use of the California Form 3803

The California Form 3803 serves a legal purpose in ensuring that children's investment income is reported and taxed appropriately. It is crucial for parents to understand that failing to report this income can lead to penalties and interest charges from the tax authorities. The form is a vital tool for maintaining compliance with state tax laws, ensuring that all income is accounted for and taxed correctly.

Filing Deadlines and Important Dates for Form 3803

Filing deadlines for the California Form 3803 align with the general tax filing deadlines in the state. Typically, the form must be submitted by April 15 of the tax year following the income earned. It is important to keep track of these dates to avoid late filing penalties. If you anticipate needing more time, consider filing for an extension to ensure that you can complete the form accurately.

Eligibility Criteria for Using the California Form 3803

Eligibility to use the California Form 3803 is primarily based on the amount of unearned income your child has received. Generally, if your child has investment income exceeding a certain threshold, they must file this form. It is important to review the specific income limits outlined by the California Franchise Tax Board to determine whether the form is necessary for your situation.

Examples of Using the California Form 3803

There are various scenarios where the California Form 3803 would be applicable. For instance, if a child receives dividends from stocks or interest from a savings account, these earnings must be reported using this form. Additionally, if a child has capital gains from selling investments, the form will be necessary to report these earnings accurately. Each situation can vary, so it’s essential to assess the specific types of income involved.

Create this form in 5 minutes or less

Find and fill out the correct ca form 3800 child with investment income is asking for

Create this form in 5 minutes!

How to create an eSignature for the ca form 3800 child with investment income is asking for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow 3803 and how does it work?

airSlate SignNow 3803 is a powerful eSignature solution that allows businesses to send and sign documents electronically. It streamlines the signing process, making it faster and more efficient. With its user-friendly interface, users can easily create, send, and manage documents from anywhere.

-

What are the pricing options for airSlate SignNow 3803?

airSlate SignNow 3803 offers flexible pricing plans to accommodate businesses of all sizes. You can choose from monthly or annual subscriptions, with options that scale based on your needs. Each plan provides access to essential features, ensuring you get the best value for your investment.

-

What features does airSlate SignNow 3803 provide?

airSlate SignNow 3803 includes a variety of features such as document templates, real-time tracking, and customizable workflows. These tools help streamline the signing process and enhance productivity. Additionally, it supports multiple file formats, making it versatile for different business needs.

-

How can airSlate SignNow 3803 benefit my business?

By using airSlate SignNow 3803, your business can reduce turnaround times for document signing, improve compliance, and enhance customer satisfaction. The platform's efficiency leads to cost savings and allows your team to focus on more strategic tasks. Overall, it empowers your business to operate more effectively.

-

Does airSlate SignNow 3803 integrate with other software?

Yes, airSlate SignNow 3803 seamlessly integrates with various third-party applications, including CRM systems and cloud storage services. This integration capability enhances your workflow by allowing you to manage documents and data across platforms. It ensures that your processes remain streamlined and efficient.

-

Is airSlate SignNow 3803 secure for sensitive documents?

Absolutely, airSlate SignNow 3803 prioritizes security with advanced encryption and compliance with industry standards. Your documents are protected throughout the signing process, ensuring confidentiality and integrity. This makes it a reliable choice for businesses handling sensitive information.

-

Can I use airSlate SignNow 3803 on mobile devices?

Yes, airSlate SignNow 3803 is fully optimized for mobile use, allowing you to send and sign documents on the go. The mobile app provides the same functionality as the desktop version, ensuring you can manage your documents anytime, anywhere. This flexibility enhances productivity for busy professionals.

Get more for CA Form 3800 Child With Investment Income Is Asking For

Find out other CA Form 3800 Child With Investment Income Is Asking For

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself