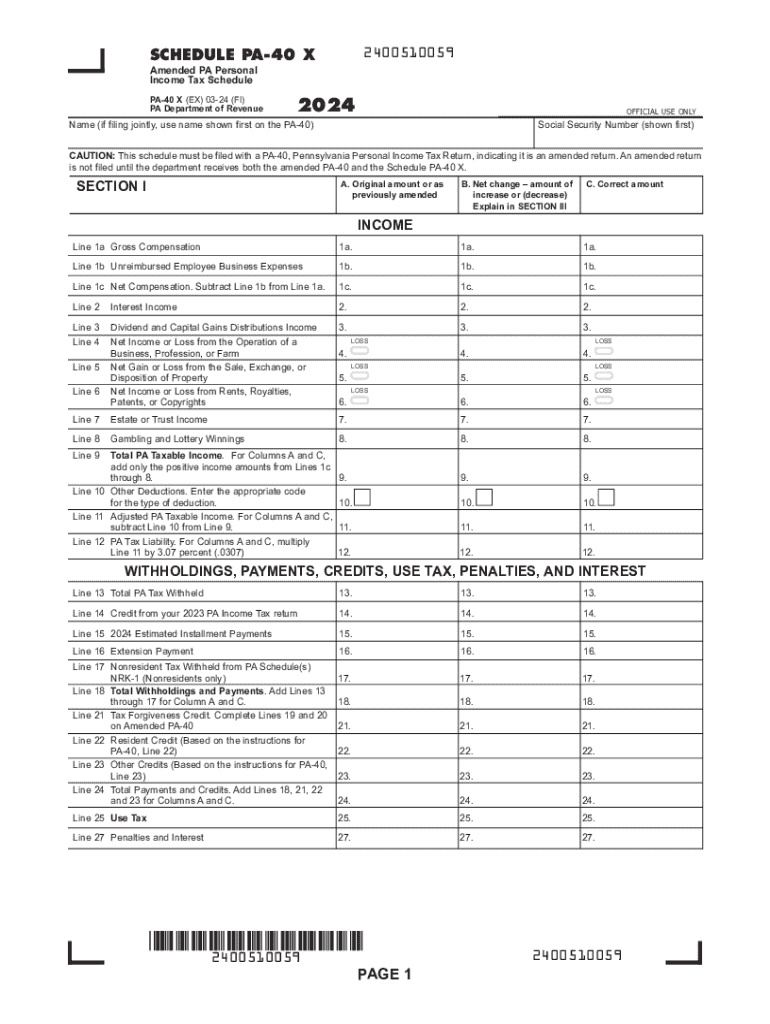

Schedule PA 40 X Amended PA Personal Income Tax Schedule PA 40 X FormsPublications 2024-2026

Understanding the PA 40 Tax Form

The PA 40 tax form is the primary document used by Pennsylvania residents to report personal income tax. This form is essential for individuals who earn income within the state, as it helps determine the amount of tax owed or the refund due. The PA 40 is designed for various taxpayers, including employees, self-employed individuals, and those with other sources of income. Completing this form accurately ensures compliance with state tax regulations and helps avoid potential penalties.

Steps to Complete the PA 40 Tax Form

Filling out the PA 40 tax form involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Fill in personal information, such as your name, address, and Social Security number.

- Report all sources of income, including wages, interest, and dividends.

- Claim any applicable deductions and credits to reduce your taxable income.

- Calculate your total tax liability and determine if you owe additional taxes or are due a refund.

- Sign and date the form before submitting it to the Pennsylvania Department of Revenue.

Legal Use of the PA 40 Tax Form

The PA 40 tax form serves as a legal document for reporting income to the state of Pennsylvania. It is crucial for taxpayers to understand that submitting this form accurately is not only a legal requirement but also a reflection of their financial integrity. Misreporting income or failing to file can lead to audits, penalties, and interest on unpaid taxes. Therefore, it is important to keep thorough records and ensure all information is correct when filing.

Filing Deadlines for the PA 40 Tax Form

Taxpayers should be aware of the filing deadlines associated with the PA 40 tax form. Typically, the deadline for submitting the form is April 15 of each year, aligning with the federal tax filing deadline. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also consider extensions if they need additional time, but it is essential to file any necessary payments by the original deadline to avoid penalties.

How to Obtain the PA 40 Tax Form

The PA 40 tax form can be obtained through various channels. Taxpayers can download the form directly from the Pennsylvania Department of Revenue's website. Additionally, physical copies may be available at local tax offices or libraries. It is advisable to ensure you have the most current version of the form, as updates may occur annually to reflect changes in tax laws or regulations.

Key Elements of the PA 40 Tax Form

Several key elements are essential to understand when completing the PA 40 tax form:

- Personal Information: This section includes name, address, and Social Security number.

- Income Reporting: Taxpayers must report all income sources, including wages and self-employment income.

- Deductions and Credits: Various deductions and credits can reduce taxable income, such as those for education or contributions to retirement accounts.

- Tax Calculation: This section determines the total tax owed based on reported income and applicable deductions.

Create this form in 5 minutes or less

Find and fill out the correct schedule pa 40 x amended pa personal income tax schedule pa 40 x formspublications

Create this form in 5 minutes!

How to create an eSignature for the schedule pa 40 x amended pa personal income tax schedule pa 40 x formspublications

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PA 40 tax form?

The PA 40 tax form is the Pennsylvania personal income tax return that residents must file annually. It is used to report income, calculate tax liability, and claim any applicable credits or deductions. Understanding the PA 40 tax form is essential for ensuring compliance with state tax laws.

-

How can airSlate SignNow help with the PA 40 tax form?

airSlate SignNow provides a seamless way to eSign and send the PA 40 tax form electronically. Our platform simplifies the document management process, allowing users to complete and submit their tax forms quickly and securely. This efficiency can save time and reduce the stress associated with tax season.

-

Is airSlate SignNow cost-effective for filing the PA 40 tax form?

Yes, airSlate SignNow offers a cost-effective solution for businesses and individuals needing to file the PA 40 tax form. With competitive pricing plans, users can access powerful features without breaking the bank. This makes it an ideal choice for those looking to streamline their tax filing process.

-

What features does airSlate SignNow offer for the PA 40 tax form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking specifically for the PA 40 tax form. These tools enhance the user experience by ensuring that all necessary information is captured accurately and efficiently. Additionally, users can collaborate in real-time, making the process even smoother.

-

Can I integrate airSlate SignNow with other software for the PA 40 tax form?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, making it easy to manage the PA 40 tax form alongside your other financial documents. This integration helps streamline workflows and ensures that all your data is synchronized across platforms.

-

What are the benefits of using airSlate SignNow for the PA 40 tax form?

Using airSlate SignNow for the PA 40 tax form offers numerous benefits, including increased efficiency, enhanced security, and reduced paper usage. Our platform allows users to complete and sign documents from anywhere, which is especially useful during tax season. Additionally, the ability to track document status ensures that you never miss a deadline.

-

Is it easy to use airSlate SignNow for the PA 40 tax form?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to navigate the process of completing the PA 40 tax form. The intuitive interface guides users through each step, ensuring that even those with minimal tech experience can successfully eSign and submit their forms. Our customer support is also available to assist with any questions.

Get more for Schedule PA 40 X Amended PA Personal Income Tax Schedule PA 40 X FormsPublications

Find out other Schedule PA 40 X Amended PA Personal Income Tax Schedule PA 40 X FormsPublications

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template