Schedule PA 40 X Amended PA Personal Income Tax Schedule PA 40 X FormsPublications 2020

Understanding the PA 40X Form

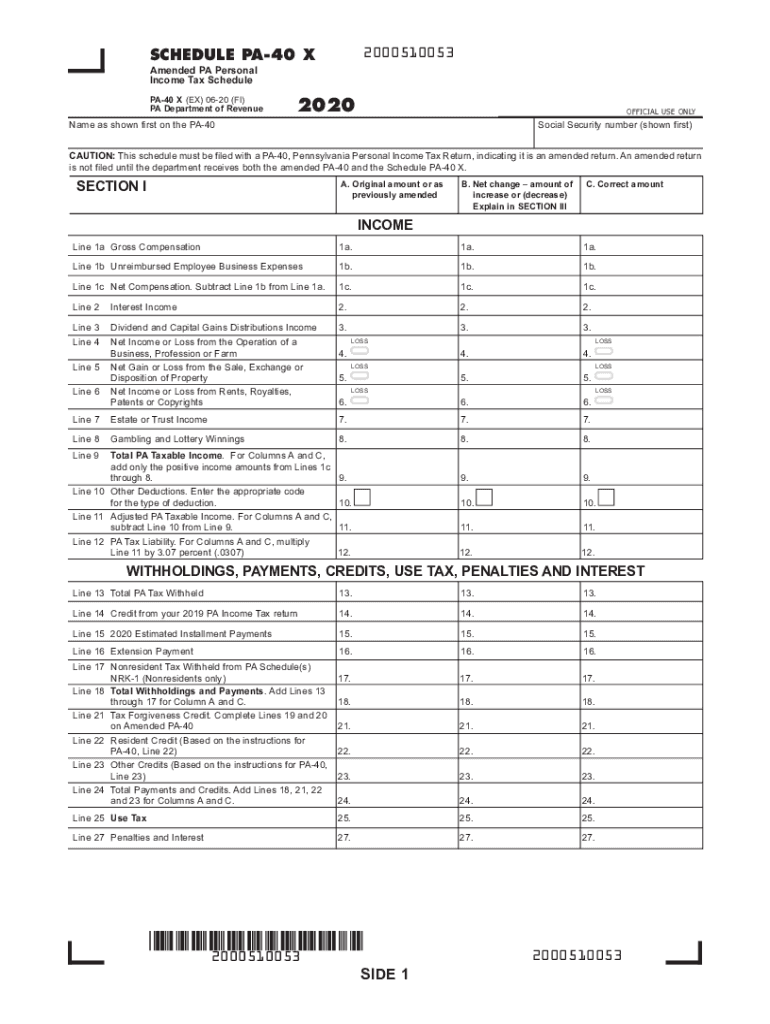

The PA 40X form, officially known as the Amended PA Personal Income Tax Schedule PA 40X, is used by Pennsylvania taxpayers to amend their previously filed personal income tax returns. This form allows individuals to correct errors or make changes to their original PA-40 filings. Common reasons for filing the PA 40X include correcting income amounts, claiming additional deductions, or addressing changes in filing status. It is essential for taxpayers to ensure that all information is accurate to avoid potential penalties or issues with the Pennsylvania Department of Revenue.

Steps to Complete the PA 40X Form

Completing the PA 40X form requires careful attention to detail. Here are the general steps to follow:

- Gather Documentation: Collect all relevant documents, including your original PA-40 return, W-2s, 1099s, and any supporting documentation for the changes you are making.

- Fill Out the Form: Clearly indicate the changes you are making on the PA 40X. Ensure that you provide accurate figures and explanations for each amendment.

- Review Your Changes: Double-check all entries for accuracy. Mistakes can lead to delays or further complications.

- Sign and Date: Ensure that you sign and date the form before submission. Unsigned forms may be rejected.

- Submit the Form: Choose your preferred submission method, whether online, by mail, or in person, and ensure it is sent to the appropriate address.

Legal Use of the PA 40X Form

The PA 40X form is legally recognized for amending personal income tax returns in Pennsylvania. To ensure its validity, it must be completed in compliance with state tax laws. The form must be filed within the designated time frame, typically within three years from the original filing date. Utilizing a reliable electronic signature solution can further enhance the legal standing of your submission, ensuring that it meets the requirements set forth by the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA).

Filing Deadlines for the PA 40X Form

Timely filing of the PA 40X form is crucial to avoid penalties. Generally, taxpayers have three years from the original filing date to submit an amended return. It is important to stay informed about specific deadlines, especially if you are filing for a previous tax year. If you are due a refund as a result of your amendments, filing within this timeframe is essential to ensure you receive your refund without complications.

Required Documents for Filing the PA 40X Form

When preparing to file the PA 40X form, certain documents are necessary to support your amendments. These may include:

- Your original PA-40 tax return.

- Any W-2 forms and 1099 statements that reflect income changes.

- Documentation for additional deductions or credits being claimed.

- Any correspondence from the Pennsylvania Department of Revenue regarding your original return.

Having these documents ready can streamline the amendment process and help ensure accuracy.

Examples of Situations Requiring the PA 40X Form

There are various scenarios in which a taxpayer might need to file the PA 40X form. Common examples include:

- Correcting reported income due to overlooked W-2 or 1099 forms.

- Claiming additional deductions that were not included in the original filing.

- Changing filing status from married filing jointly to married filing separately.

- Adjusting credits claimed due to changes in eligibility.

Each of these situations underscores the importance of accurately reporting income and deductions to ensure compliance with Pennsylvania tax regulations.

Quick guide on how to complete 2020 schedule pa 40 x amended pa personal income tax schedule pa 40 x formspublications

Complete Schedule PA 40 X Amended PA Personal Income Tax Schedule PA 40 X FormsPublications effortlessly on any device

Managing documents online has become popular among businesses and individuals. It offers an ideal eco-friendly solution to traditional printed and signed papers, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Handle Schedule PA 40 X Amended PA Personal Income Tax Schedule PA 40 X FormsPublications on any device using airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to edit and eSign Schedule PA 40 X Amended PA Personal Income Tax Schedule PA 40 X FormsPublications with ease

- Find Schedule PA 40 X Amended PA Personal Income Tax Schedule PA 40 X FormsPublications and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive details with tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal authority as a conventional wet ink signature.

- Verify all the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and eSign Schedule PA 40 X Amended PA Personal Income Tax Schedule PA 40 X FormsPublications and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 schedule pa 40 x amended pa personal income tax schedule pa 40 x formspublications

Create this form in 5 minutes!

How to create an eSignature for the 2020 schedule pa 40 x amended pa personal income tax schedule pa 40 x formspublications

The way to make an eSignature for a PDF file in the online mode

The way to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature right from your smartphone

The way to make an eSignature for a PDF file on iOS devices

How to make an electronic signature for a PDF on Android

People also ask

-

What is the PA 40X form?

The PA 40X form is a document used for Pennsylvania personal income tax returns. It is specifically designed for taxpayers who need to file to amend their tax returns. Understanding how to properly complete the PA 40X form is crucial for ensuring accurate tax reporting.

-

How can airSlate SignNow assist with the PA 40X form?

airSlate SignNow streamlines the process of completing the PA 40X form by allowing users to easily fill out, sign, and send documents electronically. Our platform enhances accuracy and efficiency, minimizing the chances of errors commonly associated with manual submissions.

-

Is there a cost associated with using airSlate SignNow for the PA 40X form?

Yes, while airSlate SignNow offers a free trial, there are subscription plans available that provide access to advanced features tailored for handling documents like the PA 40X form. Pricing is competitive and designed to be cost-effective for businesses of all sizes.

-

What features does airSlate SignNow provide for the PA 40X form?

airSlate SignNow includes features such as customizable templates, multi-signature options, and real-time tracking to enhance the completion of the PA 40X form. These features ensure that you can manage your tax documents efficiently and securely.

-

Are there any integrations available for submitting the PA 40X form?

Yes, airSlate SignNow offers integrations with various accounting and tax software solutions, which can simplify submitting the PA 40X form. This helps to streamline your workflow and eliminate data entry errors, ultimately saving you time.

-

Can I use airSlate SignNow on mobile devices for the PA 40X form?

Absolutely! airSlate SignNow is mobile-friendly, allowing you to complete and send the PA 40X form from your smartphone or tablet. This flexibility ensures that you can manage your documents on-the-go, without being tied to a desktop.

-

What benefits can I expect from using airSlate SignNow for the PA 40X form?

Using airSlate SignNow for the PA 40X form provides numerous benefits, including reduced processing time, enhanced document security, and improved compliance. This solution helps you stay organized and ensures that your tax submissions are handled accurately.

Get more for Schedule PA 40 X Amended PA Personal Income Tax Schedule PA 40 X FormsPublications

Find out other Schedule PA 40 X Amended PA Personal Income Tax Schedule PA 40 X FormsPublications

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation