How to File a Pennsylvania Tax Amendment EFile Com 2022

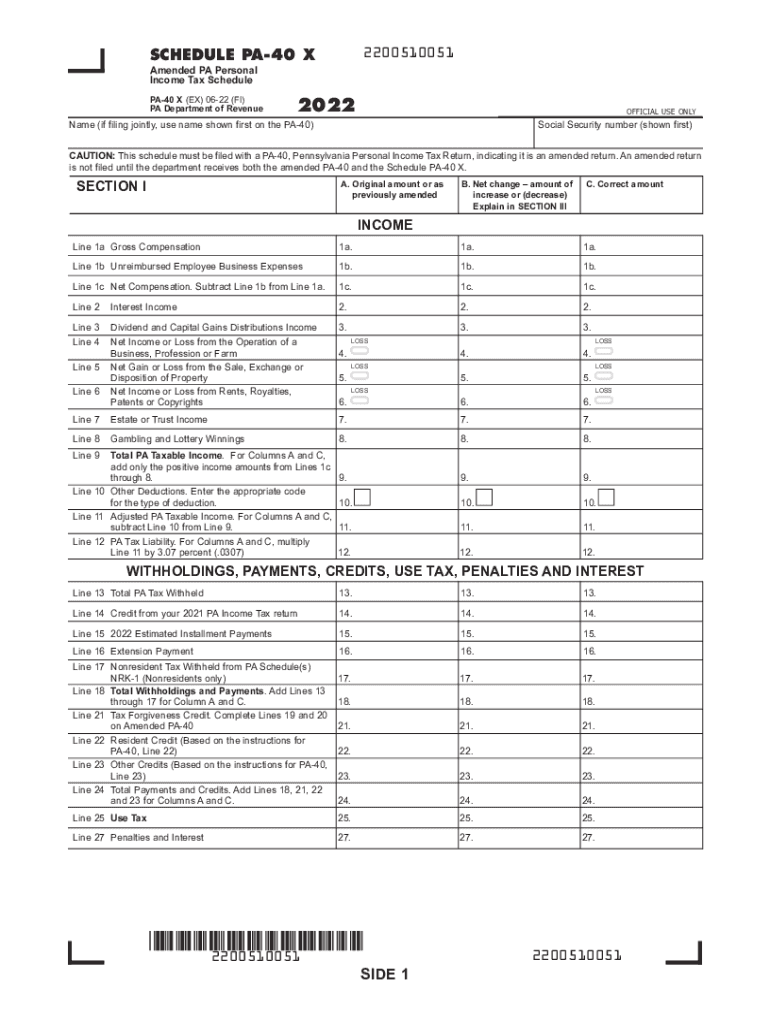

Understanding the Pennsylvania PA 40X Tax Form

The PA 40X tax form is utilized for amending a previously filed Pennsylvania personal income tax return. This form allows taxpayers to correct errors or omissions in their original filing, ensuring that their tax records are accurate and up to date. It is essential for individuals who need to report changes in income, deductions, or credits that may affect their tax liability.

Steps to Complete the PA 40X Tax Form

Filing the PA 40X involves several important steps to ensure compliance and accuracy. Begin by gathering all necessary documents related to your original tax return, including any supporting documentation for the changes you wish to make. Next, fill out the PA 40X form, clearly indicating the corrections and providing explanations where necessary. Be sure to double-check your calculations and ensure that all required fields are completed. Once the form is filled out, submit it to the Pennsylvania Department of Revenue via mail or electronically, depending on your preference.

Required Documents for Filing the PA 40X

When preparing to file the PA 40X, you will need specific documents to support your amendment. These may include:

- Your original PA 40 tax return.

- Any W-2 forms or 1099s that reflect your income.

- Receipts or documentation for deductions you are claiming.

- Any correspondence from the Pennsylvania Department of Revenue regarding your original return.

Having these documents on hand will facilitate a smoother filing process and help ensure that your amendments are accurately reflected.

Filing Deadlines for the PA 40X

It is crucial to be aware of the filing deadlines associated with the PA 40X. Generally, you must file your amended return within three years from the original due date of your tax return. This timeframe ensures that you are eligible for any potential refunds or adjustments. If you are amending a return for a prior year, be mindful of these deadlines to avoid missing out on correcting your tax records.

Legal Use of the PA 40X Tax Form

The PA 40X is legally binding once it is completed and submitted according to the guidelines set forth by the Pennsylvania Department of Revenue. It is important to ensure that all information provided is accurate and truthful, as submitting false information can lead to penalties or legal consequences. Utilizing a reliable eSignature platform can enhance the security and validity of your submission, ensuring compliance with eSignature laws.

Common Reasons for Filing a PA 40X

Taxpayers may choose to file a PA 40X for various reasons, including:

- Correcting income amounts due to overlooked W-2s or 1099s.

- Adjusting deductions that were initially claimed incorrectly.

- Updating personal information, such as filing status or dependents.

- Claiming missed tax credits that could reduce overall tax liability.

Understanding these common scenarios can help taxpayers recognize when it is appropriate to file an amendment.

Quick guide on how to complete how to file a pennsylvania tax amendment efilecom

Complete How To File A Pennsylvania Tax Amendment EFile com effortlessly on any device

Online document management has become popular among businesses and individuals. It offers an ideal sustainable alternative to traditional printed and signed documents, enabling you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage How To File A Pennsylvania Tax Amendment EFile com on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign How To File A Pennsylvania Tax Amendment EFile com seamlessly

- Find How To File A Pennsylvania Tax Amendment EFile com and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools offered by airSlate SignNow specifically for that purpose.

- Generate your signature with the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, and errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign How To File A Pennsylvania Tax Amendment EFile com and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct how to file a pennsylvania tax amendment efilecom

Create this form in 5 minutes!

How to create an eSignature for the how to file a pennsylvania tax amendment efilecom

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the pa 40x feature in airSlate SignNow?

The pa 40x feature in airSlate SignNow allows users to easily manage document workflows and signatures at an accelerated pace. This feature is designed to enhance productivity and streamline the eSigning process, making it user-friendly for all businesses.

-

How does pricing work for the pa 40x service on airSlate SignNow?

The pricing for the pa 40x service on airSlate SignNow is competitive and designed to fit various business needs. Users can choose from different plans that include the pa 40x feature, ensuring they have the right tools for document management without overspending.

-

What are the main benefits of using pa 40x with airSlate SignNow?

Using the pa 40x feature with airSlate SignNow provides signNow advantages, including faster turnaround times for eSigning documents and improved efficiency in workflow management. This leads to reduced operational costs and enhanced overall productivity.

-

Can I integrate pa 40x with other applications on airSlate SignNow?

Yes, the pa 40x feature on airSlate SignNow can be seamlessly integrated with various applications. This allows businesses to enhance their existing workflows and ensure that all tools work together effectively for document handling and signing.

-

Is training available for using the pa 40x feature in airSlate SignNow?

Absolutely! airSlate SignNow provides comprehensive training resources and customer support to help users get the most out of the pa 40x feature. Whether through online tutorials or direct assistance, users can quickly become proficient.

-

What types of documents can I sign with the pa 40x feature?

With the pa 40x feature on airSlate SignNow, you can sign a wide variety of documents including contracts, agreements, and forms. This versatility ensures that users can handle all necessary paperwork with ease and efficiency.

-

What security measures are in place with the pa 40x feature?

AirSlate SignNow implements robust security protocols for the pa 40x feature, including data encryption and compliance with industry standards. Users can rest assured that their documents are protected throughout the eSigning process.

Get more for How To File A Pennsylvania Tax Amendment EFile com

Find out other How To File A Pennsylvania Tax Amendment EFile com

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself