Personal Income TaxDepartment of Revenue 2023

Understanding the PA 40X Form

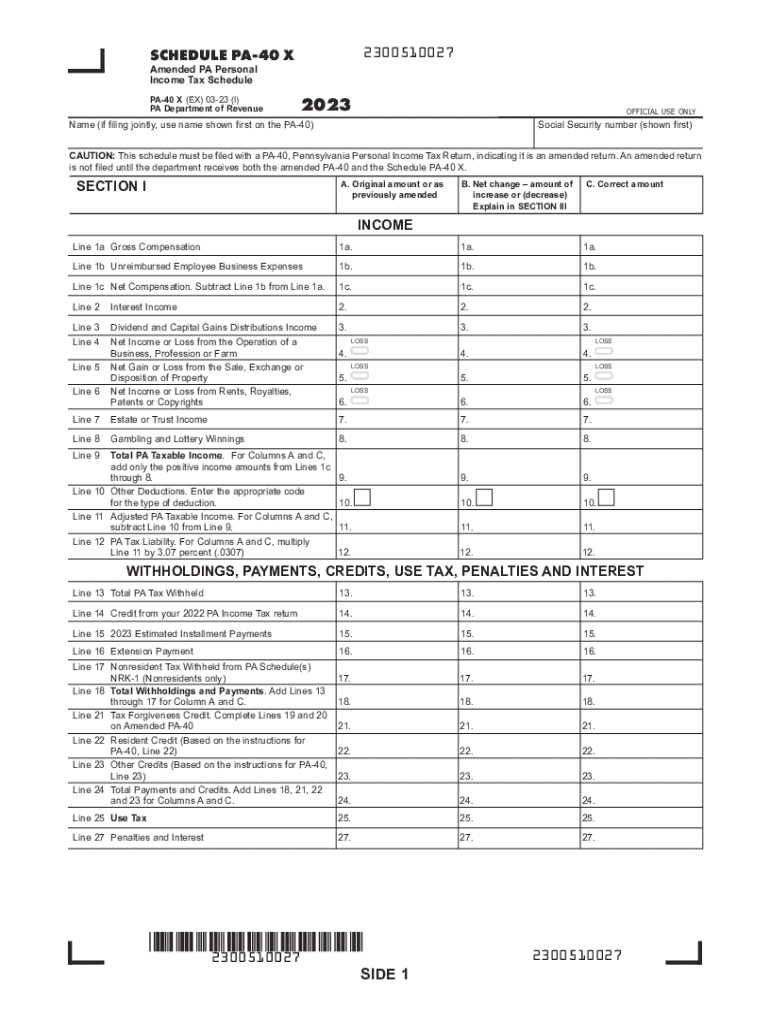

The PA 40X form is an essential document used for amending a Pennsylvania personal income tax return. This form allows taxpayers to correct any mistakes or omissions made on their original PA-40 tax return. It is crucial for ensuring that the state has accurate information regarding an individual's tax liability.

Taxpayers may need to file a PA 40X for various reasons, including changes in income, deductions, or credits. The form is specifically designed for Pennsylvania residents and must be submitted to the Pennsylvania Department of Revenue.

Steps to Complete the PA 40X Form

Completing the PA 40X form involves several straightforward steps:

- Gather all relevant documents, including your original PA-40 return and any supporting documentation for the changes you are making.

- Clearly indicate the tax year you are amending at the top of the form.

- Fill out the form with the corrected information, ensuring that all changes are clearly marked and explained.

- Provide a detailed explanation of why you are amending your return in the designated section of the form.

- Review the completed form for accuracy before submission.

Filing Deadlines for the PA 40X Form

It is important to be aware of the filing deadlines associated with the PA 40X form. Generally, the amended return must be filed within three years of the original due date of the return. This timeline ensures that taxpayers can correct their filings without facing penalties for late submissions.

Taxpayers should also consider any additional deadlines related to specific tax credits or deductions that may be affected by the changes made on the PA 40X form.

Required Documents for Submission

When submitting the PA 40X form, it is essential to include all necessary documentation to support your amendments. This may include:

- A copy of the original PA-40 return.

- Any W-2 forms, 1099s, or other income documentation that reflects the corrected amounts.

- Receipts or records for any deductions or credits you are claiming.

- A detailed explanation of the changes being made.

Including these documents will help expedite the review process by the Pennsylvania Department of Revenue.

Submission Methods for the PA 40X Form

The PA 40X form can be submitted in several ways, providing flexibility for taxpayers:

- Online: Taxpayers can file electronically through the Pennsylvania Department of Revenue's online portal.

- By Mail: The completed form can be mailed to the appropriate address provided on the form.

- In-Person: Taxpayers may also choose to submit the form in person at designated Department of Revenue offices.

Penalties for Non-Compliance

Failure to file a PA 40X form when necessary can result in penalties and interest on any unpaid taxes. The Pennsylvania Department of Revenue may impose fines for late submissions or inaccuracies in reporting. It is crucial for taxpayers to address any discrepancies promptly to avoid these penalties.

Being proactive about filing amendments can help ensure compliance with state tax laws and avoid complications in the future.

Create this form in 5 minutes or less

Find and fill out the correct personal income taxdepartment of revenue

Create this form in 5 minutes!

How to create an eSignature for the personal income taxdepartment of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the pa 40x form and how can airSlate SignNow help?

The pa 40x form is a document used for various administrative purposes. With airSlate SignNow, you can easily create, send, and eSign the pa 40x form, streamlining your workflow and ensuring compliance with legal standards.

-

How much does it cost to use airSlate SignNow for the pa 40x form?

airSlate SignNow offers competitive pricing plans that cater to different business needs. You can choose a plan that fits your budget while efficiently managing the pa 40x form and other documents.

-

What features does airSlate SignNow offer for managing the pa 40x form?

airSlate SignNow provides features such as customizable templates, real-time tracking, and secure eSigning for the pa 40x form. These tools enhance productivity and ensure that your documents are handled efficiently.

-

Can I integrate airSlate SignNow with other applications for the pa 40x form?

Yes, airSlate SignNow offers seamless integrations with various applications, allowing you to manage the pa 40x form alongside your existing tools. This integration capability enhances your overall workflow and document management.

-

What are the benefits of using airSlate SignNow for the pa 40x form?

Using airSlate SignNow for the pa 40x form provides numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security. These advantages help businesses save time and resources while ensuring compliance.

-

Is airSlate SignNow user-friendly for completing the pa 40x form?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete the pa 40x form. The intuitive interface allows users to navigate the platform effortlessly.

-

How secure is airSlate SignNow when handling the pa 40x form?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your data. When handling the pa 40x form, you can trust that your information is safe and secure.

Get more for Personal Income TaxDepartment Of Revenue

- Veterans claims va 21 526ez form

- 2023 form 588 nonresident withholding waiver request 2023 form 588 nonresident withholding waiver request

- 2023 california form 589 nonresident reduced withholding request 2023 california form 589 nonresident reduced withholding

- Ca form 593 real estate withholding statement

- Form 3522 online fill out ampamp sign online dochub

- 2023 form 540 es estimated tax for individuals 2023 form 540 es estimated tax for individuals

- 2023 form 590 withholding exemption certificate

- California form 100 es corporation estimated tax

Find out other Personal Income TaxDepartment Of Revenue

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word