Schedule Pa 40x 2019

What is the Schedule PA 40X

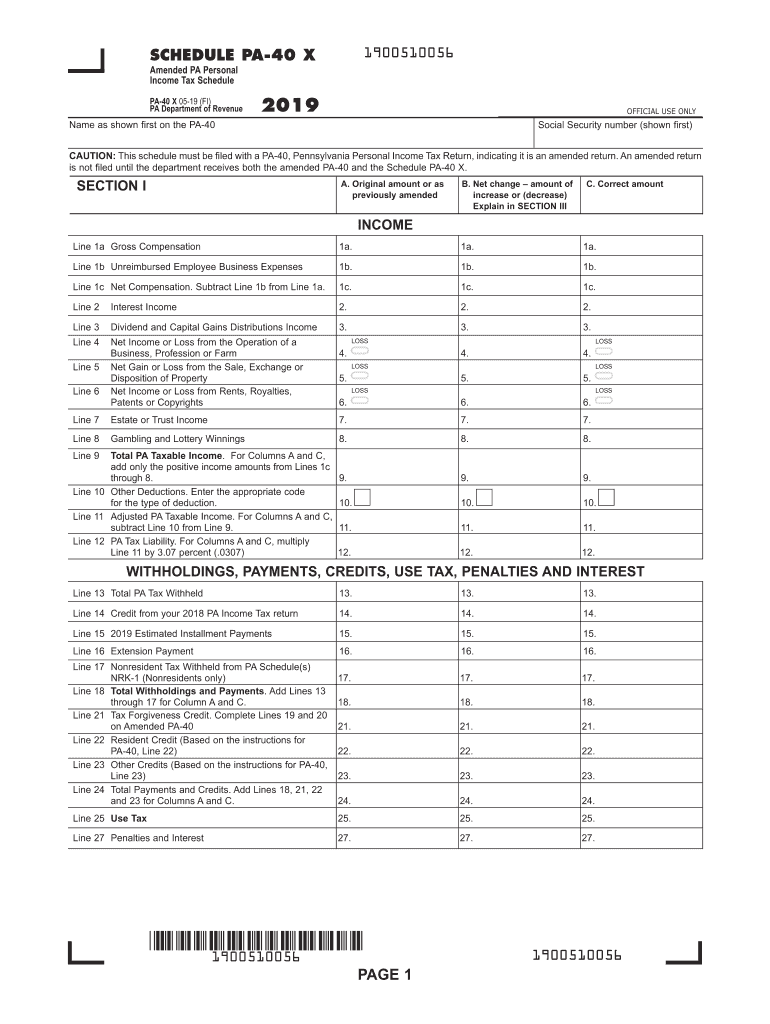

The Schedule PA 40X is a Pennsylvania tax form used for amending a previously filed Pennsylvania personal income tax return. This form allows taxpayers to correct errors or make changes to their original submissions, ensuring that their tax records are accurate. It is specifically designed for individuals who need to report changes in income, deductions, or credits that were not included in their initial filings. Utilizing the Schedule PA 40X is essential for maintaining compliance with Pennsylvania tax regulations and for ensuring that any refunds or additional taxes owed are accurately processed.

How to use the Schedule PA 40X

Using the Schedule PA 40X involves several key steps. First, gather all relevant documentation related to your original tax return, including any supporting documents that justify the changes you wish to make. Next, complete the form by providing your personal information, including your Social Security number and the tax year you are amending. Clearly indicate the changes you are making by filling out the appropriate sections of the form. After completing the Schedule PA 40X, review it for accuracy before submitting it to the Pennsylvania Department of Revenue.

Steps to complete the Schedule PA 40X

To complete the Schedule PA 40X, follow these steps:

- Obtain the Schedule PA 40X form from the Pennsylvania Department of Revenue website or your tax professional.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the tax year you are amending.

- List the original amounts from your filed return alongside the corrected amounts for each line item you are changing.

- Provide explanations for each change in the designated area.

- Sign and date the form to validate your submission.

- Submit the completed form either by mail or electronically, depending on your preference.

Legal use of the Schedule PA 40X

The Schedule PA 40X is legally recognized as a valid method for amending your Pennsylvania income tax return. To ensure its legal standing, it must be completed accurately and submitted within the appropriate time frame established by Pennsylvania tax law. This form must be signed by the taxpayer, affirming that the information provided is true and complete. Compliance with all relevant tax regulations is crucial, as failure to properly amend your return could result in penalties or additional tax liabilities.

Filing Deadlines / Important Dates

When filing the Schedule PA 40X, it is important to be aware of key deadlines. Generally, the form must be submitted within three years from the original due date of the return being amended. This includes any extensions that may have been granted. Additionally, if you are claiming a refund, it is advisable to file the amended return as soon as possible to avoid missing the deadline for receiving any potential refund. Keeping track of these dates helps ensure compliance and maximizes your chances of receiving any adjustments in a timely manner.

Required Documents

To successfully complete and file the Schedule PA 40X, you will need several documents:

- Your original Pennsylvania income tax return for the year you are amending.

- Any supporting documentation that justifies the changes, such as W-2 forms, 1099s, or receipts for deductions.

- Records of any correspondence with the Pennsylvania Department of Revenue regarding your original return.

Having these documents on hand will facilitate a smoother amendment process and help ensure that your changes are accurately reflected.

Quick guide on how to complete 2019 pa schedule pa 40 x amended pa personal income tax schedule pa 40 x formspublications

Complete Schedule Pa 40x effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal sustainable alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Schedule Pa 40x on any device with airSlate SignNow Android or iOS applications and enhance any document-based task today.

The easiest way to modify and eSign Schedule Pa 40x seamlessly

- Find Schedule Pa 40x and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your alterations.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form exploring, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Schedule Pa 40x and guarantee excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 pa schedule pa 40 x amended pa personal income tax schedule pa 40 x formspublications

Create this form in 5 minutes!

How to create an eSignature for the 2019 pa schedule pa 40 x amended pa personal income tax schedule pa 40 x formspublications

How to make an electronic signature for your 2019 Pa Schedule Pa 40 X Amended Pa Personal Income Tax Schedule Pa 40 X Formspublications online

How to generate an eSignature for the 2019 Pa Schedule Pa 40 X Amended Pa Personal Income Tax Schedule Pa 40 X Formspublications in Google Chrome

How to make an eSignature for putting it on the 2019 Pa Schedule Pa 40 X Amended Pa Personal Income Tax Schedule Pa 40 X Formspublications in Gmail

How to generate an electronic signature for the 2019 Pa Schedule Pa 40 X Amended Pa Personal Income Tax Schedule Pa 40 X Formspublications straight from your smartphone

How to generate an electronic signature for the 2019 Pa Schedule Pa 40 X Amended Pa Personal Income Tax Schedule Pa 40 X Formspublications on iOS

How to create an electronic signature for the 2019 Pa Schedule Pa 40 X Amended Pa Personal Income Tax Schedule Pa 40 X Formspublications on Android OS

People also ask

-

What is the 2017 pa 40x and how does it relate to airSlate SignNow?

The 2017 pa 40x refers to a specific tax document that may require electronic signatures. airSlate SignNow enables you to easily send and eSign the 2017 pa 40x, streamlining your document workflow and ensuring compliance.

-

How can airSlate SignNow help me efficiently manage the 2017 pa 40x?

With airSlate SignNow, you can quickly prepare, send, and track the 2017 pa 40x from any device. The platform allows you to store documents securely and retrieve them whenever needed, simplifying your tax management.

-

What pricing plans does airSlate SignNow offer for managing documents like the 2017 pa 40x?

airSlate SignNow offers various pricing plans that cater to different business needs, including options for users needing to manage the 2017 pa 40x. Each plan includes features that facilitate document eSigning and management at a cost-effective rate.

-

What are the key features of airSlate SignNow relevant to the 2017 pa 40x?

Key features of airSlate SignNow include document templates, advanced eSigning capabilities, and real-time tracking, all of which enhance the management of the 2017 pa 40x. These features ensure that the signing process is efficient and legally binding.

-

Does airSlate SignNow integrate with popular accounting software for handling the 2017 pa 40x?

Yes, airSlate SignNow offers integrations with popular accounting tools that assist in managing financial documents like the 2017 pa 40x. This seamless integration helps synchronize your documents and improve workflow efficiency.

-

Can multiple users collaborate on the 2017 pa 40x using airSlate SignNow?

Absolutely, airSlate SignNow allows multiple users to collaborate on the 2017 pa 40x simultaneously. This feature promotes teamwork and ensures that all stakeholders can contribute efficiently to the document.

-

How secure is airSlate SignNow when handling sensitive documents like the 2017 pa 40x?

airSlate SignNow prioritizes security, employing encryption and secure servers to protect documents such as the 2017 pa 40x. This commitment to data security ensures your sensitive information remains confidential and compliant with regulations.

Get more for Schedule Pa 40x

- Renewal application for permit to conduct a child care nyc form

- Pg 662 petition to receive funds on behalf of a minor probate guardianship forms

- Renewal clinical laboratory personnel license certificate lab 177 cdph ca form

- Vehicle inspection form

- Uds 1 form sco ca

- Early intervention progress 2014 form

- Appearance and answer iowacourts form

- School nurse assistant certification training program application cdph 276s cdph ca form

Find out other Schedule Pa 40x

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast