Form RI 1040

What is the Form RI 1040

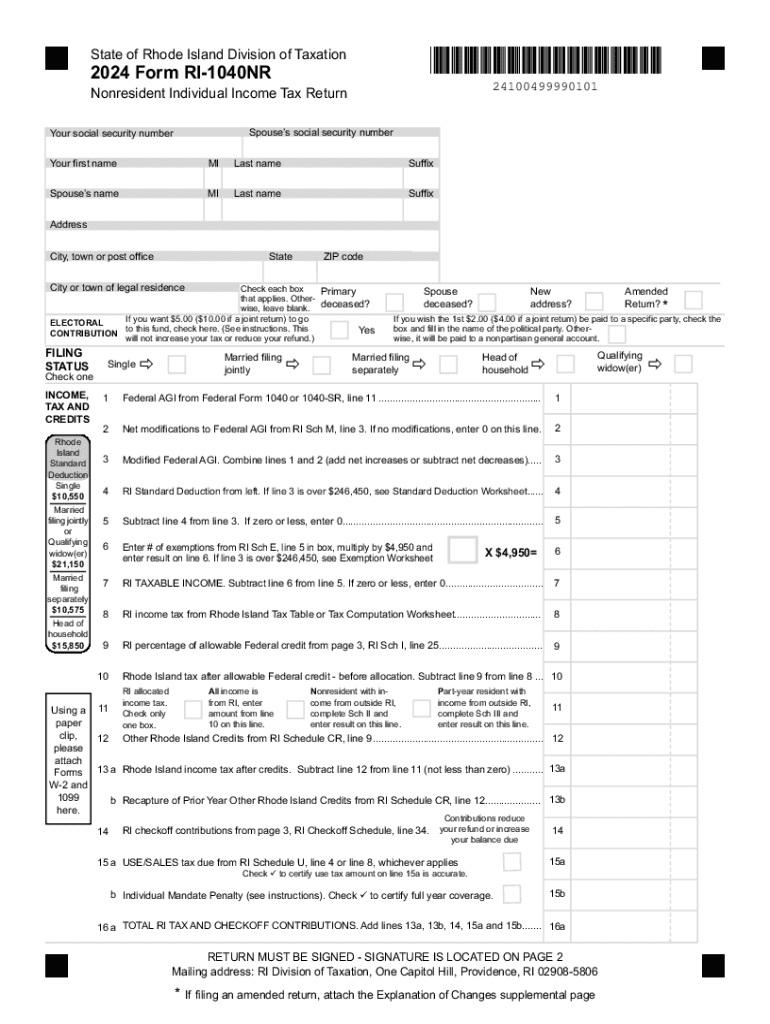

The Form RI 1040 is the official Rhode Island personal income tax form used by residents to report their income and calculate their state tax liability. This form is essential for individuals who earn income within the state, as it helps ensure compliance with Rhode Island tax laws. The RI 1040 is designed to accommodate various income sources, including wages, self-employment income, and investment earnings.

How to obtain the Form RI 1040

Residents can obtain the Form RI 1040 through several methods. The form is available for download in PDF format from the Rhode Island Division of Taxation website. Additionally, physical copies can be requested by contacting the Division of Taxation directly. Many local libraries and government offices also provide printed versions of the form for public use.

Steps to complete the Form RI 1040

Completing the Form RI 1040 involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income accurately in the designated sections.

- Calculate your total income and apply any deductions or credits you may qualify for.

- Determine your tax liability and ensure all calculations are correct.

- Sign and date the form before submission.

Required Documents

To accurately complete the Form RI 1040, you will need several documents, including:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of any other income sources, such as rental income or dividends

- Documentation for any deductions or credits claimed, such as mortgage interest statements or education expenses

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Form RI 1040. Typically, the deadline for submitting your state tax return is April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, taxpayers should note any changes in deadlines for extensions or specific circumstances that may apply.

Form Submission Methods

The Form RI 1040 can be submitted through various methods, ensuring convenience for taxpayers. Options include:

- Online submission through the Rhode Island Division of Taxation's e-filing system.

- Mailing a completed paper form to the appropriate tax office address.

- In-person submission at designated tax offices for direct assistance.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ri 1040

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Rhode Island state tax form?

The Rhode Island state tax form is a document required by the state for individuals and businesses to report their income and calculate their tax obligations. It is essential for ensuring compliance with state tax laws and can be easily completed using airSlate SignNow's eSigning features.

-

How can airSlate SignNow help with the Rhode Island state tax form?

airSlate SignNow simplifies the process of completing and submitting the Rhode Island state tax form by allowing users to eSign documents securely and efficiently. Our platform ensures that your forms are filled out correctly and submitted on time, reducing the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the Rhode Island state tax form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solutions provide access to features that streamline the completion of the Rhode Island state tax form, making it a valuable investment for businesses.

-

What features does airSlate SignNow offer for managing the Rhode Island state tax form?

airSlate SignNow provides features such as document templates, eSignature capabilities, and secure cloud storage, all of which are beneficial for managing the Rhode Island state tax form. These tools help ensure that your tax documents are organized and easily accessible.

-

Can I integrate airSlate SignNow with other software for the Rhode Island state tax form?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software, making it easier to manage the Rhode Island state tax form alongside your other financial documents. This seamless integration enhances productivity and ensures accuracy.

-

What are the benefits of using airSlate SignNow for the Rhode Island state tax form?

Using airSlate SignNow for the Rhode Island state tax form provides numerous benefits, including time savings, reduced paperwork, and enhanced security. Our platform allows you to complete and eSign your tax forms quickly, ensuring you meet deadlines without hassle.

-

Is airSlate SignNow secure for submitting the Rhode Island state tax form?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your Rhode Island state tax form and other sensitive documents are protected. We use advanced encryption and security protocols to safeguard your information during the eSigning process.

Get more for Form RI 1040

- Sra allotment letter online form

- Alg ii weiterbewilligungsantrag antrag auf weiterbewilligung der leistungen zur sicherung des lebensunterhalts nach dem zweiten form

- Pda form

- Esic accident register form 11 pdf

- Us department of justice letterhead form

- Uscg weigh in form

- Skabelon word fuldmagt skabelon form

- Launch waiver form

Find out other Form RI 1040

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors