Form it 607 Claim for Excelsior Jobs Program Tax Credit Tax Year

What is the Form IT 607 Claim For Excelsior Jobs Program Tax Credit Tax Year

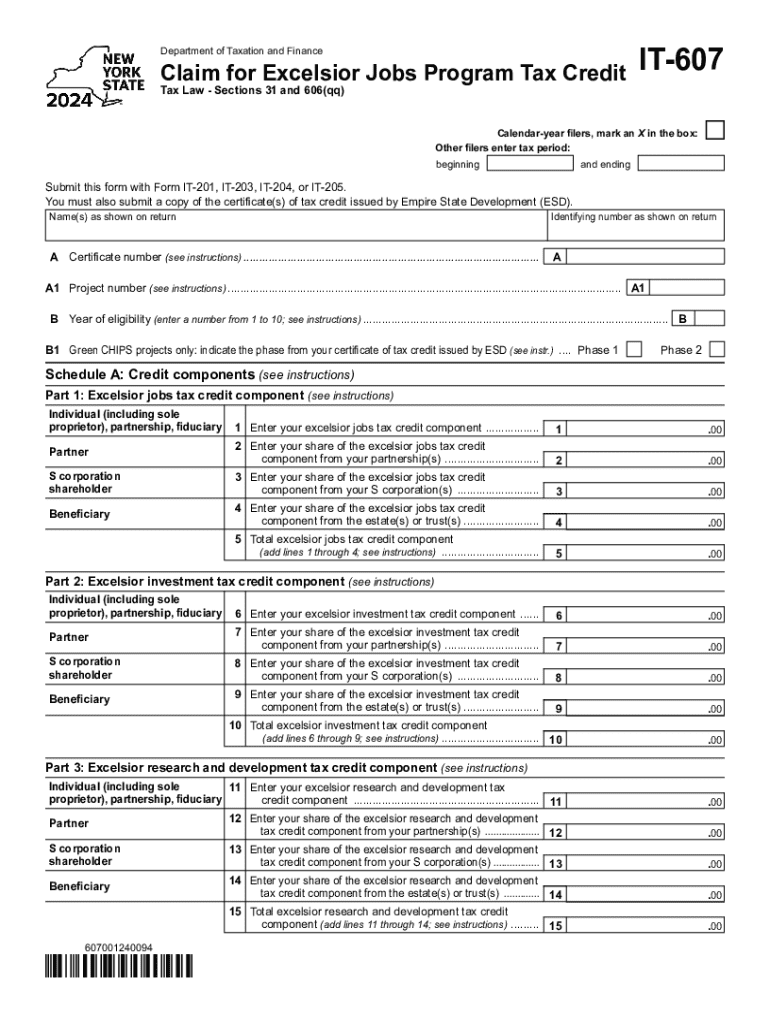

The Form IT 607 is a tax document used by businesses in New York to claim the Excelsior Jobs Program Tax Credit. This program is designed to encourage businesses to create jobs and invest in the state. The tax credit is available to eligible businesses that meet specific criteria, such as creating new jobs and making capital investments. The form must be completed accurately to ensure that businesses receive the appropriate tax benefits for the tax year in which they are filing.

Steps to complete the Form IT 607 Claim For Excelsior Jobs Program Tax Credit Tax Year

Completing the Form IT 607 involves several key steps:

- Gather necessary information about your business, including tax identification numbers and financial details.

- Review the eligibility criteria for the Excelsior Jobs Program to confirm that your business qualifies.

- Fill out the form, providing accurate details about job creation and capital investments.

- Attach any required documentation that supports your claims, such as payroll records and investment receipts.

- Review the completed form for accuracy before submission.

Eligibility Criteria

To qualify for the Excelsior Jobs Program Tax Credit, businesses must meet specific eligibility criteria set by New York State. These include:

- Creating a minimum number of new jobs within a designated period.

- Making a significant capital investment in the state.

- Operating in an eligible industry, such as manufacturing or technology.

- Maintaining the created jobs for a specified duration to retain the tax credit.

How to obtain the Form IT 607 Claim For Excelsior Jobs Program Tax Credit Tax Year

The Form IT 607 can be obtained through the New York State Department of Taxation and Finance website. It is available for download in PDF format, allowing businesses to fill it out digitally or print it for manual completion. Additionally, businesses may contact the department directly for assistance in acquiring the form or for any questions regarding its use.

Required Documents

When filing the Form IT 607, businesses must include several supporting documents to substantiate their claims. Required documents typically include:

- Payroll records showing the number of new jobs created.

- Receipts or statements verifying capital investments made.

- Any additional documentation that demonstrates compliance with program requirements.

Form Submission Methods

Businesses can submit the Form IT 607 through various methods, ensuring flexibility in the filing process. The submission options include:

- Online submission through the New York State Department of Taxation and Finance portal.

- Mailing the completed form to the designated address provided on the form itself.

- In-person submission at local tax offices, if preferred.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 607 claim for excelsior jobs program tax credit tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ny it 607 and how does it relate to airSlate SignNow?

Ny it 607 refers to a specific tax form that businesses in New York may need to manage electronically. airSlate SignNow provides an efficient platform for sending and eSigning documents, including tax forms like ny it 607, ensuring compliance and ease of use.

-

How much does airSlate SignNow cost for handling documents like ny it 607?

airSlate SignNow offers competitive pricing plans that cater to various business needs. The cost-effective solution allows businesses to manage documents such as ny it 607 without breaking the bank, making it accessible for companies of all sizes.

-

What features does airSlate SignNow offer for managing ny it 607 documents?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are essential for managing ny it 607 documents. These features streamline the process, making it easier for businesses to stay organized and compliant.

-

Can I integrate airSlate SignNow with other software for handling ny it 607?

Yes, airSlate SignNow offers integrations with various software applications, enhancing your ability to manage documents like ny it 607. This allows for seamless workflows and improved efficiency when handling important tax documents.

-

What are the benefits of using airSlate SignNow for ny it 607?

Using airSlate SignNow for ny it 607 provides numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. The platform simplifies the eSigning process, allowing businesses to focus on their core operations while ensuring compliance.

-

Is airSlate SignNow user-friendly for managing ny it 607?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to manage documents like ny it 607. The intuitive interface ensures that users can quickly learn how to send and eSign documents without extensive training.

-

How secure is airSlate SignNow when handling sensitive documents like ny it 607?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive documents such as ny it 607. Businesses can trust that their information is safe while using the platform for eSigning and document management.

Get more for Form IT 607 Claim For Excelsior Jobs Program Tax Credit Tax Year

- Wedding ceremony outline form

- Three tall women full script pdfsdocumentscom form

- View employment application pdf berkshire county sheriffamp39s office form

- Consulate general of france in dubai dubai on affidavit i undersigned of citizenship hereby solemnly certifies that form

- Wichita state university institutional review board irb webs wichita form

- Form027a 20101229doc sirinc

- Checklist for schengen visa business vfs global form

- Preliminary final plat application the city of lake worth lakeworthtx form

Find out other Form IT 607 Claim For Excelsior Jobs Program Tax Credit Tax Year

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe