Instructions for Forms C 3 S New York S Corporation Franchise Tax 2021

What is the Instructions For Forms C 3 S New York S Corporation Franchise Tax

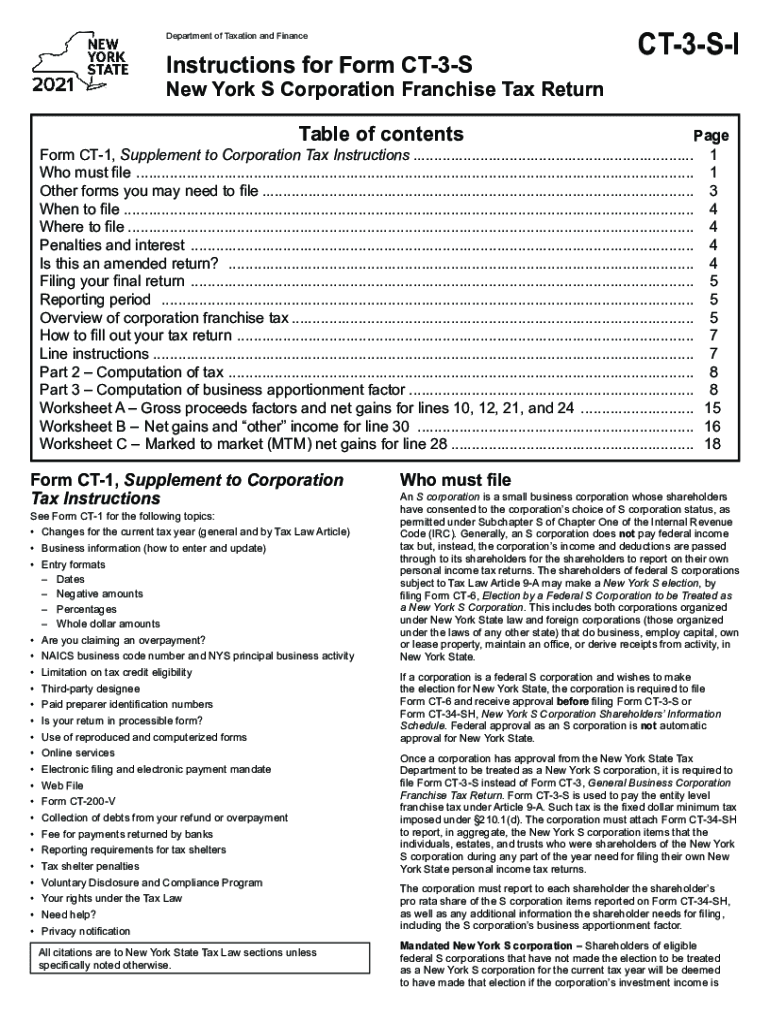

The Instructions For Forms C 3 S New York S Corporation Franchise Tax provide essential guidelines for S corporations operating in New York. This form is specifically designed to assist businesses in understanding their tax obligations under New York State law. It outlines the necessary steps for calculating franchise tax, reporting income, and ensuring compliance with state regulations. The instructions also detail the specific criteria that S corporations must meet to qualify for this tax treatment, which can significantly impact their overall tax liability.

Steps to complete the Instructions For Forms C 3 S New York S Corporation Franchise Tax

Completing the Instructions For Forms C 3 S requires careful attention to detail. Here are the key steps involved:

- Gather all necessary financial documents, including income statements and balance sheets.

- Review the eligibility criteria to confirm that your business qualifies as an S corporation.

- Follow the line-by-line instructions provided in the form to report your income accurately.

- Calculate your franchise tax based on the guidelines, ensuring all deductions and credits are applied.

- Double-check all entries for accuracy before submission.

Legal use of the Instructions For Forms C 3 S New York S Corporation Franchise Tax

The legal use of the Instructions For Forms C 3 S is critical for ensuring compliance with New York State tax laws. Properly following these instructions helps businesses avoid penalties and ensures that all tax obligations are met. The form serves as a legal document that outlines a corporation's tax responsibilities and must be completed accurately to maintain good standing with state authorities. Failure to adhere to these instructions can result in legal repercussions, including fines and increased scrutiny from tax authorities.

Filing Deadlines / Important Dates

Staying informed about filing deadlines is crucial for S corporations. The due date for submitting the Instructions For Forms C 3 S typically aligns with the corporation's annual tax return. Generally, this is the fifteenth day of the third month following the end of the tax year. For corporations operating on a calendar year, this means the deadline is March 15. It is important to mark these dates on your calendar to avoid late penalties and ensure timely compliance with state tax requirements.

Required Documents

To complete the Instructions For Forms C 3 S, several documents are necessary. These include:

- Financial statements, including income and expense reports.

- Balance sheets that reflect the corporation's financial position.

- Prior year tax returns for reference and consistency.

- Documentation supporting any deductions or credits claimed.

Having these documents readily available will streamline the completion process and help ensure accuracy in reporting.

Who Issues the Form

The Instructions For Forms C 3 S are issued by the New York State Department of Taxation and Finance. This agency is responsible for administering the state's tax laws and ensuring compliance among businesses operating within New York. By following the guidelines provided by this authoritative body, S corporations can navigate their tax obligations effectively and maintain compliance with state regulations.

Quick guide on how to complete instructions for forms c 3 s new york s corporation franchise tax

Prepare Instructions For Forms C 3 S New York S Corporation Franchise Tax effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly and without delays. Manage Instructions For Forms C 3 S New York S Corporation Franchise Tax on any device using airSlate SignNow Android or iOS applications and enhance any document-driven process now.

The easiest way to edit and electronically sign Instructions For Forms C 3 S New York S Corporation Franchise Tax without hassle

- Locate Instructions For Forms C 3 S New York S Corporation Franchise Tax and click Get Form to initiate.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant portions of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this function.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Verify the details and click the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, direct link, or download it to your computer.

Eliminate worries about lost or misplaced files, cumbersome form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Instructions For Forms C 3 S New York S Corporation Franchise Tax and ensure excellent communication at any stage of your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for forms c 3 s new york s corporation franchise tax

Create this form in 5 minutes!

How to create an eSignature for the instructions for forms c 3 s new york s corporation franchise tax

How to create an e-signature for your PDF in the online mode

How to create an e-signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

How to generate an e-signature right from your smart phone

How to generate an electronic signature for a PDF on iOS devices

How to generate an e-signature for a PDF on Android OS

People also ask

-

What are CT 3 instructions in airSlate SignNow?

CT 3 instructions refer to the specific guidelines provided by airSlate SignNow that help users understand how to properly navigate and utilize the platform for eSigning and document management. These instructions are designed to enhance user experience, ensuring that all features are easily accessible and functional.

-

How can I access the CT 3 instructions for airSlate SignNow?

To access the CT 3 instructions for airSlate SignNow, simply visit our support documentation section on our website. All instructional materials, including user guides and FAQs, are organized for your convenience, making it easy to find the information you need.

-

What features are included in the CT 3 instructions?

The CT 3 instructions cover a wide range of features, including document creation, eSignature processes, template management, and integrations with other applications. By following these instructions, you'll gain a clear understanding of how to fully leverage the capabilities of airSlate SignNow.

-

Are the CT 3 instructions applicable to all pricing plans?

Yes, the CT 3 instructions are applicable to all pricing plans of airSlate SignNow. Regardless of which plan you choose, you can utilize the comprehensive guidance offered in the CT 3 instructions to maximize your use of the platform.

-

How do CT 3 instructions benefit my business?

By following the CT 3 instructions, your business can streamline its document workflows, reduce turnaround times for eSigning, and enhance overall productivity. Proper adherence to these instructions ensures that your team can efficiently manage documents while minimizing errors.

-

Are there video tutorials available for CT 3 instructions?

Yes, airSlate SignNow offers a series of video tutorials that complement the CT 3 instructions. These resources provide visual guidance to help users understand complex processes quickly and effectively, making the learning experience more engaging.

-

Can I get personalized support for CT 3 instructions?

Absolutely! airSlate SignNow provides personalized support options for those needing additional help with the CT 3 instructions. signNow out to our customer service team, and they'll assist you in navigating any challenges or questions you may have.

Get more for Instructions For Forms C 3 S New York S Corporation Franchise Tax

Find out other Instructions For Forms C 3 S New York S Corporation Franchise Tax

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy