Instructions for Forms C 3 S New York S Corporation Franchise Tax Returns Tax Year 2020

What are the New York CT-3 S Corporation Franchise Tax Return Instructions?

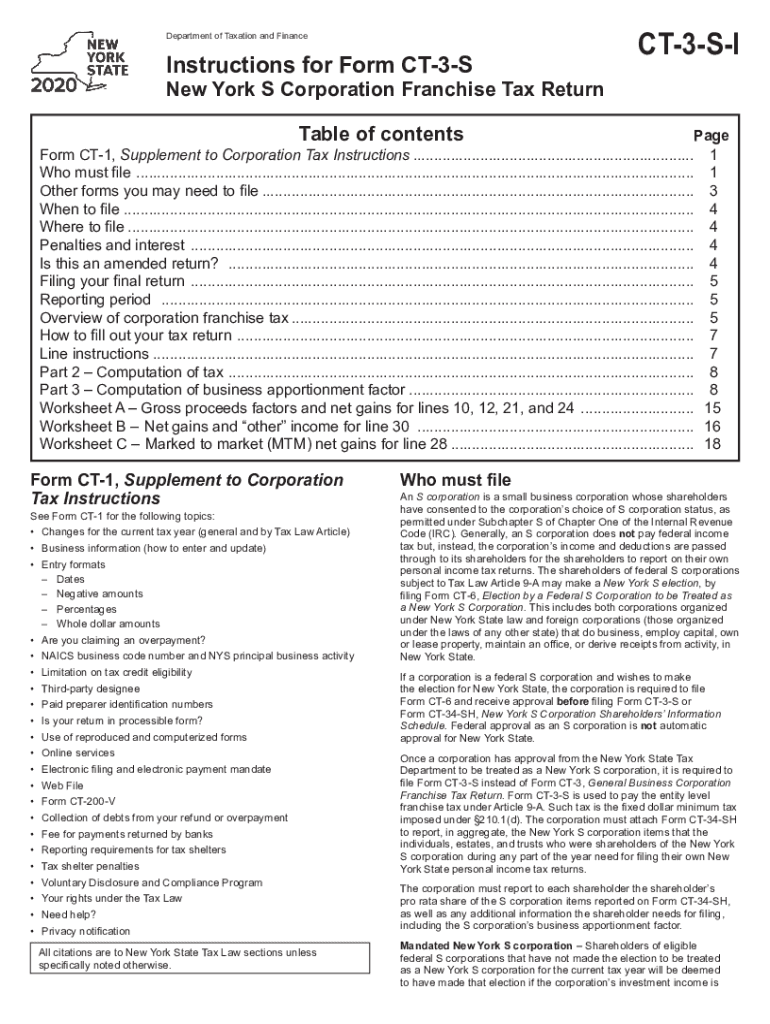

The New York CT-3 S Corporation Franchise Tax Return Instructions provide essential guidelines for S corporations operating in New York. These instructions outline the necessary steps to complete the CT-3 form accurately, ensuring compliance with state tax regulations. The form is specifically designed for S corporations, which are entities that pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. Understanding these instructions is vital for proper tax reporting and avoiding potential penalties.

Key Elements of the NY CT-3 Instructions

The key elements of the NY CT-3 instructions include detailed information on the following:

- Eligibility Criteria: Guidelines on which entities qualify to file the CT-3 form.

- Required Documents: A list of documents needed to complete the form, such as financial statements and previous tax returns.

- Filing Deadlines: Important dates for submission to ensure timely compliance.

- Penalties for Non-Compliance: Information on potential penalties for late filing or inaccuracies.

Steps to Complete the NY CT-3 Instructions

Completing the NY CT-3 form involves several steps to ensure accuracy and compliance:

- Gather all necessary financial documents and prior year tax returns.

- Review the eligibility criteria to confirm that your corporation qualifies for S corporation status.

- Fill out the CT-3 form, following the instructions for each section carefully.

- Double-check all entries for accuracy and completeness.

- Submit the completed form by the designated filing deadline.

Legal Use of the NY CT-3 Instructions

The NY CT-3 instructions serve a legal purpose by providing a framework for S corporations to report their income and taxes accurately. Adhering to these instructions ensures that corporations meet their legal obligations under New York state tax law. Failure to follow these guidelines may result in penalties and legal repercussions, making it crucial for corporations to understand and implement the instructions correctly.

Form Submission Methods for NY CT-3

Corporations can submit the NY CT-3 form through various methods:

- Online: Many corporations opt to file electronically using approved e-filing software.

- Mail: The completed form can be printed and mailed to the appropriate New York tax authority address.

- In-Person: Corporations may also choose to deliver the form directly to a local tax office.

Examples of Using the NY CT-3 Instructions

Examples of using the NY CT-3 instructions include scenarios where a corporation needs to report income from various sources, such as sales, investments, or services. By following the CT-3 instructions, corporations can accurately calculate their tax liabilities and ensure they are taking advantage of any applicable deductions or credits. This process is essential for maintaining compliance and optimizing tax outcomes.

Quick guide on how to complete instructions for forms c 3 s new york s corporation franchise tax returns tax year 2020

Effortlessly Prepare Instructions For Forms C 3 S New York S Corporation Franchise Tax Returns Tax Year on Any Device

The management of online documents has become increasingly prevalent among businesses and individuals. It presents an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, amend, and electronically sign your documents swiftly and without delays. Handle Instructions For Forms C 3 S New York S Corporation Franchise Tax Returns Tax Year on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented procedure today.

How to Amend and Electronically Sign Instructions For Forms C 3 S New York S Corporation Franchise Tax Returns Tax Year with Ease

- Obtain Instructions For Forms C 3 S New York S Corporation Franchise Tax Returns Tax Year and click on Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new copies of documents. airSlate SignNow meets your needs in document management with just a few clicks from any device you prefer. Edit and electronically sign Instructions For Forms C 3 S New York S Corporation Franchise Tax Returns Tax Year while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for forms c 3 s new york s corporation franchise tax returns tax year 2020

Create this form in 5 minutes!

How to create an eSignature for the instructions for forms c 3 s new york s corporation franchise tax returns tax year 2020

The best way to generate an eSignature for your PDF document in the online mode

The best way to generate an eSignature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature right from your mobile device

How to create an electronic signature for a PDF document on iOS devices

How to create an electronic signature for a PDF on Android devices

People also ask

-

What are the ny ct 3 instructions for using airSlate SignNow?

The ny ct 3 instructions provide guidance on how to complete and submit your Connecticut tax returns electronically using airSlate SignNow. You can easily fill out the necessary forms, sign them digitally, and submit them all in one efficient process. Our platform ensures that you comply with state guidelines while expediting your filing.

-

How much does airSlate SignNow cost for managing ny ct 3 instructions?

airSlate SignNow offers various pricing plans to cater to different business needs, including options specifically suited for handling ny ct 3 instructions. Plans are affordable and provide unlimited signing, storage, and document customization features. You can choose a plan that fits your budget while ensuring seamless e-signature capabilities.

-

What features does airSlate SignNow provide for ny ct 3 instructions?

When it comes to ny ct 3 instructions, airSlate SignNow offers features such as template creation, real-time collaboration, and automated workflows. These features help simplify the process of preparing and signing your documents. Additionally, our mobile app allows you to manage your e-signatures from anywhere at any time.

-

Can airSlate SignNow integrate with other software for ny ct 3 instructions?

Yes, airSlate SignNow integrates seamlessly with a variety of software applications to streamline the process of managing ny ct 3 instructions. Popular integrations include CRM systems, cloud storage, and accounting software, allowing you to manage your documents more effectively. This connectivity enhances productivity and ensures that all your tools work in harmony.

-

What benefits does airSlate SignNow provide for handling ny ct 3 instructions?

Utilizing airSlate SignNow for your ny ct 3 instructions offers numerous benefits, including time savings, increased accuracy, and enhanced document security. The e-signature process eliminates the need for physical paperwork, reducing delays and errors. Moreover, our platform ensures that all signed documents are securely stored and easily retrievable.

-

Is training available for using airSlate SignNow for ny ct 3 instructions?

Absolutely! airSlate SignNow offers comprehensive training resources for users, specifically tailored towards navigating ny ct 3 instructions. You can access video tutorials, live webinars, and a detailed knowledge base to help you through the process. Our customer support team is also always available to assist you directly with any questions or concerns.

-

How does airSlate SignNow ensure compliance with ny ct 3 instructions?

airSlate SignNow complies with all legal requirements related to e-signatures, ensuring that your ny ct 3 instructions are handled properly. The platform adheres to industry standards and provides an electronic audit trail for every transaction. This level of compliance helps protect your business while ensuring that your filings meet state regulations.

Get more for Instructions For Forms C 3 S New York S Corporation Franchise Tax Returns Tax Year

- Mbmf opt out form

- Biggest loser application 2023 form

- Refusal of care against medical advice university health services form

- Art contest rubric form

- Sample of filled attachment logbook for civil engineering form

- Veterinary icu treatment sheet form

- Certificate of arrival erasmus form

- Certificate of occupancy template 21316898 form

Find out other Instructions For Forms C 3 S New York S Corporation Franchise Tax Returns Tax Year

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now