Ny Ct 3 Instructions Form 2016

What is the Ny Ct 3 Instructions Form

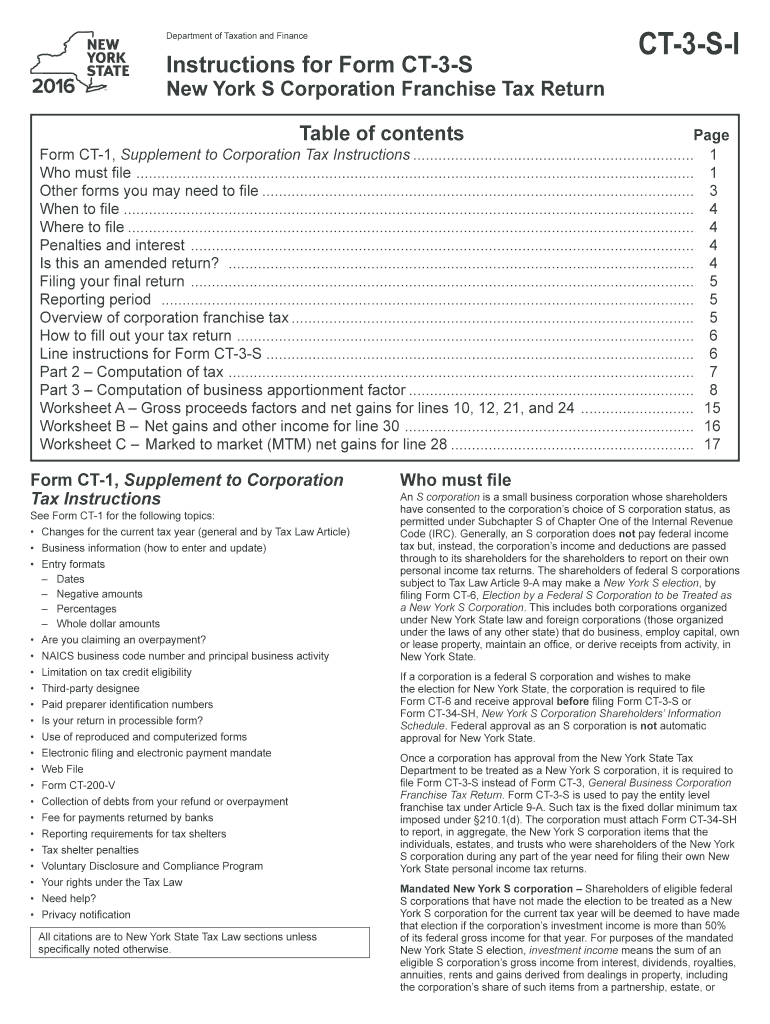

The Ny Ct 3 Instructions Form is a crucial document used for filing corporate tax returns in New York State. It provides detailed guidance on how to complete the New York Corporation Franchise Tax Return, which is essential for businesses operating within the state. This form outlines the necessary steps, calculations, and information required to ensure compliance with state tax regulations. Understanding the Ny Ct 3 Instructions Form is vital for accurate reporting and to avoid potential penalties.

How to use the Ny Ct 3 Instructions Form

Using the Ny Ct 3 Instructions Form involves several steps to ensure proper completion and submission. First, review the instructions carefully to understand the requirements specific to your business type. Gather all necessary financial documents, including income statements and balance sheets, as these will provide the data needed to fill out the form accurately. Follow the step-by-step guidance provided in the instructions to complete each section of the form. Once filled out, double-check for accuracy before submitting it to the appropriate state agency.

Steps to complete the Ny Ct 3 Instructions Form

Completing the Ny Ct 3 Instructions Form requires a systematic approach:

- Gather all relevant financial documents, including income statements and tax records.

- Review the specific instructions for your business type, as requirements may vary.

- Fill out the form section by section, ensuring all information is accurate and complete.

- Calculate any taxes owed based on the provided guidelines.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline, either electronically or by mail.

Legal use of the Ny Ct 3 Instructions Form

The Ny Ct 3 Instructions Form is legally binding when completed and submitted according to New York State tax laws. It is essential for businesses to adhere to the guidelines set forth in the instructions to ensure compliance. Failure to properly complete and file this form can result in penalties, including fines or additional taxes owed. Understanding the legal implications of this form is crucial for maintaining good standing with state tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Ny Ct 3 Instructions Form are critical to avoid penalties. Typically, the form must be submitted by the fifteenth day of the fourth month following the close of the tax year. For corporations operating on a calendar year, this means the deadline is April 15. It is important for businesses to be aware of any changes to deadlines or extensions that may apply, ensuring timely submission to maintain compliance.

Required Documents

When completing the Ny Ct 3 Instructions Form, certain documents are required to support the information provided. These typically include:

- Prior year tax returns for comparison and accuracy.

- Financial statements, including balance sheets and income statements.

- Documentation of any deductions or credits being claimed.

- Records of any estimated tax payments made during the year.

Having these documents readily available will streamline the completion process and help ensure accuracy.

Quick guide on how to complete ny ct 3 instructions 2016 form

Access Ny Ct 3 Instructions Form effortlessly on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It serves as an excellent environmentally-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, alter, and electronically sign your documents quickly and without complications. Handle Ny Ct 3 Instructions Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Ny Ct 3 Instructions Form with ease

- Find Ny Ct 3 Instructions Form and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or mask sensitive information with tools specifically available via airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which only takes a few moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or mislaid documents, the hassle of searching for forms, or mistakes that require printing additional copies. airSlate SignNow meets all your needs in document management with just a few clicks from any device you choose. Alter and electronically sign Ny Ct 3 Instructions Form to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ny ct 3 instructions 2016 form

Create this form in 5 minutes!

How to create an eSignature for the ny ct 3 instructions 2016 form

How to create an eSignature for the Ny Ct 3 Instructions 2016 Form online

How to generate an eSignature for the Ny Ct 3 Instructions 2016 Form in Chrome

How to generate an electronic signature for putting it on the Ny Ct 3 Instructions 2016 Form in Gmail

How to create an electronic signature for the Ny Ct 3 Instructions 2016 Form straight from your smart phone

How to create an eSignature for the Ny Ct 3 Instructions 2016 Form on iOS

How to generate an eSignature for the Ny Ct 3 Instructions 2016 Form on Android devices

People also ask

-

What is the Ny Ct 3 Instructions Form?

The Ny Ct 3 Instructions Form is a comprehensive guide that provides detailed instructions for completing the New York CT-3 tax return. This form is essential for corporations operating in New York to report their income, calculate tax liability, and ensure compliance with state regulations.

-

How can I access the Ny Ct 3 Instructions Form?

You can easily access the Ny Ct 3 Instructions Form through the official New York State Department of Taxation and Finance website. It is available for download as a PDF, allowing you to refer to it while preparing your tax return.

-

Is there a cost associated with the Ny Ct 3 Instructions Form?

No, the Ny Ct 3 Instructions Form is available for free on the New York State Department of Taxation and Finance website. There are no charges for downloading or using the form, making it a cost-effective resource for businesses.

-

How does airSlate SignNow help with the Ny Ct 3 Instructions Form?

airSlate SignNow streamlines the process of eSigning and sending the Ny Ct 3 Instructions Form. Our platform allows you to easily upload, sign, and share the form electronically, ensuring a faster and more efficient submission process.

-

What features does airSlate SignNow offer for handling the Ny Ct 3 Instructions Form?

airSlate SignNow offers features like customizable templates, automated reminders, and secure storage to manage the Ny Ct 3 Instructions Form. These tools enhance your workflow, making it easier to keep track of important tax documents.

-

Can I integrate airSlate SignNow with other software for the Ny Ct 3 Instructions Form?

Yes, airSlate SignNow seamlessly integrates with various applications such as Google Drive, Dropbox, and CRM systems. This integration allows you to easily manage the Ny Ct 3 Instructions Form alongside your other business documents.

-

What are the benefits of using airSlate SignNow for the Ny Ct 3 Instructions Form?

Using airSlate SignNow for the Ny Ct 3 Instructions Form provides signNow benefits including time savings, enhanced security, and improved organization. Our platform simplifies the signing process, ensuring that your forms are completed accurately and submitted on time.

Get more for Ny Ct 3 Instructions Form

- I need a copy of my transcripts from dana college form

- Nevada state workplace safety is everyones responsibility form

- Une transcript online form

- Readmission application unhm unh form

- School online letter form

- Proof of tutoring or si form unm

- Jacksonville commitment scholarship application form

- Mus 100 form unco

Find out other Ny Ct 3 Instructions Form

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement