D 4 DC Withholding Allowance Certificate 2018

What is the D-4 DC Withholding Allowance Certificate

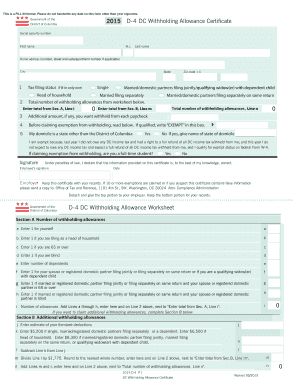

The D-4 DC Withholding Allowance Certificate is a form used by employees in Washington, D.C., to determine the amount of income tax withholding from their paychecks. This certificate allows employees to claim allowances based on their personal circumstances, such as marital status and number of dependents. The more allowances claimed, the less tax is withheld, which can impact an employee's take-home pay. Understanding this form is essential for both employees and employers to ensure accurate tax withholding throughout the year.

How to use the D-4 DC Withholding Allowance Certificate

To use the D-4 DC Withholding Allowance Certificate, employees must complete the form accurately and submit it to their employer. The form requires personal information, including name, address, and Social Security number, along with the number of allowances being claimed. Employers use this information to calculate the appropriate amount of tax to withhold from each paycheck. It is important for employees to review their allowances periodically, especially after significant life changes, to ensure their withholding reflects their current financial situation.

Steps to complete the D-4 DC Withholding Allowance Certificate

Completing the D-4 DC Withholding Allowance Certificate involves several straightforward steps:

- Obtain the D-4 form from your employer or download it from a reliable source.

- Fill in your personal information, including your name, address, and Social Security number.

- Determine the number of allowances you are eligible to claim based on your personal situation.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to your employer’s payroll department for processing.

Key elements of the D-4 DC Withholding Allowance Certificate

The D-4 DC Withholding Allowance Certificate includes several key elements that are critical for accurate tax withholding:

- Personal Information: This section requires your name, address, and Social Security number.

- Allowances Claimed: Employees must indicate the number of allowances they wish to claim, which affects their tax withholding.

- Signature: A signature is required to validate the information provided on the form.

- Employer Information: Space is provided for the employer to complete necessary details for payroll processing.

Legal use of the D-4 DC Withholding Allowance Certificate

The D-4 DC Withholding Allowance Certificate is legally recognized for determining the amount of income tax withholding in Washington, D.C. Employers are required to keep this form on file as part of their payroll records. It is essential that employees complete the form truthfully to avoid penalties related to under-withholding or over-withholding taxes. Misrepresentation on the form can lead to legal consequences for both the employee and employer.

Filing Deadlines / Important Dates

While the D-4 DC Withholding Allowance Certificate itself does not have a specific filing deadline, it is important for employees to submit the form to their employer promptly, especially at the beginning of the tax year or when personal circumstances change. Employers typically need to have this information updated before the first payroll of the year to ensure accurate withholding. Additionally, employees should be aware of tax filing deadlines to avoid any late penalties when submitting their annual tax returns.

Create this form in 5 minutes or less

Find and fill out the correct d 4 dc withholding allowance certificate

Create this form in 5 minutes!

How to create an eSignature for the d 4 dc withholding allowance certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the D 4 DC Withholding Allowance Certificate?

The D 4 DC Withholding Allowance Certificate is a form used by employees in Washington, D.C. to determine the amount of income tax withholding from their paychecks. By completing this certificate, employees can specify their withholding allowances, which can affect their take-home pay. Understanding this certificate is crucial for accurate tax planning.

-

How can airSlate SignNow help with the D 4 DC Withholding Allowance Certificate?

airSlate SignNow provides a seamless platform for electronically signing and sending the D 4 DC Withholding Allowance Certificate. Our user-friendly interface ensures that you can complete and submit this important document quickly and securely. This simplifies the process for both employers and employees.

-

Is there a cost associated with using airSlate SignNow for the D 4 DC Withholding Allowance Certificate?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans are designed to be cost-effective, ensuring that you can manage documents like the D 4 DC Withholding Allowance Certificate without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the D 4 DC Withholding Allowance Certificate?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which enhance the management of the D 4 DC Withholding Allowance Certificate. These features streamline the process, making it easier to collect signatures and keep track of submissions. Additionally, our platform ensures compliance with legal standards.

-

Can I integrate airSlate SignNow with other software for the D 4 DC Withholding Allowance Certificate?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to manage the D 4 DC Withholding Allowance Certificate alongside your existing tools. This integration capability enhances workflow efficiency and ensures that all your documents are easily accessible in one place.

-

What are the benefits of using airSlate SignNow for the D 4 DC Withholding Allowance Certificate?

Using airSlate SignNow for the D 4 DC Withholding Allowance Certificate offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows for quick document turnaround, ensuring that your withholding allowances are processed promptly. Additionally, the electronic signing process is both secure and legally binding.

-

How secure is airSlate SignNow when handling the D 4 DC Withholding Allowance Certificate?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect your documents, including the D 4 DC Withholding Allowance Certificate. Our platform complies with industry standards to ensure that your sensitive information remains confidential and secure.

Get more for D 4 DC Withholding Allowance Certificate

Find out other D 4 DC Withholding Allowance Certificate

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form