D 4 DC Withholding Allowance Worksheet D 4 DC Withholding 2018

What is the D-4 DC Withholding Allowance Worksheet?

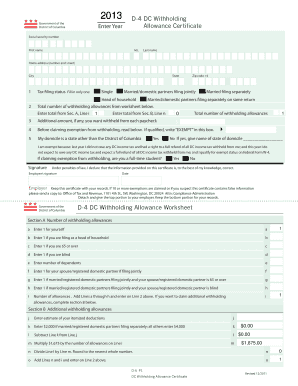

The D-4 DC Withholding Allowance Worksheet is a tax form used by employees in the District of Columbia to determine the appropriate amount of income tax withholding from their paychecks. This worksheet helps individuals calculate their withholding allowances based on their personal and financial situations, ensuring that the correct amount of taxes is withheld throughout the year. Proper completion of this form is essential for compliance with local tax laws and to avoid underpayment or overpayment of taxes.

How to Use the D-4 DC Withholding Allowance Worksheet

Using the D-4 DC Withholding Allowance Worksheet involves several straightforward steps. First, gather necessary personal information, including your filing status, number of dependents, and any additional income or deductions that may affect your tax situation. Next, follow the instructions on the worksheet to calculate your withholding allowances. This calculation will guide your employer in determining how much tax to withhold from your paycheck. It is crucial to review the worksheet periodically, especially after significant life changes, to ensure your withholding remains accurate.

Steps to Complete the D-4 DC Withholding Allowance Worksheet

Completing the D-4 DC Withholding Allowance Worksheet requires careful attention to detail. Begin by filling in your personal information at the top of the form. Then, proceed to the sections that ask about your filing status and number of dependents. Use the provided tables and instructions to calculate your allowances based on your specific circumstances. Once you have determined the number of allowances, transfer this information to your employer's payroll department. It is advisable to keep a copy of the completed worksheet for your records.

Key Elements of the D-4 DC Withholding Allowance Worksheet

The D-4 DC Withholding Allowance Worksheet includes several key elements that are crucial for accurate tax withholding. These elements typically consist of personal information fields, a section for filing status, and a detailed breakdown of allowances based on dependents and other factors. Additionally, the worksheet may contain tables that assist in calculating the total number of allowances. Understanding these components is vital for ensuring that your withholding aligns with your tax obligations.

Legal Use of the D-4 DC Withholding Allowance Worksheet

The D-4 DC Withholding Allowance Worksheet is legally recognized as the official document for determining tax withholding in the District of Columbia. Employers are required to use the information provided on this form to calculate the appropriate amount of taxes to withhold from employees' wages. Failing to complete or submit this worksheet accurately can lead to compliance issues and potential penalties from tax authorities. Therefore, it is essential to use the worksheet correctly and keep it updated as personal circumstances change.

Who Issues the Form

The D-4 DC Withholding Allowance Worksheet is issued by the Office of Tax and Revenue for the District of Columbia. This office is responsible for managing tax collection and ensuring compliance with local tax laws. Employees and employers can access the worksheet through official channels, ensuring they have the most current version for accurate tax withholding. Keeping abreast of any updates or changes to the form is important for maintaining compliance.

Create this form in 5 minutes or less

Find and fill out the correct d 4 dc withholding allowance worksheet d 4 dc withholding

Create this form in 5 minutes!

How to create an eSignature for the d 4 dc withholding allowance worksheet d 4 dc withholding

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the D 4 DC Withholding Allowance Worksheet D 4 DC Withholding?

The D 4 DC Withholding Allowance Worksheet D 4 DC Withholding is a form used by employees in Washington D.C. to determine the appropriate amount of tax withholding from their paychecks. This worksheet helps ensure that the correct amount of taxes is withheld based on personal allowances and filing status.

-

How can airSlate SignNow help with the D 4 DC Withholding Allowance Worksheet D 4 DC Withholding?

airSlate SignNow provides a seamless platform for electronically signing and sending the D 4 DC Withholding Allowance Worksheet D 4 DC Withholding. Our solution simplifies the process, making it easy for users to complete and submit their withholding forms securely and efficiently.

-

Is there a cost associated with using airSlate SignNow for the D 4 DC Withholding Allowance Worksheet D 4 DC Withholding?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses. Our cost-effective solutions ensure that you can manage your D 4 DC Withholding Allowance Worksheet D 4 DC Withholding without breaking the bank, providing excellent value for your investment.

-

What features does airSlate SignNow offer for managing the D 4 DC Withholding Allowance Worksheet D 4 DC Withholding?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage, all designed to enhance the management of the D 4 DC Withholding Allowance Worksheet D 4 DC Withholding. These features streamline the signing process and ensure that your documents are always accessible.

-

Can I integrate airSlate SignNow with other software for the D 4 DC Withholding Allowance Worksheet D 4 DC Withholding?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to easily manage your D 4 DC Withholding Allowance Worksheet D 4 DC Withholding alongside your existing tools. This flexibility enhances your workflow and improves overall efficiency.

-

What are the benefits of using airSlate SignNow for the D 4 DC Withholding Allowance Worksheet D 4 DC Withholding?

Using airSlate SignNow for the D 4 DC Withholding Allowance Worksheet D 4 DC Withholding provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled with care, making the process smoother for both employers and employees.

-

How secure is airSlate SignNow when handling the D 4 DC Withholding Allowance Worksheet D 4 DC Withholding?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect your D 4 DC Withholding Allowance Worksheet D 4 DC Withholding and other sensitive documents, ensuring that your information remains confidential and secure throughout the signing process.

Get more for D 4 DC Withholding Allowance Worksheet D 4 DC Withholding

- Dot sp7891 form

- Certificat medical les bosses de provence form

- Student financial declaration form revised v7

- Cell comparisons graphic organizer form

- Gypsy moth customer declaration kit 1 800 pack rat form

- Table of contents imperial county form

- Live performance contract template

- Live sound contract template form

Find out other D 4 DC Withholding Allowance Worksheet D 4 DC Withholding

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney