Tax Maumee Income Form 2017

What is the Tax Maumee Income Form

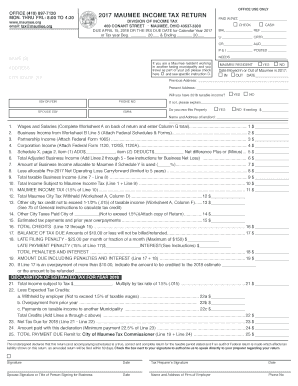

The Tax Maumee Income Form is a specific document used for reporting income and calculating taxes owed to the local government in Maumee, Ohio. This form is crucial for residents and businesses operating within the city limits, as it helps ensure compliance with local tax regulations. The form typically requires detailed information about income sources, deductions, and other financial data relevant to the taxpayer's situation.

How to use the Tax Maumee Income Form

Using the Tax Maumee Income Form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, fill out the form with your personal information, including your name, address, and Social Security number. Be sure to report all sources of income and claim any eligible deductions. After completing the form, review it for accuracy before submitting it to the appropriate local tax authority.

Steps to complete the Tax Maumee Income Form

Completing the Tax Maumee Income Form requires careful attention to detail. Follow these steps for a smooth process:

- Collect all relevant financial documents, such as W-2s and 1099s.

- Provide your personal information accurately, including your Social Security number.

- Report all sources of income, ensuring no income is omitted.

- Claim any deductions you are eligible for, such as business expenses or educational credits.

- Double-check all entries for accuracy before signing the form.

- Submit the completed form to the local tax authority by the specified deadline.

Legal use of the Tax Maumee Income Form

The Tax Maumee Income Form is legally binding when filled out and submitted according to local regulations. It is essential for taxpayers to provide accurate information, as any discrepancies can lead to penalties or audits. The form must be signed and dated by the taxpayer to validate its authenticity. Additionally, using a reliable electronic signature solution can enhance the security and legality of the submission process.

Filing Deadlines / Important Dates

Awareness of filing deadlines is crucial for taxpayers using the Tax Maumee Income Form. Typically, the form must be submitted by April fifteenth of each year, aligning with federal tax deadlines. However, it is advisable to check for any specific local extensions or changes in deadlines that may apply. Late submissions can result in penalties and interest on unpaid taxes, so timely filing is essential.

Required Documents

To complete the Tax Maumee Income Form accurately, several documents are required. These typically include:

- W-2 forms from employers, detailing annual income.

- 1099 forms for any freelance or contract work.

- Records of any additional income sources, such as rental income or dividends.

- Documentation for deductions, such as receipts for business expenses or educational costs.

Having these documents ready will streamline the completion process and help ensure compliance with local tax laws.

Quick guide on how to complete tax maumee income 2017 form

Complete Tax Maumee Income Form seamlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly without delays. Manage Tax Maumee Income Form on any platform utilizing airSlate SignNow's Android or iOS applications and streamline any document-related process today.

Steps to edit and eSign Tax Maumee Income Form easily

- Locate Tax Maumee Income Form and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or black out confidential information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and possesses the same legal validity as a conventional wet ink signature.

- Review all information and then click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searching, or mistakes that necessitate the printing of new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Tax Maumee Income Form and ensure effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax maumee income 2017 form

Create this form in 5 minutes!

How to create an eSignature for the tax maumee income 2017 form

How to create an eSignature for your Tax Maumee Income 2017 Form in the online mode

How to create an electronic signature for your Tax Maumee Income 2017 Form in Chrome

How to create an electronic signature for signing the Tax Maumee Income 2017 Form in Gmail

How to make an electronic signature for the Tax Maumee Income 2017 Form straight from your mobile device

How to create an eSignature for the Tax Maumee Income 2017 Form on iOS devices

How to make an eSignature for the Tax Maumee Income 2017 Form on Android OS

People also ask

-

What is the Tax Maumee Income Form?

The Tax Maumee Income Form is a document used by residents of Maumee to report their income for taxation purposes. It includes essential financial details and helps ensure that you meet local tax regulations. Utilizing airSlate SignNow can expedite the process of filling out and eSigning this form.

-

How can airSlate SignNow simplify my Tax Maumee Income Form submission?

airSlate SignNow streamlines the submission of your Tax Maumee Income Form by allowing you to easily create, edit, and eSign documents online. With its user-friendly interface, you can quickly navigate through the form and ensure all necessary information is accurately captured. This helps save time and reduces the likelihood of errors.

-

What are the pricing options for using airSlate SignNow for the Tax Maumee Income Form?

airSlate SignNow offers competitive pricing plans tailored for individuals and businesses looking to manage their Tax Maumee Income Form efficiently. By choosing a subscription, you gain access to various features that enhance your document management experience. Check our pricing page for detailed information on plans that fit your needs.

-

Does airSlate SignNow offer any features specifically for tax documents like the Tax Maumee Income Form?

Yes, airSlate SignNow includes features designed specifically for tax documents, including customizable templates for the Tax Maumee Income Form. You can also manage signatures, track document status, and store your forms securely. These features facilitate a smooth tax filing experience.

-

How secure is airSlate SignNow when handling my Tax Maumee Income Form?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive documents like the Tax Maumee Income Form. Our platform employs industry-standard encryption and secure cloud storage to protect your information. This ensures that your data remains confidential and secure throughout the signing process.

-

Can I integrate airSlate SignNow with other software to manage my Tax Maumee Income Form?

Absolutely! airSlate SignNow seamlessly integrates with various software applications, making it easy to manage your Tax Maumee Income Form alongside your existing tools. This includes integrations with popular accounting and tax preparation software, enhancing your overall workflow.

-

What are the benefits of using airSlate SignNow for the Tax Maumee Income Form?

Using airSlate SignNow for your Tax Maumee Income Form offers numerous benefits, including time savings, increased accuracy, and a more organized document management system. You can eSign forms from any device, track changes in real-time, and collaborate with others, ensuring a hassle-free filing process.

Get more for Tax Maumee Income Form

Find out other Tax Maumee Income Form

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF