Form 4506T EZ Rev 3 2023

What is the Form 4506T EZ Rev 3

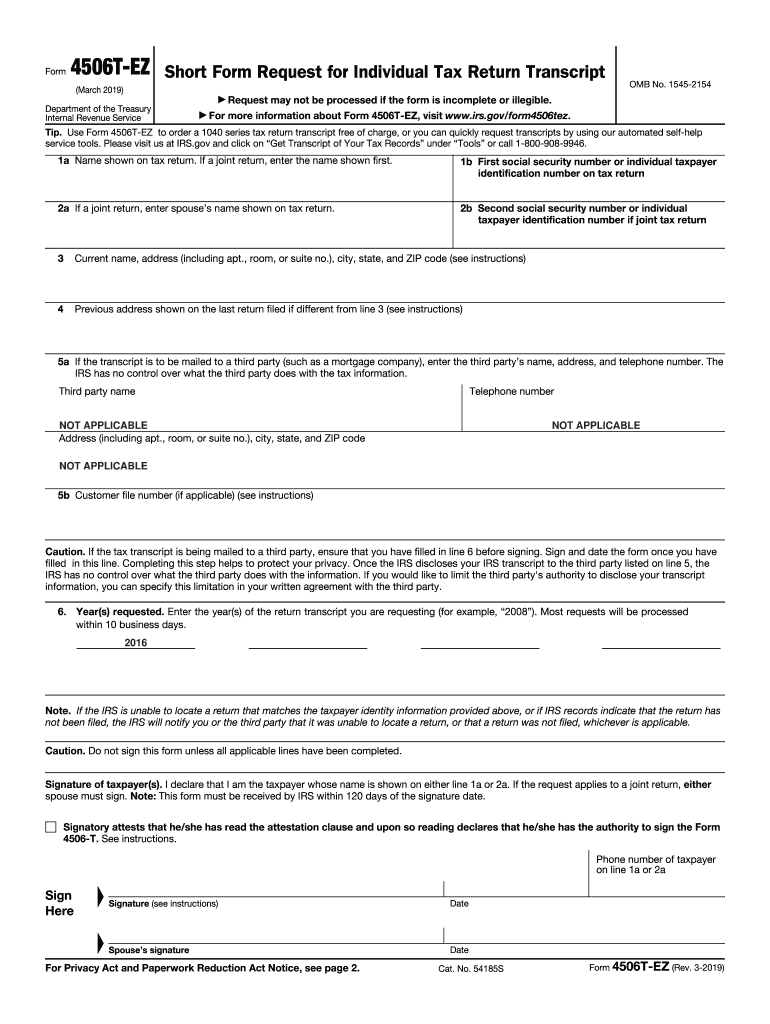

The Form 4506T EZ Rev 3 is a simplified version of the IRS Form 4506-T, designed for taxpayers who need to request a transcript of their tax return information. This form allows individuals to obtain a record of their tax filings from the IRS, which can be useful for various purposes, such as applying for loans, verifying income, or resolving tax issues. The EZ version streamlines the process, making it easier for users to complete and submit their requests.

How to use the Form 4506T EZ Rev 3

To effectively use the Form 4506T EZ Rev 3, follow these steps:

- Fill out the form with your personal information, including your name, address, and Social Security number.

- Indicate the specific tax years for which you are requesting transcripts.

- Specify the type of transcript you need, such as a tax return transcript or an account transcript.

- Sign and date the form to authorize the IRS to release your information.

- Submit the completed form to the IRS by mail or fax, depending on your preference.

Steps to complete the Form 4506T EZ Rev 3

Completing the Form 4506T EZ Rev 3 involves several straightforward steps:

- Begin by entering your personal details in the designated fields, ensuring accuracy.

- Choose the appropriate tax years for which you need transcripts, with options typically covering the last three tax years.

- Select the type of transcript required, based on your needs.

- Review the form for completeness and correctness before signing.

- Submit the form via the appropriate submission method, either by fax or mailing it to the IRS.

Legal use of the Form 4506T EZ Rev 3

The Form 4506T EZ Rev 3 is legally recognized by the IRS as a valid method for requesting tax transcripts. It is important for users to understand that submitting this form grants the IRS permission to disclose their tax information to the specified third parties. This legal aspect is crucial for ensuring compliance with privacy regulations and safeguarding sensitive information.

Required Documents

When submitting the Form 4506T EZ Rev 3, you generally do not need to provide additional documents. However, it is essential to ensure that your personal information is accurate and matches the records held by the IRS. If you are requesting transcripts for a business entity, you may need to include additional identification details specific to the business.

Form Submission Methods

The Form 4506T EZ Rev 3 can be submitted to the IRS through various methods:

- By faxing the completed form to the appropriate IRS fax number, which can be found on the IRS website.

- By mailing the form to the address specified for transcript requests in the instructions provided with the form.

Choosing the right submission method can affect the speed at which you receive your transcripts.

Create this form in 5 minutes or less

Find and fill out the correct form 4506t ez rev 3

Create this form in 5 minutes!

How to create an eSignature for the form 4506t ez rev 3

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 4506T EZ Rev 3?

The Form 4506T EZ Rev 3 is a simplified version of the IRS form used to request a transcript of tax return information. It allows individuals to obtain their tax information quickly and efficiently, making it ideal for various financial processes.

-

How can airSlate SignNow help with the Form 4506T EZ Rev 3?

airSlate SignNow streamlines the process of completing and signing the Form 4506T EZ Rev 3. With our platform, users can easily fill out the form, eSign it, and send it securely, ensuring a hassle-free experience.

-

Is there a cost associated with using airSlate SignNow for the Form 4506T EZ Rev 3?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solutions ensure that you can manage the Form 4506T EZ Rev 3 and other documents without breaking the bank.

-

What features does airSlate SignNow offer for the Form 4506T EZ Rev 3?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking for the Form 4506T EZ Rev 3. These tools enhance efficiency and ensure that your documents are handled securely.

-

Can I integrate airSlate SignNow with other applications for the Form 4506T EZ Rev 3?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to manage the Form 4506T EZ Rev 3 alongside your existing workflows. This flexibility helps streamline your document management processes.

-

What are the benefits of using airSlate SignNow for the Form 4506T EZ Rev 3?

Using airSlate SignNow for the Form 4506T EZ Rev 3 provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform simplifies the signing process, making it easier for users to obtain their tax transcripts.

-

Is airSlate SignNow secure for handling the Form 4506T EZ Rev 3?

Yes, airSlate SignNow prioritizes security and compliance. We utilize advanced encryption and security protocols to ensure that your Form 4506T EZ Rev 3 and other sensitive documents are protected throughout the signing process.

Get more for Form 4506T EZ Rev 3

- Ocfs ldss 4433 form pdf 100257835

- Cafas assessment pdf form

- Equipment list lea form 6 roane jackson technical center

- Cr 180 form

- City of san diego circuit card form

- Surgery scheduling form phone 903 408 1200 fax 903 408

- Texas pool inspection checklist form

- Cast clinic referral form dell childrens medical center of central

Find out other Form 4506T EZ Rev 3

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now