Form 4506T EZ Rev 3 2023

What is the Form 4506T EZ Rev 3

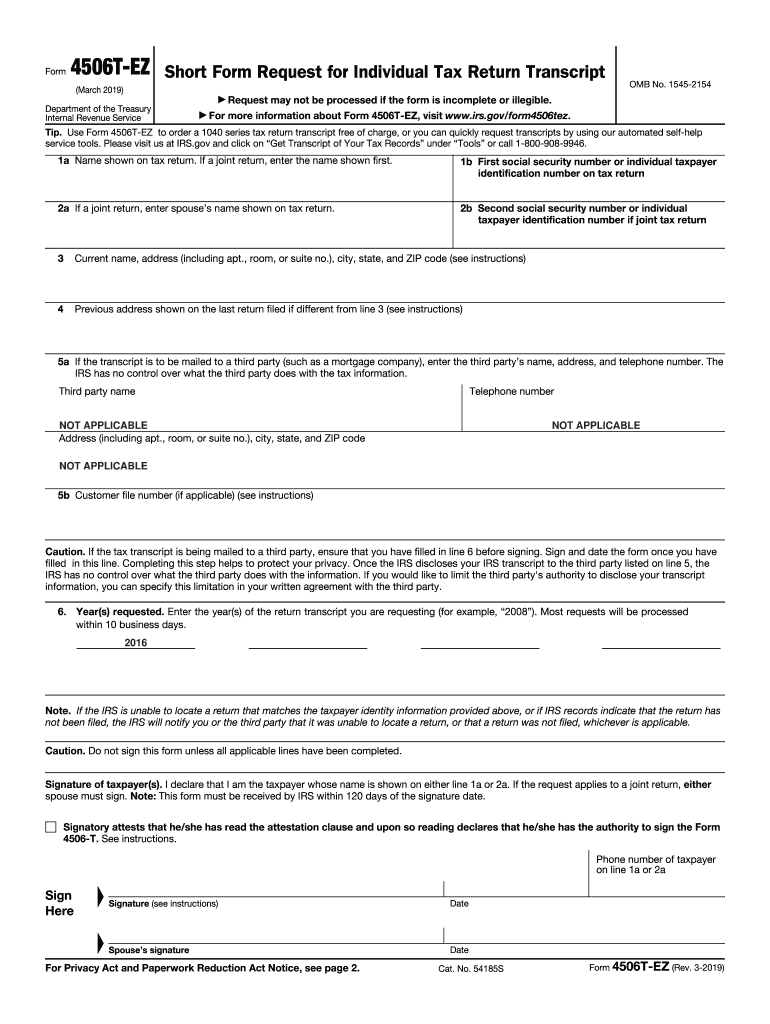

The Form 4506T EZ Rev 3 is a simplified version of the IRS Form 4506-T, designed for taxpayers who need to request a transcript of their tax return information. This form allows individuals to obtain a record of their tax filings from the IRS, which can be useful for various purposes, such as applying for loans, verifying income, or resolving tax issues. The EZ version streamlines the process, making it easier for users to complete and submit their requests.

How to use the Form 4506T EZ Rev 3

To effectively use the Form 4506T EZ Rev 3, follow these steps:

- Fill out the form with your personal information, including your name, address, and Social Security number.

- Indicate the specific tax years for which you are requesting transcripts.

- Specify the type of transcript you need, such as a tax return transcript or an account transcript.

- Sign and date the form to authorize the IRS to release your information.

- Submit the completed form to the IRS by mail or fax, depending on your preference.

Steps to complete the Form 4506T EZ Rev 3

Completing the Form 4506T EZ Rev 3 involves several straightforward steps:

- Begin by entering your personal details in the designated fields, ensuring accuracy.

- Choose the appropriate tax years for which you need transcripts, with options typically covering the last three tax years.

- Select the type of transcript required, based on your needs.

- Review the form for completeness and correctness before signing.

- Submit the form via the appropriate submission method, either by fax or mailing it to the IRS.

Legal use of the Form 4506T EZ Rev 3

The Form 4506T EZ Rev 3 is legally recognized by the IRS as a valid method for requesting tax transcripts. It is important for users to understand that submitting this form grants the IRS permission to disclose their tax information to the specified third parties. This legal aspect is crucial for ensuring compliance with privacy regulations and safeguarding sensitive information.

Required Documents

When submitting the Form 4506T EZ Rev 3, you generally do not need to provide additional documents. However, it is essential to ensure that your personal information is accurate and matches the records held by the IRS. If you are requesting transcripts for a business entity, you may need to include additional identification details specific to the business.

Form Submission Methods

The Form 4506T EZ Rev 3 can be submitted to the IRS through various methods:

- By faxing the completed form to the appropriate IRS fax number, which can be found on the IRS website.

- By mailing the form to the address specified for transcript requests in the instructions provided with the form.

Choosing the right submission method can affect the speed at which you receive your transcripts.

Create this form in 5 minutes or less

Find and fill out the correct form 4506t ez rev 3

Create this form in 5 minutes!

How to create an eSignature for the form 4506t ez rev 3

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 4506T EZ Rev 3?

The Form 4506T EZ Rev 3 is a simplified version of the IRS form used to request a transcript of tax return information. It allows individuals to obtain their tax information quickly and efficiently, making it ideal for various financial processes.

-

How can airSlate SignNow help with the Form 4506T EZ Rev 3?

airSlate SignNow streamlines the process of completing and signing the Form 4506T EZ Rev 3. With our platform, users can easily fill out the form, eSign it, and send it securely, ensuring a hassle-free experience.

-

Is there a cost associated with using airSlate SignNow for the Form 4506T EZ Rev 3?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solutions ensure that you can manage the Form 4506T EZ Rev 3 and other documents without breaking the bank.

-

What features does airSlate SignNow offer for the Form 4506T EZ Rev 3?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking for the Form 4506T EZ Rev 3. These tools enhance efficiency and ensure that your documents are handled securely.

-

Can I integrate airSlate SignNow with other applications for the Form 4506T EZ Rev 3?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to manage the Form 4506T EZ Rev 3 alongside your existing workflows. This flexibility helps streamline your document management processes.

-

What are the benefits of using airSlate SignNow for the Form 4506T EZ Rev 3?

Using airSlate SignNow for the Form 4506T EZ Rev 3 provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform simplifies the signing process, making it easier for users to obtain their tax transcripts.

-

Is airSlate SignNow secure for handling the Form 4506T EZ Rev 3?

Yes, airSlate SignNow prioritizes security and compliance. We utilize advanced encryption and security protocols to ensure that your Form 4506T EZ Rev 3 and other sensitive documents are protected throughout the signing process.

Get more for Form 4506T EZ Rev 3

Find out other Form 4506T EZ Rev 3

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple

- Can I eSignature New York Bulk Sale Agreement

- How Do I Electronic signature Tennessee Web Hosting Agreement

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template

- Electronic signature Georgia Stock Transfer Form Template Fast

- Electronic signature Michigan Stock Transfer Form Template Myself

- Electronic signature Montana Stock Transfer Form Template Computer

- Help Me With Electronic signature Texas Debt Settlement Agreement Template

- How Do I Electronic signature Nevada Stock Transfer Form Template