SMALL ESTATE AFFIDAVIT Small Estate Affidavit to the Secretary of the State of Illinois 2023-2026

What is the SMALL ESTATE AFFIDAVIT Small Estate Affidavit To The Secretary Of The State Of Illinois

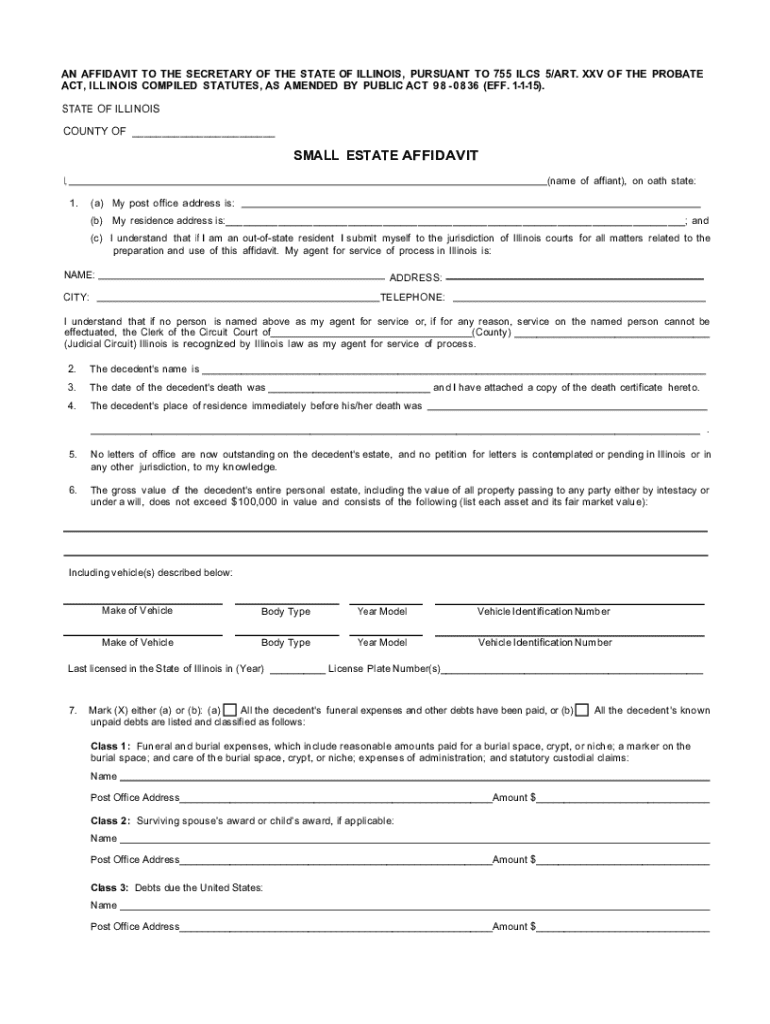

The SMALL ESTATE AFFIDAVIT is a legal document used in Illinois to facilitate the transfer of assets from a deceased person's estate without the need for formal probate proceedings. This affidavit allows heirs or beneficiaries to claim property, bank accounts, or other assets valued below a certain threshold, streamlining the process and reducing the burden on families during a difficult time. The affidavit must be filed with the Secretary of State and includes essential information about the deceased, the assets involved, and the individuals entitled to inherit.

Steps to complete the SMALL ESTATE AFFIDAVIT Small Estate Affidavit To The Secretary Of The State Of Illinois

Completing the SMALL ESTATE AFFIDAVIT involves several key steps:

- Gather necessary information about the deceased, including their full name, date of death, and details of the estate.

- Identify the assets that qualify for transfer under the affidavit, ensuring their total value does not exceed the state’s threshold.

- Complete the affidavit form accurately, providing all required details about the heirs or beneficiaries.

- Sign the affidavit in the presence of a notary public to ensure its validity.

- File the completed affidavit with the appropriate office, typically the Secretary of State, and retain copies for personal records.

How to obtain the SMALL ESTATE AFFIDAVIT Small Estate Affidavit To The Secretary Of The State Of Illinois

To obtain the SMALL ESTATE AFFIDAVIT form in Illinois, individuals can visit the Secretary of State's website or contact their office directly. The form is often available for download in PDF format, allowing users to print and fill it out at their convenience. Additionally, local courthouses or legal aid offices may provide copies of the affidavit for those who need assistance in completing it.

Key elements of the SMALL ESTATE AFFIDAVIT Small Estate Affidavit To The Secretary Of The State Of Illinois

Several key elements must be included in the SMALL ESTATE AFFIDAVIT for it to be valid:

- The full name and address of the deceased.

- The date of death of the deceased.

- A description of the assets being claimed.

- The names and addresses of the heirs or beneficiaries.

- A statement affirming that the total value of the estate does not exceed the statutory limit.

- Signatures of the heirs or beneficiaries, along with a notary's acknowledgment.

Legal use of the SMALL ESTATE AFFIDAVIT Small Estate Affidavit To The Secretary Of The State Of Illinois

The SMALL ESTATE AFFIDAVIT serves a crucial legal function by allowing for the transfer of assets without the lengthy probate process. It is legally binding and must be executed in accordance with Illinois law. The affidavit can be used to claim various types of assets, including bank accounts, real estate, and personal property, provided they fall within the specified value limits. Proper use of this affidavit can help heirs settle the estate efficiently and with minimal legal complications.

Eligibility Criteria

To be eligible to use the SMALL ESTATE AFFIDAVIT in Illinois, certain criteria must be met:

- The total value of the estate must not exceed the limit set by Illinois law, which is typically around $100,000 for personal property.

- The individual filing the affidavit must be an heir or beneficiary named in the will or recognized under state intestacy laws.

- The deceased must have passed away without any outstanding debts that require formal probate proceedings.

Handy tips for filling out SMALL ESTATE AFFIDAVIT Small Estate Affidavit To The Secretary Of The State Of Illinois online

Quick steps to complete and e-sign SMALL ESTATE AFFIDAVIT Small Estate Affidavit To The Secretary Of The State Of Illinois online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms could be. Gain access to a GDPR and HIPAA compliant platform for optimum simplicity. Use signNow to electronically sign and share SMALL ESTATE AFFIDAVIT Small Estate Affidavit To The Secretary Of The State Of Illinois for collecting e-signatures.

Create this form in 5 minutes or less

Find and fill out the correct small estate affidavit small estate affidavit to the secretary of the state of illinois

Create this form in 5 minutes!

How to create an eSignature for the small estate affidavit small estate affidavit to the secretary of the state of illinois

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a SMALL ESTATE AFFIDAVIT Small Estate Affidavit To The Secretary Of The State Of Illinois?

A SMALL ESTATE AFFIDAVIT Small Estate Affidavit To The Secretary Of The State Of Illinois is a legal document that allows heirs to claim assets of a deceased person without going through the full probate process. This affidavit simplifies the transfer of small estates, making it easier and faster for beneficiaries to access their inheritance.

-

How much does it cost to file a SMALL ESTATE AFFIDAVIT Small Estate Affidavit To The Secretary Of The State Of Illinois?

The cost to file a SMALL ESTATE AFFIDAVIT Small Estate Affidavit To The Secretary Of The State Of Illinois can vary depending on the county and any associated fees. Typically, the filing fee is relatively low compared to the costs of full probate, making it a cost-effective solution for small estates.

-

What are the benefits of using a SMALL ESTATE AFFIDAVIT Small Estate Affidavit To The Secretary Of The State Of Illinois?

Using a SMALL ESTATE AFFIDAVIT Small Estate Affidavit To The Secretary Of The State Of Illinois allows for a quicker resolution of estate matters. It eliminates the need for lengthy probate proceedings, saving time and money for the heirs involved.

-

Who can file a SMALL ESTATE AFFIDAVIT Small Estate Affidavit To The Secretary Of The State Of Illinois?

Typically, any heir or beneficiary of the deceased can file a SMALL ESTATE AFFIDAVIT Small Estate Affidavit To The Secretary Of The State Of Illinois. However, it is important to ensure that the estate qualifies as a small estate under Illinois law, which generally means the total value of the estate is below a certain threshold.

-

What documents are needed to complete a SMALL ESTATE AFFIDAVIT Small Estate Affidavit To The Secretary Of The State Of Illinois?

To complete a SMALL ESTATE AFFIDAVIT Small Estate Affidavit To The Secretary Of The State Of Illinois, you will need the deceased's death certificate, a list of assets, and any relevant identification for the heirs. Additional documentation may be required depending on the specific circumstances of the estate.

-

Can I use airSlate SignNow to create a SMALL ESTATE AFFIDAVIT Small Estate Affidavit To The Secretary Of The State Of Illinois?

Yes, airSlate SignNow provides an easy-to-use platform for creating and signing a SMALL ESTATE AFFIDAVIT Small Estate Affidavit To The Secretary Of The State Of Illinois. Our solution allows you to customize documents and securely eSign them, streamlining the process for you.

-

Is airSlate SignNow secure for handling legal documents like a SMALL ESTATE AFFIDAVIT Small Estate Affidavit To The Secretary Of The State Of Illinois?

Absolutely! airSlate SignNow employs advanced security measures to protect your documents, including encryption and secure cloud storage. You can confidently handle your SMALL ESTATE AFFIDAVIT Small Estate Affidavit To The Secretary Of The State Of Illinois knowing that your information is safe.

Get more for SMALL ESTATE AFFIDAVIT Small Estate Affidavit To The Secretary Of The State Of Illinois

- Legal last will and testament form for single person with no children west virginia

- Legal last will and testament form for a single person with minor children west virginia

- Legal last will and testament form for single person with adult and minor children west virginia

- Legal last will and testament form for single person with adult children west virginia

- Legal last will and testament for married person with minor children from prior marriage west virginia form

- Legal last will and testament form for married person with adult children from prior marriage west virginia

- Legal last will and testament form for divorced person not remarried with adult children west virginia

- Legal last will and testament form for divorced person not remarried with no children west virginia

Find out other SMALL ESTATE AFFIDAVIT Small Estate Affidavit To The Secretary Of The State Of Illinois

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement