Form 8300 Rev July Internal Revenue Service 2023

What is the Form 8300 Rev July Internal Revenue Service

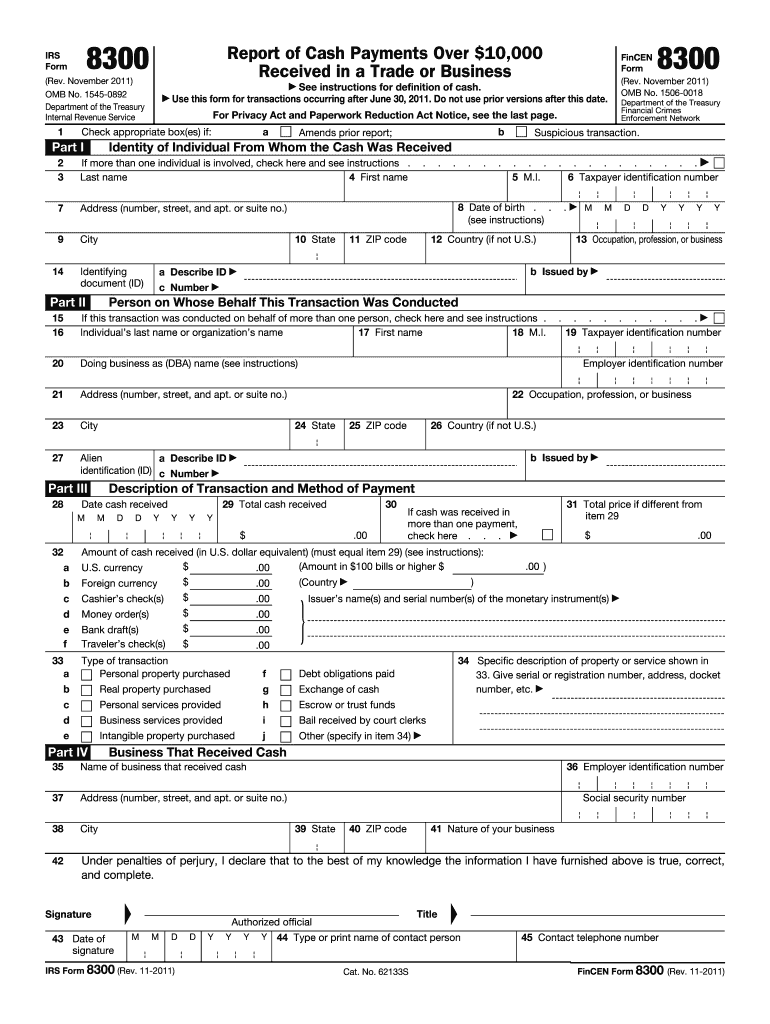

The Form 8300, officially titled "Report of Cash Payments Over Ten Thousand Dollars Received in a Trade or Business," is a document required by the Internal Revenue Service (IRS) for businesses that receive cash payments exceeding ten thousand dollars in a single transaction or related transactions. This form is crucial for compliance with the Bank Secrecy Act and helps the IRS track large cash transactions to prevent money laundering and tax evasion.

How to use the Form 8300 Rev July Internal Revenue Service

Using Form 8300 involves a straightforward process. Businesses must complete the form when they receive qualifying cash payments. This includes payments made in cash, cashier's checks, bank drafts, or money orders. The form requires detailed information about the transaction, including the payer's name, address, and taxpayer identification number, as well as the amount received and the nature of the transaction. Once completed, the form must be submitted to the IRS within 15 days of receiving the cash payment.

Steps to complete the Form 8300 Rev July Internal Revenue Service

Completing Form 8300 involves several key steps:

- Gather necessary information about the transaction and the payer.

- Fill out the form with details such as the date of the transaction, the amount received, and the payer's identification information.

- Ensure accuracy to avoid penalties; double-check all entries for correctness.

- Submit the form to the IRS within 15 days of the cash payment.

- Keep a copy of the submitted form for your records.

Legal use of the Form 8300 Rev July Internal Revenue Service

The legal requirement to file Form 8300 is established under the Bank Secrecy Act. Businesses must comply with this regulation to report large cash transactions accurately. Failure to file can result in significant penalties, including fines and potential criminal charges. It is essential for businesses to understand their obligations under this law and ensure proper reporting of cash transactions to maintain compliance.

Filing Deadlines / Important Dates

Form 8300 must be filed within 15 days of receiving cash payments that exceed ten thousand dollars. It is important for businesses to mark their calendars to ensure timely submission. If the 15th day falls on a weekend or holiday, the form should be submitted on the next business day. Additionally, businesses should be aware of any changes in IRS regulations that may affect filing deadlines.

Penalties for Non-Compliance

Non-compliance with the requirements of Form 8300 can lead to serious consequences. The IRS imposes penalties for failing to file the form or for filing it late. These penalties can range from a few hundred dollars to several thousand, depending on the circumstances. In cases of willful neglect or fraudulent reporting, criminal charges may also be pursued. Businesses should prioritize compliance to avoid these risks.

Create this form in 5 minutes or less

Find and fill out the correct form 8300 rev july internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the form 8300 rev july internal revenue service

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8300 Rev July Internal Revenue Service?

Form 8300 Rev July Internal Revenue Service is a document used by businesses to report cash payments over $10,000 received in a trade or business. This form helps the IRS track large cash transactions and prevent money laundering. Understanding this form is crucial for compliance and avoiding penalties.

-

How can airSlate SignNow help with Form 8300 Rev July Internal Revenue Service?

airSlate SignNow simplifies the process of completing and submitting Form 8300 Rev July Internal Revenue Service by allowing users to eSign and send documents securely. Our platform ensures that all necessary fields are filled out correctly, reducing the risk of errors. This streamlines compliance and saves time for businesses.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, starting with a free trial. Each plan includes features that support the completion of important documents like Form 8300 Rev July Internal Revenue Service. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow provide for document management?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking. These tools are particularly useful for managing forms like Form 8300 Rev July Internal Revenue Service. Our platform enhances efficiency and ensures that all documents are handled securely.

-

Is airSlate SignNow compliant with IRS regulations?

Yes, airSlate SignNow is designed to comply with IRS regulations, including those related to Form 8300 Rev July Internal Revenue Service. Our platform uses advanced security measures to protect sensitive information and ensure that your documents meet legal standards. This gives you peace of mind when handling important forms.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your workflow. This includes popular tools that can help you manage Form 8300 Rev July Internal Revenue Service and other essential documents seamlessly within your existing systems.

-

What are the benefits of using airSlate SignNow for Form 8300 Rev July Internal Revenue Service?

Using airSlate SignNow for Form 8300 Rev July Internal Revenue Service provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows for quick eSigning and easy document sharing, which helps businesses stay compliant without the hassle of traditional methods.

Get more for Form 8300 Rev July Internal Revenue Service

- No agreement form

- Request to register foreign order pursuant to rsa 458 a26 form

- Pdffiller fillable online courts state nh parenting plan form

- Parenting petition new hampshire judicial branch form

- Bill of sale form new hampshire financial affidavit form

- 2013 2019 form nh nhjb 2066 fs fill online printable

- Affidavit of receipt of service form

- This decree is choose one form

Find out other Form 8300 Rev July Internal Revenue Service

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself