11 3 22 Disclosure to Certain Federal Officers and 2023-2026

Understanding the IRS Form 8300

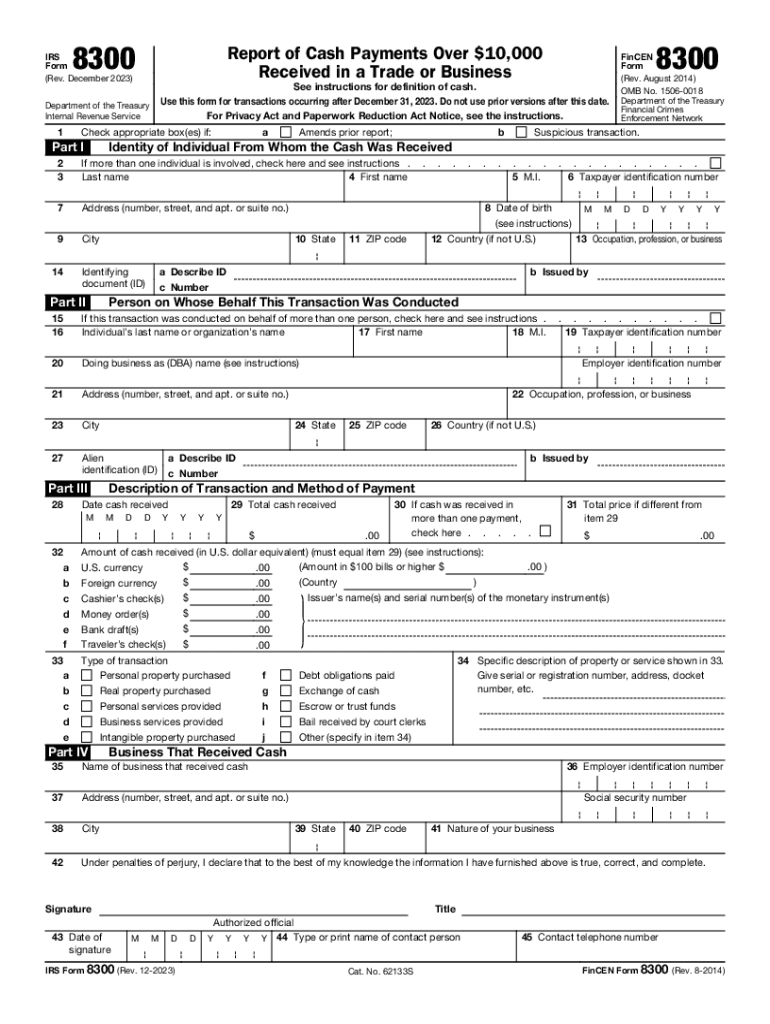

The IRS Form 8300 is a crucial document that businesses must file when they receive cash payments exceeding $10,000 in a single transaction or related transactions. This form is essential for reporting large cash transactions to the Internal Revenue Service (IRS) and the Financial Crimes Enforcement Network (FinCEN). The primary purpose of the 8300 form is to prevent money laundering and other financial crimes by ensuring transparency in significant cash dealings.

Steps to Complete the IRS Form 8300

Filling out the IRS Form 8300 involves several straightforward steps:

- Gather necessary information about the transaction, including the date, amount, and method of payment.

- Collect details about the payer, such as their name, address, and taxpayer identification number (TIN).

- Fill in the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form electronically or by mail to the appropriate IRS office.

Filing Deadlines for Form 8300

Businesses must file Form 8300 within 15 days of receiving cash payments that meet the reporting threshold. This timely filing is essential to avoid potential penalties for non-compliance. Additionally, if a transaction occurs over multiple days, businesses should aggregate the amounts to determine if the total exceeds the $10,000 threshold.

Legal Use of the IRS Form 8300

The legal requirement to file Form 8300 applies to any business that receives cash payments exceeding $10,000. This includes various industries, such as retail, real estate, and automotive sales. Failure to comply with this requirement can result in significant penalties, including fines and potential legal action. Understanding the legal implications of this form is essential for businesses to maintain compliance with federal regulations.

Penalties for Non-Compliance with Form 8300

Non-compliance with the filing requirements for Form 8300 can lead to severe consequences. Penalties may include fines that can range from $100 to $50,000, depending on the severity of the violation. Additionally, willful neglect to file can result in criminal charges, further emphasizing the importance of adhering to the reporting requirements.

IRS Guidelines for Completing Form 8300

The IRS provides specific guidelines for completing Form 8300, which include detailed instructions on what information is required and how to report it accurately. Businesses should refer to the IRS instructions for Form 8300 to ensure compliance with all reporting requirements. These guidelines help clarify the process and ensure that businesses can complete the form correctly, minimizing the risk of errors.

Form Submission Methods for IRS Form 8300

Businesses have multiple options for submitting Form 8300. The form can be filed electronically through the IRS e-file system, which is often the most efficient method. Alternatively, businesses can submit a paper form by mailing it to the appropriate IRS address. It is important to choose the submission method that best suits the business’s needs while ensuring compliance with the filing deadlines.

Quick guide on how to complete 11 3 22 disclosure to certain federal officers and

Prepare 11 3 22 Disclosure To Certain Federal Officers And effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage 11 3 22 Disclosure To Certain Federal Officers And on any platform using airSlate SignNow applications for Android or iOS and simplify any document-related process today.

How to modify and eSign 11 3 22 Disclosure To Certain Federal Officers And without any hassle

- Locate 11 3 22 Disclosure To Certain Federal Officers And and then click Get Form to commence.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the details and then click on the Done button to save your modifications.

- Choose your preferred delivery method for your form, whether by email, text message (SMS), an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign 11 3 22 Disclosure To Certain Federal Officers And and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 11 3 22 disclosure to certain federal officers and

Create this form in 5 minutes!

How to create an eSignature for the 11 3 22 disclosure to certain federal officers and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8300 and why is it important?

Form 8300 is a document used by businesses to report cash payments exceeding $10,000 received in a single transaction. It's crucial for compliance with federal regulations to prevent money laundering. Understanding this form helps businesses avoid hefty fines and legal issues.

-

How can airSlate SignNow help with Form 8300?

airSlate SignNow simplifies the process of creating and eSigning Form 8300. With our platform, you can generate the form electronically, ensuring accuracy and compliance. Additionally, our user-friendly interface makes it easy for you to send and track your Form 8300 securely.

-

Is there a cost associated with using airSlate SignNow for Form 8300?

Yes, airSlate SignNow offers various pricing plans that cater to different business sizes and needs. Our affordable solutions ensure you can efficiently manage documents like Form 8300 without breaking the bank. Explore our pricing page to find a plan that fits your requirements.

-

What features does airSlate SignNow offer for handling Form 8300?

Our platform provides features such as customizable templates, real-time notifications, and document tracking, all designed to facilitate the management of Form 8300. Additionally, eSigning provides a hassle-free way to finalize agreements swiftly while maintaining legal compliance.

-

Can I integrate airSlate SignNow with other software for Form 8300 management?

Absolutely! airSlate SignNow offers integration with various popular applications, including CRM systems and accounting software. This capability allows seamless data transfer, enhancing your overall workflow when handling Form 8300 and other essential documents.

-

What are the benefits of using airSlate SignNow for Form 8300 compared to traditional methods?

Using airSlate SignNow for Form 8300 streamlines the document process, reducing the time and paper associated with traditional methods. Our digital solution ensures secure storage and easy retrieval of documents, enhancing efficiency and compliance with reporting requirements.

-

Is electronic signing of Form 8300 legally binding?

Yes, electronic signatures on Form 8300 are legally binding under the ESIGN Act and UETA. airSlate SignNow ensures that all eSignatures comply with federal regulations, providing you with peace of mind when electronically signing important documents like Form 8300.

Get more for 11 3 22 Disclosure To Certain Federal Officers And

- Weekly planner template edit fill sign onlinehandypdf form

- Group benefits ampampamp hr archives page 2 of 3 deland form

- Debitshipping authorization form

- What is compressed workweek hr definitions ampamp examples form

- Depreciation schedule template for straight line and form

- Employee conflict of interest policy template form

- Letter of transmittal form smartdraw

- Cover page nmpsfaorg form

Find out other 11 3 22 Disclosure To Certain Federal Officers And

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document