8300 Form 2004

What is the 8300 Form

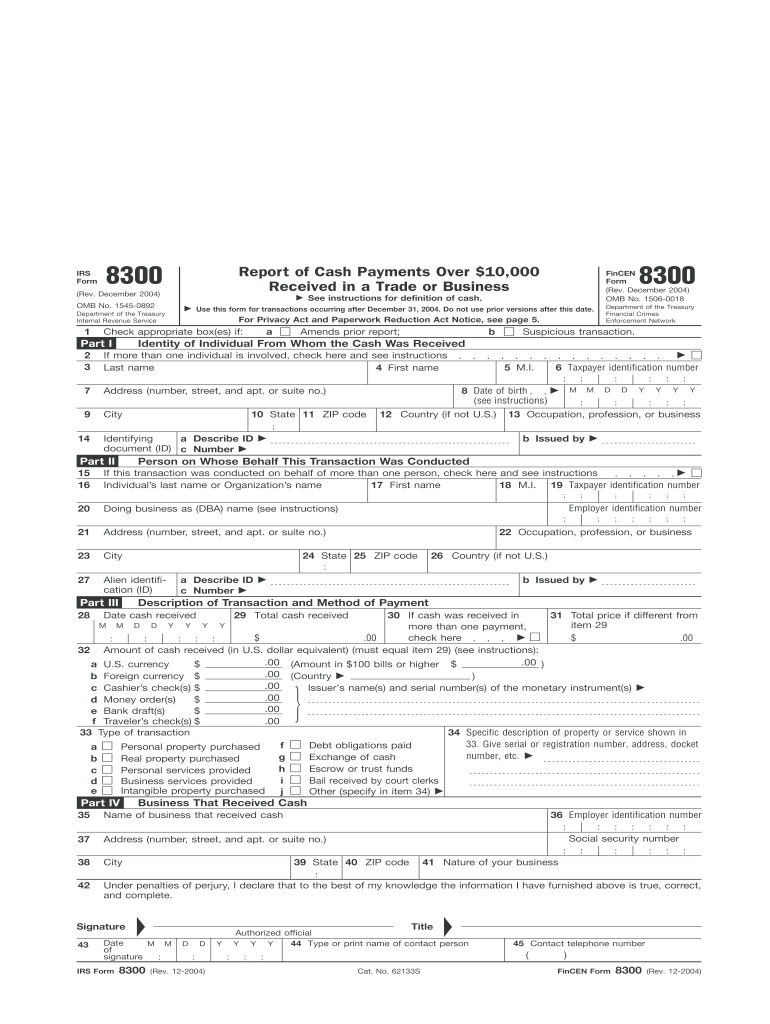

The 8300 Form is a report that businesses in the United States must file with the Internal Revenue Service (IRS) when they receive cash payments exceeding $10,000 in a single transaction or related transactions. This form is crucial for preventing money laundering and ensuring compliance with federal regulations. By documenting large cash transactions, the IRS can monitor suspicious activities and enforce tax laws effectively.

How to use the 8300 Form

To use the 8300 Form, businesses need to gather relevant information about the transaction, including the name and address of the payer, the amount received, and the date of the transaction. Once the information is collected, it can be entered into the form. The completed form must be submitted to the IRS within 15 days of receiving the cash payment. It is also advisable to keep a copy of the form for your records.

Steps to complete the 8300 Form

Completing the 8300 Form involves several key steps:

- Gather necessary information about the transaction, including payer details and transaction amount.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the IRS within the specified timeframe.

Legal use of the 8300 Form

The legal use of the 8300 Form is essential for compliance with the Bank Secrecy Act and other federal regulations. Businesses must file this form to report cash transactions that meet the reporting threshold. Failure to file can result in significant penalties, including fines and legal repercussions. It is important for businesses to understand their obligations under the law to avoid non-compliance.

Filing Deadlines / Important Dates

Businesses must file the 8300 Form within 15 days of receiving cash payments that exceed $10,000. It is important to keep track of these deadlines to ensure timely compliance. Missing the deadline can lead to penalties, so businesses should establish a system for monitoring cash transactions and filing the form promptly.

Penalties for Non-Compliance

Non-compliance with the 8300 Form filing requirements can result in severe penalties. The IRS may impose fines for failing to file the form or for filing it late. Additionally, businesses may face criminal charges if they knowingly fail to report cash transactions. Understanding these penalties can motivate businesses to adhere to the reporting requirements and maintain compliance.

Quick guide on how to complete 8300 form 2004

Effortlessly Prepare 8300 Form on Any Device

The management of online documents has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly and without delays. Manage 8300 Form on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

Effortlessly Edit and eSign 8300 Form

- Find 8300 Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal authority as a conventional ink signature.

- Review all the details and then click the Done button to save your changes.

- Select your preferred method to send your form—via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searches, or errors that require printing new copies. airSlate SignNow meets all your document management requirements with just a few clicks from any device you choose. Edit and eSign 8300 Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 8300 form 2004

Create this form in 5 minutes!

How to create an eSignature for the 8300 form 2004

The best way to create an eSignature for your PDF file online

The best way to create an eSignature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The way to make an eSignature right from your mobile device

The way to generate an electronic signature for a PDF file on iOS

The way to make an eSignature for a PDF on Android devices

People also ask

-

What is the 8300 Form and why is it important?

The 8300 Form is a document required by the IRS for reporting cash transactions over $10,000. It is important for businesses to comply with this requirement to avoid penalties and ensure proper tax reporting. Using airSlate SignNow, you can easily eSign and send the 8300 Form, ensuring a smooth filing process.

-

How does airSlate SignNow facilitate the signing of the 8300 Form?

airSlate SignNow streamlines the signing process of the 8300 Form with its user-friendly interface. You can create templates for the 8300 Form, allowing you to send it to clients for easy electronic signatures, making compliance faster and more efficient.

-

What features does airSlate SignNow offer for the 8300 Form?

airSlate SignNow provides features such as eSigning, document storage, and tracking for the 8300 Form. You can also customize workflows, making it easy to manage your document processes and ensure timely filing with the IRS.

-

Is there a cost associated with using airSlate SignNow to handle the 8300 Form?

Yes, airSlate SignNow offers various pricing plans that are designed to fit different business needs. The cost-effective solutions enable you to handle the 8300 Form without breaking your budget while benefiting from its robust features.

-

Can I integrate airSlate SignNow with other software for managing the 8300 Form?

Absolutely! airSlate SignNow integrates with popular applications such as CRM systems and accounting software. This allows you to manage the 8300 Form efficiently alongside your existing tools, maintaining a seamless workflow.

-

How secure is airSlate SignNow when handling sensitive 8300 Form information?

Security is a top priority at airSlate SignNow. The platform uses advanced encryption methods to protect your 8300 Form and other sensitive documents, ensuring that your data remains confidential and secure at all times.

-

What benefits does using airSlate SignNow provide for businesses filing the 8300 Form?

Using airSlate SignNow for the 8300 Form offers several benefits, including faster processing times and improved accuracy. The electronic signing feature helps in reducing paperwork errors and enhances compliance, allowing you to focus on your core business tasks.

Get more for 8300 Form

- Lease subordination agreement illinois form

- Apartment rules and regulations illinois form

- Agreed cancellation of lease illinois form

- Amendment of residential lease illinois form

- Illinois unpaid form

- Commercial lease assignment from tenant to new tenant illinois form

- Tenant consent to background and reference check illinois form

- Book a house for a month in illinois form

Find out other 8300 Form

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast

- Can I Sign Virginia Business Letter Template

- Can I Sign Ohio Startup Costs Budget Worksheet

- How Do I Sign Maryland 12 Month Sales Forecast

- How Do I Sign Maine Profit and Loss Statement

- How To Sign Wisconsin Operational Budget Template

- Sign North Carolina Profit and Loss Statement Computer