8300 Form 2012

What is the 8300 Form

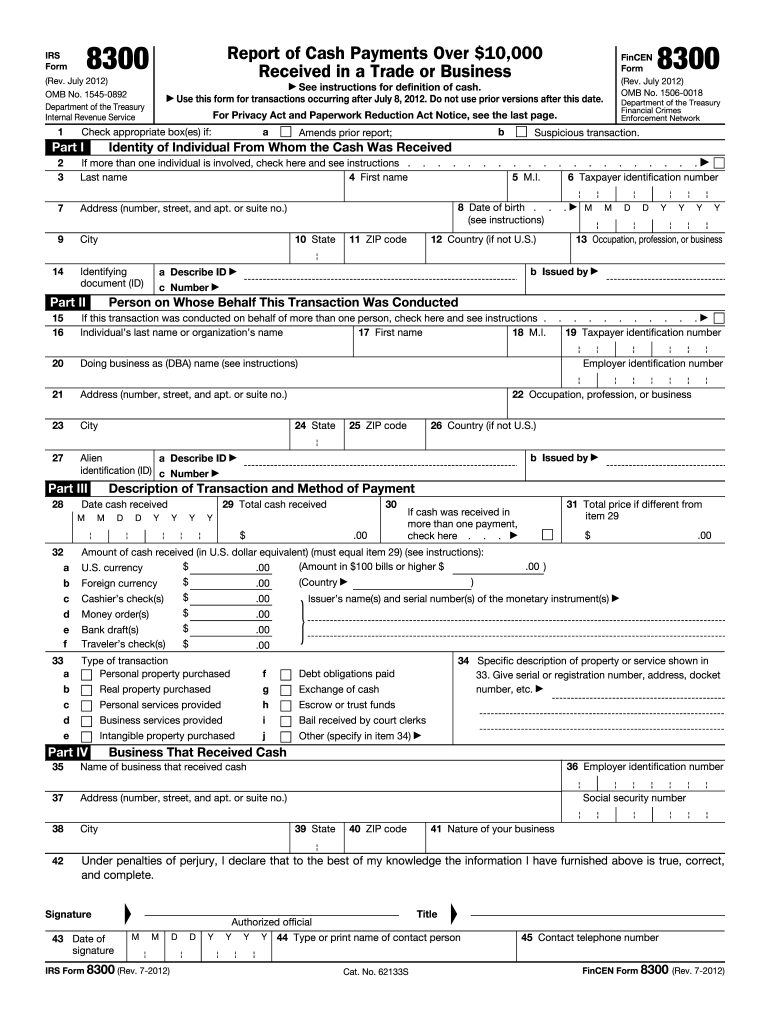

The 8300 Form, officially known as the Report of Cash Payments Over Ten Thousand Dollars Received in a Trade or Business, is a document used by businesses in the United States to report cash transactions exceeding ten thousand dollars. This form is essential for compliance with the Bank Secrecy Act, which aims to prevent money laundering and other financial crimes. Businesses must file this form with the Internal Revenue Service (IRS) when they receive large cash payments from a single buyer or a series of related transactions within a single business day.

How to use the 8300 Form

Using the 8300 Form involves several steps to ensure accurate reporting of cash transactions. First, businesses should gather all relevant information about the transaction, including the buyer's name, address, and taxpayer identification number. Next, fill out the form with details such as the amount received, the date of the transaction, and the nature of the business. Once completed, the form must be submitted to the IRS within 15 days of receiving the cash payment. Additionally, a copy of the form should be provided to the buyer within the same timeframe to inform them of the report.

Steps to complete the 8300 Form

Completing the 8300 Form requires careful attention to detail. Follow these steps:

- Gather necessary information about the transaction and the buyer.

- Obtain the 8300 Form from the IRS website or through your tax software.

- Fill in the business name, address, and Employer Identification Number (EIN).

- Provide details of the cash transaction, including the amount and date.

- Include the buyer's information, such as name, address, and identification number.

- Review the form for accuracy before submission.

- Submit the completed form to the IRS and provide a copy to the buyer.

Legal use of the 8300 Form

The legal use of the 8300 Form is crucial for businesses to comply with federal regulations. Filing this form is not only a legal obligation but also a protective measure against potential penalties for non-compliance. The IRS requires businesses to report cash transactions exceeding ten thousand dollars to help monitor large cash flows and prevent illegal activities. Failure to file the form can result in significant fines and legal repercussions, making it essential for businesses to understand their obligations regarding cash transactions.

Filing Deadlines / Important Dates

Timeliness is critical when filing the 8300 Form. Businesses must submit the form to the IRS within 15 days of receiving cash payments that exceed ten thousand dollars. Additionally, a copy of the form must be provided to the buyer within the same timeframe. It is important for businesses to maintain a calendar of these deadlines to ensure compliance and avoid penalties. Keeping accurate records of cash transactions will aid in timely and correct filings.

Penalties for Non-Compliance

Non-compliance with the filing requirements of the 8300 Form can lead to severe penalties. If a business fails to file the form on time or provides incorrect information, it may face fines of up to twenty-five thousand dollars for each violation. Repeat offenders could incur even higher penalties. Understanding these consequences emphasizes the importance of accurate and timely reporting of cash transactions to the IRS.

Quick guide on how to complete 8300 2012 form

Easily prepare 8300 Form on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, edit, and electronically sign your documents promptly without delays. Manage 8300 Form on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest way to edit and electronically sign 8300 Form effortlessly

- Find 8300 Form and click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and electronically sign 8300 Form and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 8300 2012 form

Create this form in 5 minutes!

How to create an eSignature for the 8300 2012 form

How to generate an electronic signature for a PDF file in the online mode

How to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your smartphone

How to make an eSignature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF on Android

People also ask

-

What is the 8300 Form and who needs to file it?

The 8300 Form is a tax form used in the United States to report cash payments exceeding $10,000 received in a trade or business. Businesses that receive large cash payments, such as those in the real estate or automotive industries, must file the 8300 Form to comply with IRS regulations and avoid potential penalties.

-

How can airSlate SignNow help with the 8300 Form?

airSlate SignNow simplifies the process of preparing and submitting the 8300 Form by allowing users to create, edit, and electronically sign documents securely. Our platform ensures that your 8300 Form is filled out correctly and can be submitted quickly, saving you time and reducing the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the 8300 Form?

Yes, airSlate SignNow offers various pricing plans to suit different business needs, including features for managing documents like the 8300 Form. You can choose a plan that fits your budget while benefiting from our easy-to-use interface and excellent customer support.

-

What features does airSlate SignNow offer for managing the 8300 Form?

airSlate SignNow provides a range of features for managing the 8300 Form, including customizable templates, multi-party signing, and secure document storage. These features ensure that your form is properly formatted and accessible whenever you need it.

-

Can I integrate airSlate SignNow with other systems for the 8300 Form?

Yes, airSlate SignNow offers seamless integrations with popular business applications, allowing you to streamline your workflow when handling the 8300 Form. Whether you use CRM systems or financial software, our platform can integrate smoothly to enhance your document management process.

-

What are the benefits of using airSlate SignNow for the 8300 Form?

Using airSlate SignNow for the 8300 Form offers several benefits, including increased efficiency, enhanced security, and reduced paperwork. Our digital solution enables businesses to manage compliance effortlessly while minimizing the risk of losing important documents.

-

How secure is airSlate SignNow when handling the 8300 Form?

airSlate SignNow prioritizes security with advanced encryption protocols and compliance with industry standards, ensuring your 8300 Form and other documents are protected. Our platform undergoes regular security audits to maintain the integrity and confidentiality of your sensitive information.

Get more for 8300 Form

- Reproductive clinical science msdegree program skills report reproductive clinical science msdegree program skills report form

- Specified disease benefits claim form vt 17503vtpdf gr 82393

- Ohio dentist and dental hygienist loan repayment programs form

- Idi pkts 18473vtpdf gr 83067 form

- Printable horse health records form

- 2017 flu drive thru clinic intake form cokittitaswaus

- Print very form

- Cape may county park amp scavenger hunt form

Find out other 8300 Form

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online