MO PTC Print Only2023 PDF Missouri Department of Revenue 2022-2026

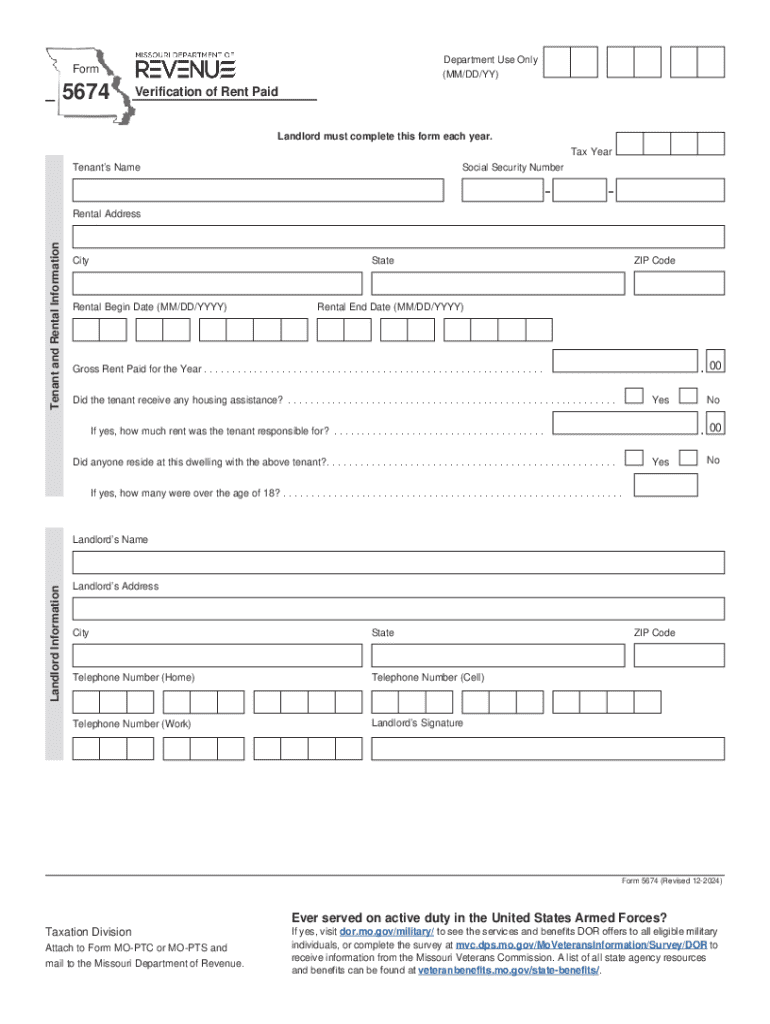

Understanding IRS Form 5674

IRS Form 5674 is a specific document used by taxpayers in Missouri to report certain tax information. This form is essential for individuals and businesses who need to comply with state tax regulations. It is particularly relevant for those who are involved in specific transactions that require disclosure to the Missouri Department of Revenue. Understanding the purpose and requirements of this form is crucial for accurate tax reporting and compliance.

Steps to Complete IRS Form 5674

Completing IRS Form 5674 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents and information required for the form. This may include income statements, expense reports, and any relevant supporting documentation. Next, carefully fill out the form, ensuring that all sections are completed accurately. Double-check your entries for any errors or omissions. Finally, review the completed form to ensure it meets all requirements before submission.

Legal Use of IRS Form 5674

The legal use of IRS Form 5674 is strictly defined by the Missouri Department of Revenue. This form must be used in accordance with state tax laws to report specific financial information. Failure to use the form correctly may result in penalties or legal repercussions. It is important for taxpayers to understand the legal implications of filing this form and to ensure that they are in compliance with all applicable regulations.

Filing Deadlines for IRS Form 5674

Filing deadlines for IRS Form 5674 are critical for maintaining compliance with tax regulations. Taxpayers should be aware of the specific dates by which the form must be submitted to avoid penalties. Generally, the deadline aligns with the annual tax filing date, but it is advisable to check for any updates or changes from the Missouri Department of Revenue. Timely submission is essential to avoid interest charges or additional fees.

Form Submission Methods

IRS Form 5674 can be submitted through various methods, including online, by mail, or in person. Each submission method has its own guidelines and requirements. For online submissions, taxpayers may need to use specific software or platforms approved by the Missouri Department of Revenue. Mail submissions should be sent to the designated address provided in the form instructions. In-person submissions can be made at local tax offices, where assistance may also be available.

Eligibility Criteria for IRS Form 5674

Eligibility criteria for filing IRS Form 5674 depend on the specific circumstances of the taxpayer. Generally, individuals or businesses that engage in certain financial activities or transactions that require reporting to the state must complete this form. It is important to review the eligibility guidelines provided by the Missouri Department of Revenue to determine if this form is necessary for your situation.

Common Scenarios for Using IRS Form 5674

There are various scenarios in which taxpayers may need to use IRS Form 5674. For example, self-employed individuals may need to report specific income or expenses related to their business activities. Similarly, small businesses may use this form to disclose financial information relevant to their operations. Understanding these scenarios can help taxpayers determine when and why they need to complete this form.

Handy tips for filling out MO PTC Print Only2023 pdf Missouri Department Of Revenue online

Quick steps to complete and e-sign MO PTC Print Only2023 pdf Missouri Department Of Revenue online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing documents can be. Get access to a GDPR and HIPAA compliant solution for optimum simpleness. Use signNow to electronically sign and send out MO PTC Print Only2023 pdf Missouri Department Of Revenue for e-signing.

Create this form in 5 minutes or less

Find and fill out the correct mo ptc print only2023 pdf missouri department of revenue

Create this form in 5 minutes!

How to create an eSignature for the mo ptc print only2023 pdf missouri department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 5674 and why is it important?

IRS Form 5674 is a tax form used by businesses to report specific information to the IRS. Understanding this form is crucial for compliance and avoiding penalties. Using airSlate SignNow can streamline the process of completing and submitting IRS Form 5674, ensuring accuracy and efficiency.

-

How can airSlate SignNow help with IRS Form 5674?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending IRS Form 5674. With its intuitive interface, users can quickly fill out the form, gather necessary signatures, and submit it securely. This simplifies the entire process, making it more efficient for businesses.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for small businesses and enterprises. Each plan includes features that facilitate the management of documents like IRS Form 5674. You can choose a plan that best fits your budget and requirements.

-

Are there any integrations available with airSlate SignNow for IRS Form 5674?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your workflow when dealing with IRS Form 5674. You can connect it with popular tools like Google Drive, Dropbox, and CRM systems. This integration allows for easy access to documents and improves overall efficiency.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure cloud storage, which are beneficial for managing IRS Form 5674. These features help ensure that your documents are organized and easily accessible. Additionally, the platform provides tracking capabilities to monitor the status of your forms.

-

Is airSlate SignNow secure for handling IRS Form 5674?

Absolutely, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive documents like IRS Form 5674. The platform employs advanced encryption and authentication measures to protect your data. You can trust that your information is secure while using our services.

-

Can I use airSlate SignNow on mobile devices for IRS Form 5674?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to manage IRS Form 5674 on the go. Whether you are using a smartphone or tablet, you can easily access, sign, and send documents. This flexibility ensures that you can handle your paperwork anytime, anywhere.

Get more for MO PTC Print Only2023 pdf Missouri Department Of Revenue

Find out other MO PTC Print Only2023 pdf Missouri Department Of Revenue

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment