Missouri Form 5674 Instructions 2016

What is the Missouri Form 5674?

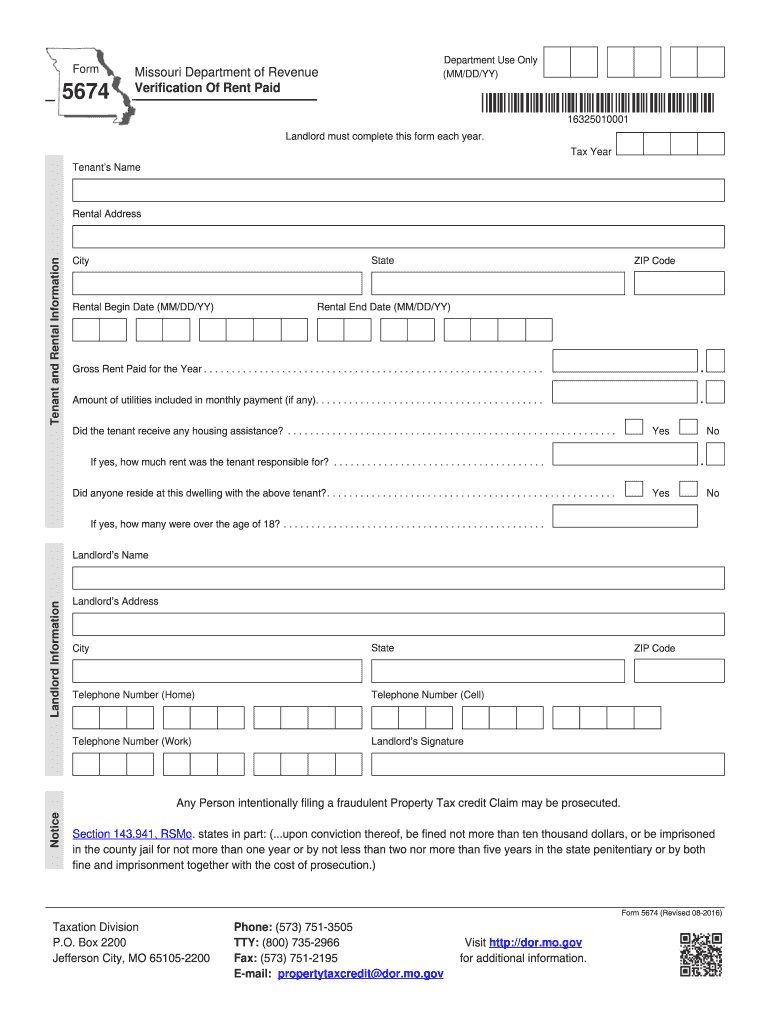

The Missouri Form 5674 is a tax form used to verify rent paid by tenants for the purpose of claiming a rent rebate. This form is essential for residents who wish to apply for a refund of a portion of their rent paid during the tax year. It is particularly relevant for individuals who qualify under the state's guidelines for rent rebates, which are designed to provide financial relief to eligible renters. Understanding the function of this form is crucial for ensuring compliance with state tax regulations and maximizing potential refunds.

Steps to Complete the Missouri Form 5674

Completing the Missouri Form 5674 involves several key steps to ensure accuracy and compliance with state requirements. Begin by gathering necessary documentation, including proof of rent payments, such as receipts or lease agreements. Next, fill out the form by providing personal information, including your name, address, and Social Security number. Be sure to accurately report the total rent paid during the year. After completing the form, review it for any errors before submitting it to the Missouri Department of Revenue. This careful attention to detail helps avoid delays in processing your rebate claim.

Legal Use of the Missouri Form 5674

The Missouri Form 5674 is legally binding when filled out correctly and submitted in accordance with state regulations. It serves as an official declaration of the rent paid, which may be subject to verification by the Missouri Department of Revenue. To ensure the form's legal standing, it is important to provide accurate information and retain copies of all supporting documents. The use of this form is governed by state tax laws, and proper submission can help secure the financial benefits intended for eligible renters.

Filing Deadlines for the Missouri Form 5674

Filing deadlines for the Missouri Form 5674 are crucial for ensuring that you receive your rent rebate in a timely manner. Typically, the form must be submitted by July 1 of the year following the tax year for which you are claiming the rebate. It is advisable to check for any updates or changes to deadlines each tax year, as they may vary. Meeting these deadlines helps prevent complications and ensures that your application is processed without unnecessary delays.

Required Documents for the Missouri Form 5674

When completing the Missouri Form 5674, several documents are required to support your claim for a rent rebate. These typically include:

- Proof of rent payments, such as receipts or bank statements.

- A copy of your lease agreement, if applicable.

- Identification documents, such as your Social Security card or driver's license.

Having these documents readily available will facilitate the completion of the form and help ensure a smooth filing process.

Form Submission Methods for the Missouri Form 5674

The Missouri Form 5674 can be submitted through various methods, providing flexibility for applicants. You can file the form online through the Missouri Department of Revenue's website, which offers a streamlined process for electronic submissions. Alternatively, you may choose to mail the completed form along with any required documentation to the appropriate state office. In-person submissions are also accepted at designated locations. Each method has its own processing times, so consider your preferences and deadlines when choosing how to submit your form.

Quick guide on how to complete missouri form 5674 instructions

Effortlessly Prepare Missouri Form 5674 Instructions on Any Device

Digital document management has gained signNow traction among organizations and individuals. It serves as an ideal eco-friendly replacement for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly without any holdups. Manage Missouri Form 5674 Instructions across any device with airSlate SignNow's Android or iOS applications and simplify any document-focused process today.

The easiest way to alter and electronically sign Missouri Form 5674 Instructions effortlessly

- Locate Missouri Form 5674 Instructions and click Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Generate your electronic signature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the data and click on the Done button to save your changes.

- Choose how to share your form—via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Missouri Form 5674 Instructions to ensure excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct missouri form 5674 instructions

Create this form in 5 minutes!

How to create an eSignature for the missouri form 5674 instructions

The way to create an electronic signature for your PDF file online

The way to create an electronic signature for your PDF file in Google Chrome

How to make an e-signature for signing PDFs in Gmail

The way to make an e-signature straight from your mobile device

The best way to create an electronic signature for a PDF file on iOS

The way to make an e-signature for a PDF document on Android devices

People also ask

-

What is form 5674 Missouri?

Form 5674 Missouri is a state form used to report certain tax-related information to the Missouri Department of Revenue. This form ensures compliance with local regulations and helps businesses in accurately reporting their income. Utilizing airSlate SignNow can simplify the process of eSigning and submitting form 5674 Missouri efficiently.

-

How can airSlate SignNow help with form 5674 Missouri?

airSlate SignNow helps streamline the process of filling out and eSigning form 5674 Missouri. Its user-friendly interface allows for quick document editing, digital signing, and secure storage. By using our platform, businesses can accelerate their workflow while ensuring that form 5674 Missouri is completed accurately.

-

Is there a cost associated with using airSlate SignNow for form 5674 Missouri?

Yes, there is a pricing structure for using airSlate SignNow, tailored to suit different business needs and sizes. Our plans are designed to be affordable and provide excellent value for users who frequently manage forms like form 5674 Missouri. You can choose from various subscription options based on your document management requirements.

-

What features does airSlate SignNow offer for managing form 5674 Missouri?

airSlate SignNow offers features such as easy document editing, eSignature capabilities, and automated workflows for managing form 5674 Missouri. Additionally, our platform provides templates, reminders, and real-time tracking to ensure that your documents are handled promptly and efficiently. This enhances the overall experience of completing important forms.

-

Are there any benefits to using airSlate SignNow for form 5674 Missouri?

Using airSlate SignNow for form 5674 Missouri provides several benefits, including increased efficiency and reduced processing time. Our solution minimizes the paperwork burden and facilitates quick eSigning, allowing businesses to focus more on their core activities. Plus, documents are stored securely, reducing the risk of loss or misfiling.

-

Can I integrate airSlate SignNow with other software when working on form 5674 Missouri?

Yes, airSlate SignNow is built to integrate seamlessly with a variety of software applications, enhancing your workflow when managing form 5674 Missouri. Popular integrations include CRM systems, project management tools, and cloud storage services, enabling teams to collaborate and share documents effortlessly. This flexibility enhances productivity and ease of use.

-

How secure is airSlate SignNow when handling form 5674 Missouri?

security is a priority at airSlate SignNow, particularly when handling sensitive documents like form 5674 Missouri. Our platform incorporates advanced security measures, including encryption, multi-factor authentication, and secure storage. You can trust that your information remains confidential and protected from unauthorized access.

Get more for Missouri Form 5674 Instructions

- New state resident package west virginia form

- Commercial property sales package west virginia form

- General partnership package west virginia form

- Statutory medical power of attorney and living will west virginia form

- Contract for deed package west virginia form

- Revocation of statutory medical power of attorney and living will west virginia form

- Power of attorney forms package west virginia

- Revised anatomical gift act donation west virginia form

Find out other Missouri Form 5674 Instructions

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors