Vehicle Expense Worksheet Form

What is the Vehicle Expense Worksheet

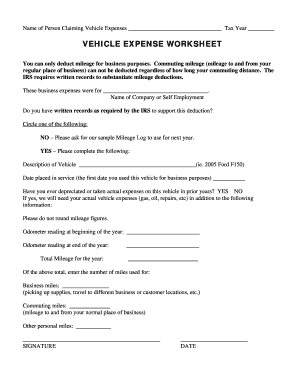

The vehicle expense worksheet is a financial tool designed to help individuals and businesses track and calculate expenses associated with vehicle use. This worksheet typically includes categories for fuel, maintenance, repairs, insurance, and depreciation. It is particularly useful for self-employed individuals and business owners who need to document vehicle-related expenses for tax purposes. By maintaining accurate records, users can maximize deductions and ensure compliance with IRS regulations.

How to use the Vehicle Expense Worksheet

Using the vehicle expense worksheet involves several straightforward steps. First, gather all relevant receipts and documentation related to vehicle expenses, including fuel purchases, maintenance records, and insurance statements. Next, fill in the worksheet by categorizing each expense under the appropriate section. Be sure to include the date of each transaction, the amount spent, and a brief description. Regularly updating the worksheet throughout the year can simplify the tax filing process and provide a clear overview of vehicle-related costs.

Steps to complete the Vehicle Expense Worksheet

Completing the vehicle expense worksheet requires a systematic approach. Start by listing all vehicle-related expenses incurred during the tax year. This includes:

- Fuel costs

- Maintenance and repair expenses

- Insurance premiums

- Registration fees

- Depreciation of the vehicle

Next, calculate the total for each category and enter these totals in the designated areas of the worksheet. Ensure that all figures are accurate and supported by receipts. Finally, review the worksheet for completeness and accuracy before submitting it with your tax return.

Key elements of the Vehicle Expense Worksheet

Several key elements are essential for a comprehensive vehicle expense worksheet. These include:

- Date: The date of each expense incurred.

- Description: A brief description of the expense.

- Amount: The total cost associated with the expense.

- Category: Classification of the expense (e.g., fuel, maintenance).

- Mileage: If applicable, the number of miles driven for business purposes.

These elements help ensure that all necessary information is captured for accurate reporting and tax deduction purposes.

IRS Guidelines

The IRS provides specific guidelines regarding vehicle expenses and deductions. It is important to understand the difference between the standard mileage rate and actual expense methods for calculating deductions. The IRS updates these rates annually, so staying informed is crucial. Additionally, the IRS requires adequate documentation to support any claims made on tax returns. This includes maintaining a log of business miles driven and retaining receipts for all expenses. Familiarizing yourself with these guidelines can help ensure compliance and optimize potential deductions.

Filing Deadlines / Important Dates

Filing deadlines for tax returns can vary based on individual circumstances, but generally, the deadline for submitting personal income tax returns is April 15. For businesses, deadlines may differ depending on the entity type. It is essential to keep track of these dates to avoid penalties and ensure timely submission of the vehicle expense worksheet along with your tax return. Additionally, taxpayers should be aware of any extensions that may apply, as these can impact filing timelines.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vehicle expense worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a vehicle expense worksheet?

A vehicle expense worksheet is a tool designed to help individuals and businesses track their vehicle-related expenses. It allows users to categorize costs such as fuel, maintenance, and insurance, making it easier to manage budgets and prepare for tax deductions.

-

How can airSlate SignNow help with my vehicle expense worksheet?

airSlate SignNow provides a seamless way to create, send, and eSign your vehicle expense worksheet. With our user-friendly platform, you can easily customize your worksheet, ensuring all necessary details are included for accurate tracking and reporting.

-

Is there a cost associated with using the vehicle expense worksheet feature?

While airSlate SignNow offers various pricing plans, the vehicle expense worksheet feature is included in our subscription options. We provide a cost-effective solution that allows you to manage your vehicle expenses without breaking the bank.

-

What features are included in the vehicle expense worksheet?

The vehicle expense worksheet includes features such as customizable fields, automatic calculations, and the ability to attach receipts. These features streamline the expense tracking process, making it easier to maintain accurate records.

-

Can I integrate the vehicle expense worksheet with other tools?

Yes, airSlate SignNow allows for integrations with various accounting and financial software. This means you can easily sync your vehicle expense worksheet data with your existing tools, enhancing your overall expense management process.

-

What are the benefits of using a vehicle expense worksheet?

Using a vehicle expense worksheet helps you gain better visibility into your spending habits related to vehicle use. It simplifies the process of tracking expenses, which can lead to signNow savings during tax season and improved financial planning.

-

Is the vehicle expense worksheet suitable for both personal and business use?

Absolutely! The vehicle expense worksheet is versatile and can be used for both personal and business vehicle expenses. Whether you're an individual tracking personal costs or a business managing fleet expenses, this tool is designed to meet your needs.

Get more for Vehicle Expense Worksheet

- Ethiopian insurance corporation pdf form

- Direct deposit agreement form smokey bones jobs

- American retirement forms

- Spartan waiver form

- Removal of agent harris county appraisal district hcad form

- Are you an innocent spouse required attachments information

- Wellsense fitness reimbursement form

- Restricted stock award agreement template form

Find out other Vehicle Expense Worksheet

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF