Mortgage Discharge Forms 2023

Understanding Mortgage Discharge Forms

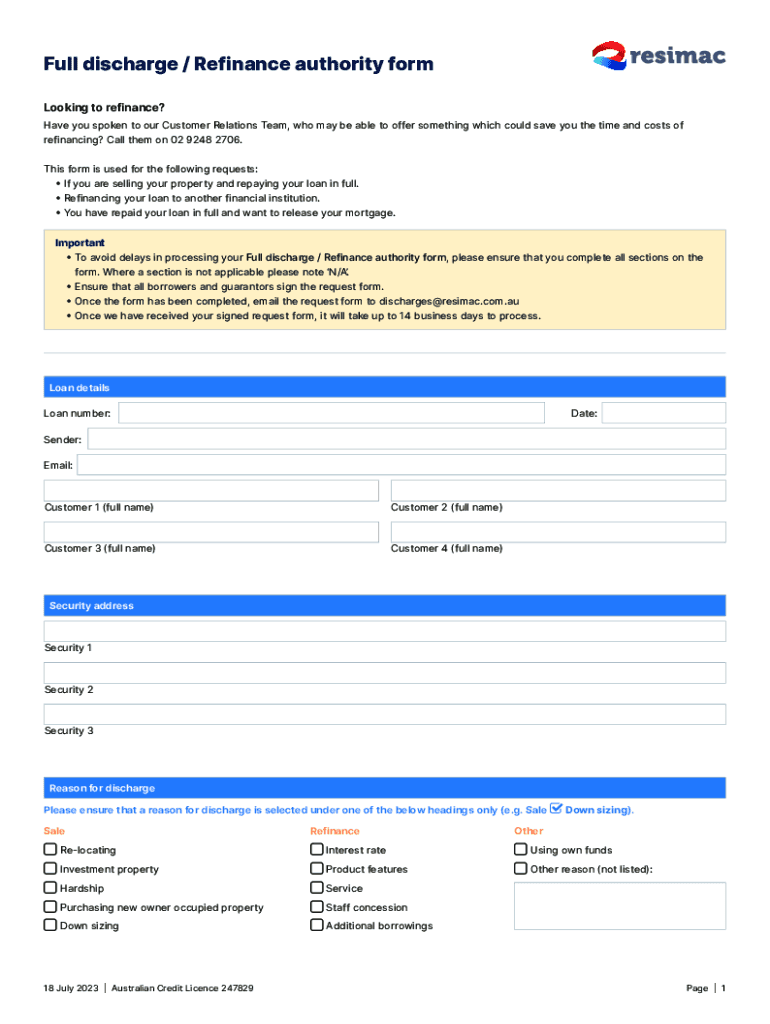

Mortgage discharge forms are essential legal documents that signify the release of a borrower from their mortgage obligations once the loan has been paid in full. These forms are typically issued by the lender and serve to confirm that the mortgage lien on the property has been removed. This process is crucial for homeowners, as it ensures that they have clear title to their property without any encumbrances from the mortgage. Understanding the purpose and importance of these forms is vital for anyone who has recently paid off their mortgage.

Steps to Complete Mortgage Discharge Forms

Completing mortgage discharge forms involves several important steps to ensure accuracy and compliance with legal requirements. First, gather all necessary information, including the original mortgage documents, property details, and personal identification. Next, fill out the form with accurate data, ensuring that all required fields are completed. After completing the form, review it for any errors or omissions. Finally, submit the form to your lender for processing. It is advisable to keep a copy of the submitted form for your records.

Obtaining Mortgage Discharge Forms

To obtain mortgage discharge forms, homeowners can typically request them directly from their mortgage lender. Many lenders provide these forms online through their customer service portals, making it convenient for borrowers to access them. If the lender does not offer online access, homeowners may need to contact their customer service department or visit a local branch to request the form. Additionally, some state or local government websites may provide standardized discharge forms that can be used.

Legal Use of Mortgage Discharge Forms

The legal use of mortgage discharge forms is crucial for ensuring that the borrower’s rights are protected. Once the form is completed and submitted, it must be recorded with the appropriate local government office, typically the county recorder or clerk’s office. This recording process serves to officially document the discharge of the mortgage lien, which is essential for establishing clear ownership of the property. Failure to properly file the discharge can lead to complications in future property transactions.

Key Elements of Mortgage Discharge Forms

Mortgage discharge forms contain several key elements that are necessary for their validity. These elements typically include the names of the borrower and lender, the original mortgage details, property description, and a statement confirming that the mortgage has been fully paid. Additionally, the form may require signatures from both the borrower and an authorized representative of the lender. Ensuring that all these elements are present and accurate is essential for the form to be legally effective.

State-Specific Rules for Mortgage Discharge Forms

Each state in the U.S. may have specific rules and regulations governing mortgage discharge forms. These rules can vary significantly, affecting how the forms are completed and submitted. For example, some states may require additional documentation or specific language to be included in the discharge form. It is important for homeowners to familiarize themselves with their state’s requirements to ensure compliance and avoid potential legal issues.

Examples of Using Mortgage Discharge Forms

Mortgage discharge forms are commonly used in various scenarios, such as when a homeowner pays off their mortgage loan or refinances their property. For instance, if a homeowner sells their property after paying off the mortgage, they will need to present the discharge form to prove that the mortgage lien has been removed. Additionally, if a borrower refinances their mortgage, the new lender may require a discharge form from the previous lender to ensure that there are no outstanding liens on the property.

Create this form in 5 minutes or less

Find and fill out the correct mortgage discharge forms

Create this form in 5 minutes!

How to create an eSignature for the mortgage discharge forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Mortgage Discharge Forms?

Mortgage Discharge Forms are legal documents that release a borrower from their mortgage obligations once the loan is paid off. These forms are essential for homeowners to clear their title and ensure that the mortgage lender no longer has a claim on the property. Understanding how to properly complete and submit these forms is crucial for a smooth transition.

-

How can airSlate SignNow help with Mortgage Discharge Forms?

airSlate SignNow provides an easy-to-use platform for creating, sending, and eSigning Mortgage Discharge Forms. Our solution streamlines the process, allowing users to complete necessary paperwork quickly and efficiently. With our digital tools, you can ensure that your forms are filled out correctly and submitted on time.

-

Are there any costs associated with using airSlate SignNow for Mortgage Discharge Forms?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our plans are designed to be cost-effective, ensuring that you can manage your Mortgage Discharge Forms without breaking the bank. You can choose a plan that fits your budget while still accessing all the necessary features.

-

What features does airSlate SignNow offer for managing Mortgage Discharge Forms?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking specifically for Mortgage Discharge Forms. These tools help you manage your documents efficiently and ensure compliance with legal requirements. Additionally, our platform allows for easy collaboration with all parties involved.

-

Can I integrate airSlate SignNow with other software for Mortgage Discharge Forms?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easier to manage your Mortgage Discharge Forms alongside your existing tools. Whether you use CRM systems, cloud storage, or other document management solutions, our platform can seamlessly connect to enhance your workflow.

-

What are the benefits of using airSlate SignNow for Mortgage Discharge Forms?

Using airSlate SignNow for Mortgage Discharge Forms provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to complete and sign documents from anywhere, saving you time and effort. Additionally, the digital nature of our service helps minimize the risk of errors and delays.

-

Is it easy to eSign Mortgage Discharge Forms with airSlate SignNow?

Yes, eSigning Mortgage Discharge Forms with airSlate SignNow is incredibly straightforward. Users can sign documents electronically in just a few clicks, eliminating the need for printing and scanning. This convenience not only speeds up the process but also ensures that your forms are securely stored and easily accessible.

Get more for Mortgage Discharge Forms

- State of utah department of workforce services authorization form

- Uiw community service form

- Iowa high school wrestling skin form

- Jenkins restorations subcontractor packet form

- Body disposition authorization affidavit form

- Chdp annual school report form

- Adult discharge instructions ambulatory surgery center of form

- Restaurant manager employment contract template form

Find out other Mortgage Discharge Forms

- How Do I Install Electronic signature in Jitterbit

- How Can I Install Electronic signature in Jitterbit

- Help Me With Install Electronic signature in 1Password

- Can I Install Electronic signature in 1Password

- How To Use Electronic signature in ServiceNow

- Can I Use Electronic signature in ServiceNow

- Help Me With Use Electronic signature in NetSuite

- How Can I Install Electronic signature in eSignPay

- How To Install Electronic signature in Android

- How Do I Implement eSignature in 1Password

- Help Me With Add Electronic signature in CMS

- How Can I Add Electronic signature in CMS

- How Do I Add Electronic signature in SalesForce

- Can I Add Electronic signature in CMS

- How To Add Electronic signature in SalesForce

- How To Use Electronic signature in Oracle

- How Do I Use Electronic signature in Oracle

- Help Me With Use Electronic signature in Oracle

- How Can I Use Electronic signature in Oracle

- Can I Use Electronic signature in Oracle