IRA Distribution D2 Secure05principalcom Form

What is the IRA Distribution D2 Secure05principalcom

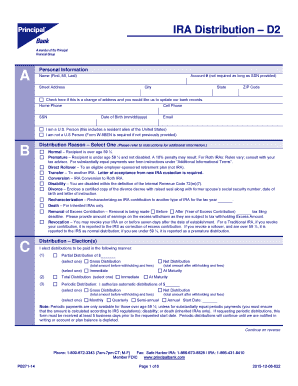

The IRA Distribution D2 Secure05principalcom is a specific form used for processing distributions from Individual Retirement Accounts (IRAs). This form is essential for individuals who wish to withdraw funds from their retirement accounts, ensuring compliance with IRS regulations. It captures necessary details about the distribution, including the amount, the reason for the withdrawal, and the recipient's information. Understanding this form is crucial for maintaining the tax-deferred status of the IRA and avoiding potential penalties.

Steps to complete the IRA Distribution D2 Secure05principalcom

Completing the IRA Distribution D2 Secure05principalcom involves several key steps:

- Gather necessary information: Collect personal details, including your Social Security number, account number, and the amount you wish to withdraw.

- Choose the type of distribution: Indicate whether the distribution is for retirement, hardship, or another qualified reason.

- Fill out the form: Carefully enter the required information in each section of the form to ensure accuracy.

- Review for errors: Double-check all entries to avoid mistakes that could delay processing or incur penalties.

- Submit the form: Send the completed form to the appropriate financial institution or custodian managing your IRA.

Legal use of the IRA Distribution D2 Secure05principalcom

The IRA Distribution D2 Secure05principalcom must be used in accordance with IRS guidelines to ensure legal compliance. This form allows for the proper documentation of distributions, which is necessary for tax reporting purposes. Failure to use the form correctly can result in penalties, including taxes on early withdrawals if the individual is under the age of fifty-nine and a half. It is important to understand the legal implications of the distribution type selected and to keep records of the submission for future reference.

Required Documents

When completing the IRA Distribution D2 Secure05principalcom, certain documents are typically required to support the withdrawal request. These may include:

- Identification: A government-issued ID, such as a driver's license or passport.

- Proof of IRA ownership: Documentation that verifies your ownership of the IRA account.

- Withdrawal justification: Any documents that may be necessary to justify the reason for the distribution, such as medical bills for hardship withdrawals.

IRS Guidelines

The IRS has specific guidelines regarding IRA distributions that must be followed to avoid penalties. Key points include:

- Distributions may be subject to income tax, depending on the type of IRA and the age of the account holder.

- Withdrawals before the age of fifty-nine and a half may incur an additional ten percent penalty unless exceptions apply.

- Proper documentation must be maintained to substantiate the distribution for tax reporting purposes.

Eligibility Criteria

To use the IRA Distribution D2 Secure05principalcom, individuals must meet certain eligibility criteria. These criteria typically include:

- Being the account holder of the IRA from which funds are being withdrawn.

- Meeting age requirements or qualifying for exceptions to early withdrawal penalties.

- Providing valid reasons for the distribution, such as retirement, disability, or financial hardship.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ira distribution d2 secure05principalcom

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRA Distribution D2 Secure05principalcom?

IRA Distribution D2 Secure05principalcom is a specialized service designed to facilitate secure electronic signatures and document management for IRA distributions. This solution ensures compliance with regulatory requirements while providing a user-friendly experience for both businesses and clients.

-

How does airSlate SignNow support IRA Distribution D2 Secure05principalcom?

airSlate SignNow offers a seamless integration with IRA Distribution D2 Secure05principalcom, allowing users to easily send, sign, and manage documents related to IRA distributions. The platform's intuitive interface simplifies the process, making it accessible for users of all technical backgrounds.

-

What are the pricing options for IRA Distribution D2 Secure05principalcom?

Pricing for IRA Distribution D2 Secure05principalcom varies based on the features and volume of documents processed. airSlate SignNow provides flexible pricing plans that cater to different business needs, ensuring that you only pay for what you use while benefiting from a cost-effective solution.

-

What features does IRA Distribution D2 Secure05principalcom offer?

IRA Distribution D2 Secure05principalcom includes features such as customizable templates, automated workflows, and secure cloud storage. These features enhance efficiency and security, making it easier for businesses to manage their IRA distribution processes.

-

What are the benefits of using IRA Distribution D2 Secure05principalcom?

Using IRA Distribution D2 Secure05principalcom streamlines the document signing process, reduces turnaround times, and enhances security. Businesses can improve customer satisfaction by providing a fast and reliable way to handle IRA distributions electronically.

-

Can IRA Distribution D2 Secure05principalcom integrate with other software?

Yes, IRA Distribution D2 Secure05principalcom can integrate with various third-party applications, enhancing its functionality. This allows businesses to connect their existing systems with airSlate SignNow for a more cohesive workflow.

-

Is IRA Distribution D2 Secure05principalcom compliant with regulations?

Absolutely, IRA Distribution D2 Secure05principalcom is designed to comply with all relevant regulations governing electronic signatures and document management. This ensures that your IRA distribution processes meet legal standards and protect your business from potential liabilities.

Get more for IRA Distribution D2 Secure05principalcom

- South carolina warranty form

- Quitclaim deed from two individualshusband and wife to individual south carolina form

- South carolina form sc

- South carolina owner form

- Quitclaim deed by two individuals to llc south carolina form

- Warranty deed from two individuals to llc south carolina form

- Notice to owner by corporation or llc south carolina form

- South carolina notice form

Find out other IRA Distribution D2 Secure05principalcom

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement