1140 Tax Form 2024

What is the 1140 Tax Form

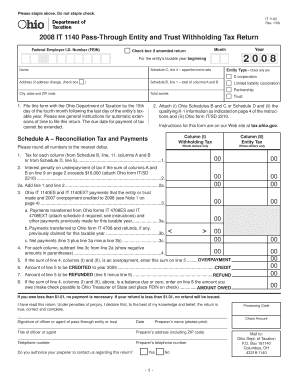

The 1140 Tax Form is a tax document used by certain business entities in the United States to report income, deductions, and tax liability to the Internal Revenue Service (IRS). This form is specifically designed for corporations that elect to be taxed as S corporations. It allows these businesses to pass income, losses, deductions, and credits directly to their shareholders, avoiding double taxation at the corporate level.

How to obtain the 1140 Tax Form

To obtain the 1140 Tax Form, individuals and businesses can visit the official IRS website, where the form is available for download in PDF format. Alternatively, the form can be requested by contacting the IRS directly. It is important to ensure that you are using the most current version of the form, as tax regulations may change annually.

Steps to complete the 1140 Tax Form

Completing the 1140 Tax Form involves several key steps:

- Gather necessary financial documents, including income statements and expense reports.

- Fill out the form with accurate information regarding the business's income, deductions, and credits.

- Ensure all calculations are correct to avoid errors that could lead to penalties.

- Review the completed form for completeness and accuracy before submission.

Filing Deadlines / Important Dates

The deadline for filing the 1140 Tax Form typically falls on the fifteenth day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by March 15. If additional time is needed, businesses may file for an extension, which can provide an additional six months to submit the form.

Key elements of the 1140 Tax Form

The 1140 Tax Form includes several key elements that must be accurately completed:

- Identification information for the corporation, including name, address, and Employer Identification Number (EIN).

- Income section detailing all sources of revenue.

- Deductions section, which outlines allowable expenses that can reduce taxable income.

- Tax computation section, where the tax liability is calculated based on the reported income and deductions.

Penalties for Non-Compliance

Failure to file the 1140 Tax Form by the deadline can result in significant penalties. The IRS imposes a failure-to-file penalty, which is calculated based on the number of months the form is late. Additionally, inaccuracies on the form can lead to audits and further penalties. It is crucial for businesses to comply with all filing requirements to avoid these consequences.

Create this form in 5 minutes or less

Find and fill out the correct 1140 tax form

Create this form in 5 minutes!

How to create an eSignature for the 1140 tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1140 Tax Form and who needs to file it?

The 1140 Tax Form is a tax document used by certain businesses to report their income and calculate their tax liability. Typically, corporations and partnerships that meet specific criteria must file this form. Understanding the requirements for the 1140 Tax Form is essential for compliance and avoiding penalties.

-

How can airSlate SignNow help with the 1140 Tax Form?

airSlate SignNow simplifies the process of preparing and signing the 1140 Tax Form by providing an intuitive platform for document management. Users can easily upload, edit, and eSign their tax forms, ensuring accuracy and compliance. This streamlines the filing process, saving time and reducing stress.

-

What are the pricing options for using airSlate SignNow for the 1140 Tax Form?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Whether you need basic features or advanced functionalities for managing the 1140 Tax Form, there is a plan that fits your budget. You can choose from monthly or annual subscriptions, making it a cost-effective solution.

-

Are there any integrations available for the 1140 Tax Form with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage the 1140 Tax Form. These integrations allow for automatic data transfer, reducing the risk of errors and saving time. You can connect with popular platforms to enhance your workflow.

-

What features does airSlate SignNow offer for managing the 1140 Tax Form?

airSlate SignNow provides features such as document templates, eSignature capabilities, and secure cloud storage specifically designed for the 1140 Tax Form. These tools help ensure that your forms are completed accurately and stored safely. Additionally, you can track the status of your documents in real-time.

-

How secure is airSlate SignNow when handling the 1140 Tax Form?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive documents like the 1140 Tax Form. The platform employs advanced encryption and compliance measures to protect your data. You can trust that your information is safe and secure while using our services.

-

Can I access my 1140 Tax Form documents from anywhere?

Absolutely! With airSlate SignNow, you can access your 1140 Tax Form documents from any device with an internet connection. This flexibility allows you to manage your tax forms on the go, ensuring you never miss a deadline. The cloud-based system makes it easy to stay organized and efficient.

Get more for 1140 Tax Form

- Form it 611 claim for brownfield redevelopment tax credit tax year 2022

- Forms collegechoice advisor 529 savings plan

- Form it 398 new york state depreciation schedule for irc

- Military personnel information request individual income

- Form it 251 credit for employment of persons taxnygov

- Instructions for form it 216 claim for child and dependent

- Form it 612 claim for remediated brownfield credit for real property taxes tax year 2021

- Form it 225 new york state modifications tax year 2022

Find out other 1140 Tax Form

- Electronic signature Indiana Sponsorship Agreement Free

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template