Dodd Frank Form 2010-2026

What is the Dodd Frank Form

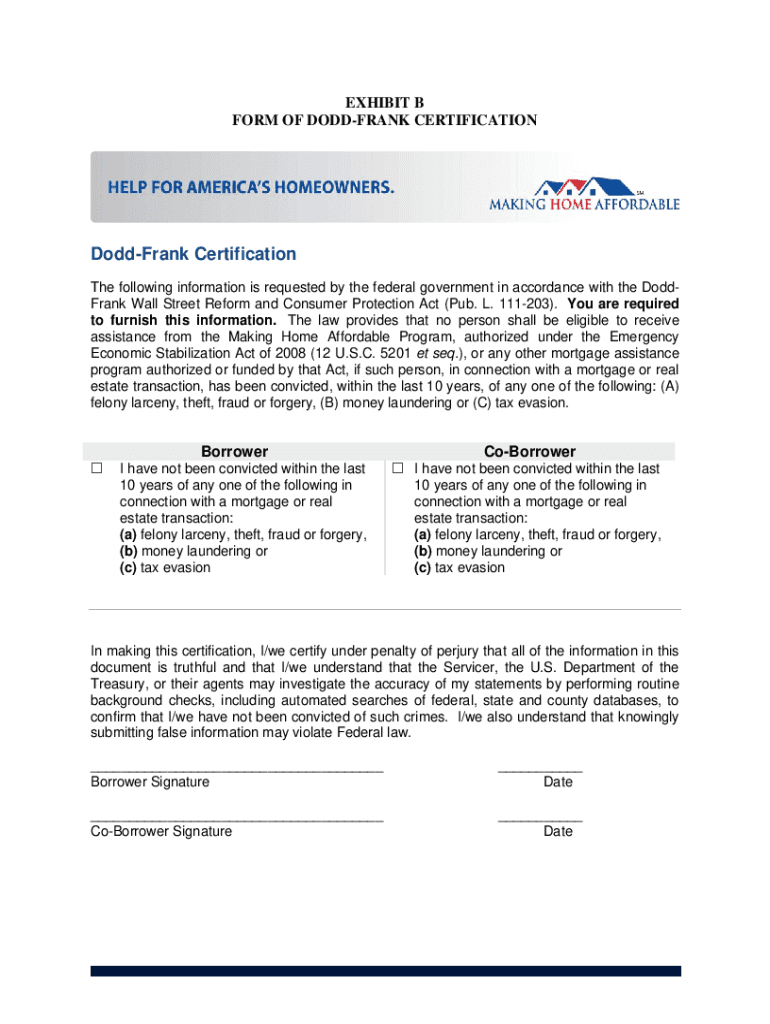

The Dodd Frank certification form is a crucial document designed to ensure compliance with the Dodd-Frank Wall Street Reform and Consumer Protection Act. This form is primarily used by financial institutions and businesses to certify that they adhere to the regulations set forth by the Dodd-Frank Act. It aims to promote transparency and accountability in the financial sector, thereby protecting consumers and investors.

How to use the Dodd Frank Form

Using the Dodd Frank certification form involves several key steps. First, businesses must accurately fill out the required information, which typically includes details about the entity, the nature of its operations, and compliance measures in place. Once completed, the form can be submitted electronically or through traditional mail, depending on the specific requirements of the regulatory body overseeing the submission. It is essential to ensure that all information is accurate and up-to-date to avoid penalties.

Steps to complete the Dodd Frank Form

Completing the Dodd Frank certification form can be streamlined by following these steps:

- Gather necessary information about your business and its operations.

- Access the official Dodd Frank certification form, ensuring you have the latest version.

- Fill out the form carefully, providing all required details.

- Review the completed form for accuracy and completeness.

- Submit the form via the designated method, either online or by mail.

Legal use of the Dodd Frank Form

The legal validity of the Dodd Frank certification form hinges on compliance with several regulations, including the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). These laws ensure that electronic signatures and submissions are legally binding. It is crucial for businesses to understand these legal frameworks to ensure that their submissions are recognized and enforceable.

Key elements of the Dodd Frank Form

Key elements of the Dodd Frank certification form include:

- Business identification details, such as name and address.

- Information regarding the nature of the business and its compliance with Dodd-Frank regulations.

- Signature of an authorized representative, affirming the accuracy of the information provided.

- Date of submission, which is important for compliance tracking.

Form Submission Methods

The Dodd Frank certification form can be submitted through various methods, including:

- Online submission via designated regulatory portals.

- Mailing a hard copy to the appropriate regulatory agency.

- In-person submission at designated offices, if applicable.

Quick guide on how to complete dodd frank certification requirement select mediation llc

Discover how to effortlessly navigate the Dodd Frank Form completion with this simple guide

Submitting and filling out documents digitally is becoming more widespread and is the preferred choice for many users. It provides numerous benefits compared to conventional printed forms, such as convenience, time savings, enhanced accuracy, and security.

With tools like airSlate SignNow, you can find, modify, sign, and enhance your Dodd Frank Form without the hassle of ongoing printing and scanning. Follow this brief guide to begin and finalize your document.

Follow these steps to obtain and complete Dodd Frank Form

- Begin by clicking on the Get Form button to open your form in our editor.

- Pay attention to the green label on the left that indicates required fields so you don’t miss any.

- Utilize our advanced features to annotate, modify, sign, secure, and enhance your form.

- Protect your document or convert it into an interactive form using the appropriate tab features.

- Review the form and verify it for any mistakes or inconsistencies.

- Press DONE to complete the editing process.

- Change the name of your document or leave it as is.

- Choose the storage option you prefer to save your form, send it via USPS, or click the Download Now button to download your file.

If Dodd Frank Form isn’t what you were seeking, you can explore our extensive library of pre-loaded templates that you can fill out with ease. Try our platform today!

Create this form in 5 minutes or less

FAQs

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

Create this form in 5 minutes!

How to create an eSignature for the dodd frank certification requirement select mediation llc

How to create an electronic signature for your Dodd Frank Certification Requirement Select Mediation Llc in the online mode

How to create an eSignature for the Dodd Frank Certification Requirement Select Mediation Llc in Chrome

How to generate an eSignature for putting it on the Dodd Frank Certification Requirement Select Mediation Llc in Gmail

How to generate an eSignature for the Dodd Frank Certification Requirement Select Mediation Llc from your mobile device

How to create an electronic signature for the Dodd Frank Certification Requirement Select Mediation Llc on iOS devices

How to generate an electronic signature for the Dodd Frank Certification Requirement Select Mediation Llc on Android

People also ask

-

What is the Dodd Frank Form and why is it important?

The Dodd Frank Form is a regulatory document required under the Dodd-Frank Wall Street Reform and Consumer Protection Act. It is important because it ensures compliance with financial regulations designed to protect consumers and maintain transparency in financial transactions. Using airSlate SignNow, businesses can easily create, send, and eSign Dodd Frank Forms to streamline their compliance processes.

-

How does airSlate SignNow simplify the Dodd Frank Form process?

airSlate SignNow simplifies the Dodd Frank Form process by providing a user-friendly platform that allows businesses to easily generate and manage their forms. With features like templates and eSignature capabilities, users can quickly fill out and sign Dodd Frank Forms, reducing the time and effort typically required for compliance.

-

Is there a cost associated with using airSlate SignNow for Dodd Frank Forms?

Yes, airSlate SignNow offers various pricing plans suitable for different business needs, including those specifically designed for handling Dodd Frank Forms. The cost is competitive and reflects the robust features and compliance support provided. This makes it a cost-effective solution for businesses to manage their Dodd Frank Form requirements efficiently.

-

Can I integrate airSlate SignNow with other tools for Dodd Frank Form management?

Absolutely! airSlate SignNow provides seamless integrations with popular business tools such as CRM systems and document management platforms. This allows users to incorporate Dodd Frank Form management into their existing workflows, enhancing efficiency and ensuring that all documents are easily accessible and manageable.

-

What features does airSlate SignNow offer for completing Dodd Frank Forms?

airSlate SignNow offers a range of features for completing Dodd Frank Forms, including customizable templates, electronic signature capabilities, and secure document storage. These features help ensure that your forms are not only compliant but also easy to fill out, sign, and track throughout the process.

-

How secure is the airSlate SignNow platform for handling Dodd Frank Forms?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like Dodd Frank Forms. The platform employs advanced encryption methods and complies with industry standards to ensure that all data is protected and secure during transmission and storage.

-

Can I access my Dodd Frank Forms from any device using airSlate SignNow?

Yes, airSlate SignNow is designed to be accessible from any device, whether it’s a desktop, tablet, or smartphone. This flexibility allows users to manage their Dodd Frank Forms on-the-go, ensuring that they can complete and sign documents anytime, anywhere.

Get more for Dodd Frank Form

Find out other Dodd Frank Form

- Help Me With Sign Ohio Banking Document

- How To Sign Oregon Banking PDF

- Help Me With Sign Oregon Banking Presentation

- Can I Sign Pennsylvania Banking Form

- How To Sign Arizona Business Operations PDF

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation