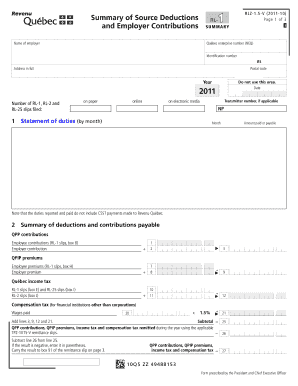

Rl 1 Summary Fillable 2022

What is the Rl 1 Summary Fillable

The Rl 1 Summary Fillable is a tax form used primarily in the United States for reporting income and tax information. This form is essential for individuals and businesses to accurately summarize their earnings and tax obligations for a given tax year. It is particularly relevant for those who need to report various income sources, including wages, dividends, and interest. The fillable format allows users to complete the form digitally, making it easier to manage and submit.

How to use the Rl 1 Summary Fillable

Using the Rl 1 Summary Fillable involves several straightforward steps. First, ensure you have all necessary documentation, such as W-2s or 1099s, which detail your income. Next, access the fillable form on a compatible device. Enter your personal information accurately, including your name, address, and Social Security number. Follow the prompts to input your income details and any applicable deductions. Once completed, review the information for accuracy before saving or submitting the form electronically.

Steps to complete the Rl 1 Summary Fillable

Completing the Rl 1 Summary Fillable involves a series of clear steps:

- Gather all relevant income documents, such as W-2s and 1099s.

- Access the fillable form on a computer or tablet.

- Input your personal information in the designated fields.

- Enter your income details from your documentation.

- Include any deductions or credits you may qualify for.

- Review the form for accuracy and completeness.

- Save the completed form and submit it as required.

Legal use of the Rl 1 Summary Fillable

The Rl 1 Summary Fillable serves a legal function in tax reporting. It is recognized by the Internal Revenue Service (IRS) and must be completed accurately to comply with federal tax laws. Failing to use the form correctly can lead to penalties, including fines or audits. It is crucial to ensure that all information reported on the form is truthful and complete to avoid any legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the Rl 1 Summary Fillable are critical for compliance. Typically, the form must be submitted by April fifteenth of the following tax year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is essential to stay informed about any changes to deadlines, as timely submission is necessary to avoid penalties.

Who Issues the Form

The Rl 1 Summary Fillable is issued by the Internal Revenue Service (IRS). This federal agency is responsible for collecting taxes and enforcing tax laws in the United States. The IRS provides guidelines and resources for taxpayers to ensure proper completion and submission of the form, making it a reliable source for any questions regarding the Rl 1 Summary Fillable.

Create this form in 5 minutes or less

Find and fill out the correct rl 1 summary fillable

Create this form in 5 minutes!

How to create an eSignature for the rl 1 summary fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Rl 1 Summary Fillable form?

An Rl 1 Summary Fillable form is a digital document that allows users to input and submit their information electronically. This form is designed to streamline the process of reporting income and deductions, making it easier for businesses and individuals to manage their tax obligations.

-

How can I create an Rl 1 Summary Fillable form using airSlate SignNow?

Creating an Rl 1 Summary Fillable form with airSlate SignNow is simple. You can start by selecting a template or uploading your own document, then use our intuitive editing tools to make it fillable. Once completed, you can easily share it with others for eSigning.

-

Is there a cost associated with using the Rl 1 Summary Fillable feature?

Yes, airSlate SignNow offers various pricing plans that include access to the Rl 1 Summary Fillable feature. Our plans are designed to be cost-effective, ensuring that businesses of all sizes can benefit from our eSigning solutions without breaking the bank.

-

What are the benefits of using an Rl 1 Summary Fillable form?

Using an Rl 1 Summary Fillable form provides numerous benefits, including increased efficiency and reduced paperwork. It allows for quick data entry and submission, minimizes errors, and ensures that all necessary information is captured accurately, making tax reporting easier.

-

Can I integrate the Rl 1 Summary Fillable form with other software?

Absolutely! airSlate SignNow supports integrations with various software applications, allowing you to connect your Rl 1 Summary Fillable form with tools you already use. This integration helps streamline your workflow and enhances productivity.

-

Is the Rl 1 Summary Fillable form secure?

Yes, security is a top priority at airSlate SignNow. Our Rl 1 Summary Fillable forms are protected with advanced encryption and security protocols, ensuring that your sensitive information remains safe and confidential throughout the signing process.

-

Can I track the status of my Rl 1 Summary Fillable form?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your Rl 1 Summary Fillable form. You will receive notifications when the document is viewed, signed, or completed, giving you peace of mind throughout the process.

Get more for Rl 1 Summary Fillable

Find out other Rl 1 Summary Fillable

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form