Loan Product Form 1999

What is the Loan Product Form

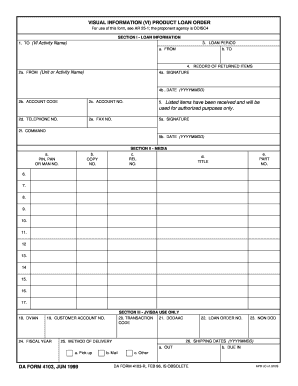

The Loan Product Form is a crucial document used by financial institutions to collect essential information from borrowers seeking loans. This form typically includes personal identification details, financial history, and specific loan requirements. It serves as a foundational element in the loan application process, ensuring that lenders can assess the eligibility and creditworthiness of applicants effectively.

Steps to complete the Loan Product Form

Completing the Loan Product Form involves several key steps:

- Gather necessary personal information, including your name, address, and Social Security number.

- Provide financial details such as income, employment history, and current debts.

- Specify the type of loan you are applying for and the amount needed.

- Review the form for accuracy and completeness before submission.

Ensuring that all information is correct helps expedite the loan approval process and reduces the likelihood of delays.

How to use the Loan Product Form

The Loan Product Form is used by individuals or businesses applying for various types of loans, including personal, auto, and mortgage loans. To use the form effectively, follow these guidelines:

- Fill out all required fields accurately.

- Attach any supporting documentation, such as proof of income or credit history.

- Submit the form through the designated method, whether online, by mail, or in person.

Proper usage of the form ensures that lenders have all the necessary information to process your loan application efficiently.

Required Documents

When completing the Loan Product Form, certain documents are typically required to support your application. These may include:

- Proof of identity, such as a driver's license or passport.

- Income verification, such as recent pay stubs or tax returns.

- Credit history report, which may be obtained through a credit bureau.

- Documentation of any existing debts or financial obligations.

Having these documents ready can facilitate a smoother application process and enhance your chances of approval.

Legal use of the Loan Product Form

The Loan Product Form must be used in accordance with applicable laws and regulations governing lending practices. This includes ensuring that:

- The information provided is truthful and accurate.

- All disclosures required by law are included, such as interest rates and terms.

- Borrowers understand their rights and obligations under the loan agreement.

Adhering to these legal requirements helps protect both borrowers and lenders and promotes fair lending practices.

Eligibility Criteria

Eligibility for loans typically depends on various factors outlined in the Loan Product Form. Common criteria include:

- Minimum credit score requirements.

- Proof of stable income or employment.

- Debt-to-income ratio assessments.

- Age and residency status.

Understanding these criteria can help applicants prepare their submissions and improve their chances of receiving loan approval.

Create this form in 5 minutes or less

Find and fill out the correct loan product form

Create this form in 5 minutes!

How to create an eSignature for the loan product form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Loan Product Form?

A Loan Product Form is a customizable document that allows businesses to collect essential information from borrowers efficiently. With airSlate SignNow, you can create and manage these forms seamlessly, ensuring a smooth application process for your clients.

-

How does airSlate SignNow enhance the Loan Product Form process?

airSlate SignNow streamlines the Loan Product Form process by enabling electronic signatures and real-time collaboration. This means that your clients can fill out and sign forms from anywhere, reducing turnaround time and improving overall efficiency.

-

What are the pricing options for using the Loan Product Form feature?

airSlate SignNow offers flexible pricing plans that cater to different business needs. You can choose a plan that includes the Loan Product Form feature, ensuring you get the best value for your investment while enhancing your document management capabilities.

-

Can I integrate the Loan Product Form with other software?

Yes, airSlate SignNow allows for seamless integration with various third-party applications. This means you can connect your Loan Product Form with CRM systems, payment processors, and other tools to create a comprehensive workflow that meets your business requirements.

-

What benefits does the Loan Product Form provide for my business?

The Loan Product Form offers numerous benefits, including improved accuracy, faster processing times, and enhanced customer satisfaction. By utilizing airSlate SignNow, you can ensure that your loan applications are handled efficiently, leading to better business outcomes.

-

Is it easy to customize the Loan Product Form?

Absolutely! airSlate SignNow provides an intuitive interface that allows you to easily customize your Loan Product Form. You can add fields, adjust layouts, and incorporate branding elements to ensure the form aligns with your business identity.

-

How secure is the information collected through the Loan Product Form?

Security is a top priority at airSlate SignNow. The information collected through the Loan Product Form is protected with advanced encryption and compliance with industry standards, ensuring that your clients' data remains safe and confidential.

Get more for Loan Product Form

Find out other Loan Product Form

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online