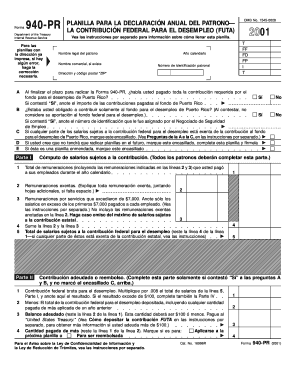

940 Pr Form

What is the 940 Pr Form

The 940 Pr Form is a tax document used by employers in the United States to report annual Federal Unemployment Tax Act (FUTA) taxes. This form is essential for businesses that pay unemployment taxes, as it helps the Internal Revenue Service (IRS) track the amount owed and paid by employers. The form consolidates information regarding wages, employee counts, and tax liabilities, ensuring compliance with federal regulations.

How to use the 940 Pr Form

To effectively use the 940 Pr Form, employers must gather relevant payroll information from the tax year, including the total wages paid to employees and any adjustments for prior periods. The form requires accurate calculations of the unemployment tax owed, which is typically a percentage of the taxable wages. Once completed, the form must be submitted to the IRS by the designated deadline, ensuring that all information is correct to avoid penalties.

Steps to complete the 940 Pr Form

Completing the 940 Pr Form involves several key steps:

- Gather Information: Collect payroll records, including total wages and employee counts for the year.

- Calculate Tax: Determine the total FUTA tax owed based on taxable wages.

- Fill Out the Form: Enter the required information accurately, ensuring all calculations are correct.

- Review: Double-check the form for accuracy and completeness before submission.

- Submit: Send the completed form to the IRS by the specified deadline, either electronically or by mail.

Legal use of the 940 Pr Form

The 940 Pr Form is legally binding when completed accurately and submitted on time. It must comply with IRS regulations to ensure that the information provided is valid and can be used for tax assessment purposes. Employers are responsible for maintaining records that support the data reported on the form, as these may be requested during audits or reviews by the IRS.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines associated with the 940 Pr Form to avoid penalties. The form is typically due by January 31 of the year following the tax year being reported. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is essential for employers to mark their calendars and prepare in advance to ensure timely submission.

Key elements of the 940 Pr Form

The 940 Pr Form includes several key elements that must be accurately filled out:

- Employer Identification Number (EIN): A unique number assigned to the business for tax purposes.

- Total Payments to Employees: The total amount of wages subject to FUTA tax.

- Taxable Wages: The portion of wages that are subject to unemployment tax.

- FUTA Tax Calculation: The computed tax based on taxable wages.

- Signature: The form must be signed by an authorized individual, confirming the accuracy of the information provided.

Quick guide on how to complete 940 pr 2001 form

Effortlessly Prepare [SKS] on Any Device

Online document management has gained popularity among businesses and individuals alike. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without complications. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to Modify and eSign [SKS] with Ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as an old-fashioned wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method for submitting your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing additional copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device of your choice. Modify and eSign [SKS] and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 940 Pr Form

Create this form in 5 minutes!

How to create an eSignature for the 940 pr 2001 form

How to generate an eSignature for the 940 Pr 2001 Form online

How to generate an eSignature for the 940 Pr 2001 Form in Chrome

How to make an eSignature for putting it on the 940 Pr 2001 Form in Gmail

How to make an electronic signature for the 940 Pr 2001 Form straight from your mobile device

How to create an electronic signature for the 940 Pr 2001 Form on iOS

How to make an eSignature for the 940 Pr 2001 Form on Android devices

People also ask

-

What is a 940 Pr Form and why is it important?

The 940 Pr Form is essential for employers to report annual unemployment tax contributions to the IRS in Puerto Rico. Understanding this form is crucial for compliance, as failure to file can result in penalties. Using airSlate SignNow can simplify the process of completing and eSigning the 940 Pr Form accurately.

-

How does airSlate SignNow streamline the completion of the 940 Pr Form?

airSlate SignNow offers a user-friendly platform where you can easily fill out the 940 Pr Form electronically. The software provides templates and guides to ensure all necessary fields are completed. This reduces errors and saves time during tax preparation.

-

Is there a fee to use airSlate SignNow for the 940 Pr Form?

Yes, airSlate SignNow operates on a subscription-based model, but it offers various pricing plans to fit different business needs. Costs are generally lower than traditional signing methods, making it a cost-effective solution for managing the 940 Pr Form. Additionally, the value of time saved often offsets the subscription expense.

-

What features does airSlate SignNow offer for managing tax documents like the 940 Pr Form?

airSlate SignNow provides several features for managing documents, including secure eSigning, collaboration tools, and automated workflows. For the 940 Pr Form, these features allow for seamless tracking and sharing with stakeholders. This enhances productivity and ensures all parties are aligned on the form’s status.

-

Can I integrate airSlate SignNow with other software to manage the 940 Pr Form?

Yes, airSlate SignNow offers integration capabilities with popular accounting software and platforms. This allows for a streamlined process when working on the 940 Pr Form, as data can be transferred easily between systems, reducing duplication of effort and enhancing accuracy.

-

What are the benefits of using airSlate SignNow over traditional methods for the 940 Pr Form?

Using airSlate SignNow for the 940 Pr Form offers several advantages, including increased efficiency, enhanced security, and ease of use. Traditional methods can be time-consuming and prone to error, while airSlate SignNow minimizes these risks with its electronic signing and tracking features. This ensures a smoother filing process.

-

Is airSlate SignNow compliant with regulations related to the 940 Pr Form?

Yes, airSlate SignNow is designed to comply with federal regulations governing eSigning and document management. This means that when you use airSlate SignNow for the 940 Pr Form, you can trust that the process adheres to industry standards for security and legality, ensuring peace of mind for your business.

Get more for 940 Pr Form

- If you are not required to make estimated tax payments for you can discard this package form

- Instruction 941 schedule b pr rev february instructions for schedule b form 941 pr report of tax liability for semiweekly

- Form 990 schedule c political campaign and lobbying activities

- Department of the treasury internal revenue service notice 1382 january changes for form 1023 mailing address parts ix and x

- Form 1041 t allocation of estimated tax payments to beneficiaries under code section 643g for calendar year or fiscal year

- Instruction 1065 schedule c instructions for schedule c form 1065 additional information for schedule m 3 filers

- Instructions for form 1099 h instructions for form 1099 h health coverage tax credit hctc advance payments

- Form 1120 schedule o rev december

Find out other 940 Pr Form

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation