Department of Taxation2017 Tax Rate Schedules Form

What is the Department Of Taxation2017 Tax Rate Schedules

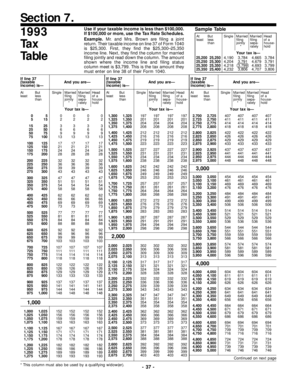

The Department Of Taxation2017 Tax Rate Schedules are official documents that outline the tax rates applicable for various income brackets for the tax year 2017. These schedules are essential for individuals and businesses in calculating their tax liabilities accurately. They provide a structured overview of how much tax is owed based on different income levels, ensuring compliance with federal and state tax regulations.

How to use the Department Of Taxation2017 Tax Rate Schedules

To effectively use the Department Of Taxation2017 Tax Rate Schedules, individuals should first locate their taxable income within the schedules. By identifying the correct income bracket, taxpayers can determine the applicable tax rate. It is important to apply any relevant deductions or credits before calculating the total tax owed. This ensures that the tax liability reflects the taxpayer's true financial situation.

Steps to complete the Department Of Taxation2017 Tax Rate Schedules

Completing the Department Of Taxation2017 Tax Rate Schedules involves several key steps:

- Gather all necessary financial documents, including income statements and previous tax returns.

- Identify your filing status, as this will affect the tax rates applicable to you.

- Locate the appropriate tax rate schedule for your income level.

- Calculate your taxable income by subtracting any eligible deductions from your gross income.

- Use the schedule to find your tax rate and calculate the total tax owed.

- Review your calculations for accuracy before submission.

Legal use of the Department Of Taxation2017 Tax Rate Schedules

The legal use of the Department Of Taxation2017 Tax Rate Schedules is crucial for ensuring compliance with tax laws. These schedules are recognized by the IRS and state tax authorities as valid references for determining tax liabilities. Properly utilizing these schedules helps prevent potential legal issues related to tax evasion or underreporting income.

Filing Deadlines / Important Dates

Filing deadlines for the Department Of Taxation2017 Tax Rate Schedules typically align with the annual tax filing season. Generally, individual taxpayers must submit their returns by April fifteenth of the following year. It is important to stay informed about any extensions or changes to these deadlines, as they can vary by state or due to specific circumstances.

Penalties for Non-Compliance

Failure to comply with the Department Of Taxation2017 Tax Rate Schedules can result in significant penalties. Taxpayers may face fines for late filings, underpayment of taxes, or inaccuracies in their tax returns. Understanding the potential consequences of non-compliance emphasizes the importance of accurately completing and submitting the necessary forms on time.

Quick guide on how to complete department of taxation2017 tax rate schedules

Complete [SKS] effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Handle [SKS] on any platform using airSlate SignNow Android or iOS applications and simplify any document-centric process today.

The easiest way to modify and eSign [SKS] without effort

- Locate [SKS] and then click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign feature, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Decide how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign [SKS] while ensuring excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Department Of Taxation2017 Tax Rate Schedules

Create this form in 5 minutes!

How to create an eSignature for the department of taxation2017 tax rate schedules

How to create an eSignature for the Department Of Taxation2017 Tax Rate Schedules in the online mode

How to generate an eSignature for your Department Of Taxation2017 Tax Rate Schedules in Chrome

How to make an electronic signature for signing the Department Of Taxation2017 Tax Rate Schedules in Gmail

How to make an electronic signature for the Department Of Taxation2017 Tax Rate Schedules straight from your smart phone

How to create an eSignature for the Department Of Taxation2017 Tax Rate Schedules on iOS devices

How to generate an eSignature for the Department Of Taxation2017 Tax Rate Schedules on Android devices

People also ask

-

What are the Department Of Taxation2017 Tax Rate Schedules?

The Department Of Taxation2017 Tax Rate Schedules provide detailed guidelines on income tax rates applicable for the year 2017. These schedules help individuals and businesses calculate their tax liabilities accurately. It's essential to refer to these schedules to ensure compliance with 2017 tax regulations.

-

How can airSlate SignNow assist with managing the Department Of Taxation2017 Tax Rate Schedules?

airSlate SignNow simplifies the process ofDocument preparation and signing related to the Department Of Taxation2017 Tax Rate Schedules. With our easy-to-use platform, you can quickly create, send, and manage your tax-related documents. This streamlines your workflow and ensures accuracy in your tax submissions.

-

What pricing options does airSlate SignNow offer for businesses needing the Department Of Taxation2017 Tax Rate Schedules?

airSlate SignNow offers flexible pricing plans designed to accommodate businesses of all sizes. Our plans provide cost-effective solutions for managing documents related to the Department Of Taxation2017 Tax Rate Schedules. Contact us for a personalized quote based on your needs.

-

Are there any features specifically designed for handling the Department Of Taxation2017 Tax Rate Schedules?

Yes, airSlate SignNow includes features such as customizable templates and automated workflows that cater specifically to tax documentation. These tools can help you efficiently manage documents tied to the Department Of Taxation2017 Tax Rate Schedules, ensuring that all necessary information is captured.

-

Can airSlate SignNow integrate with other accounting software for the Department Of Taxation2017 Tax Rate Schedules?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software to enhance your workflow when dealing with the Department Of Taxation2017 Tax Rate Schedules. This ensures that all your tax-related documents are synchronized, making it easier to manage your financial records.

-

What are the benefits of using airSlate SignNow for tax document management, including the Department Of Taxation2017 Tax Rate Schedules?

Using airSlate SignNow for your tax document management, including the Department Of Taxation2017 Tax Rate Schedules, provides numerous benefits such as increased efficiency, reduced errors, and enhanced compliance. Our platform ensures that documents are signed electronically and stored securely, simplifying the entire tax process.

-

Is airSlate SignNow secure for handling sensitive documents related to the Department Of Taxation2017 Tax Rate Schedules?

Yes, airSlate SignNow is committed to security and compliance. Our platform employs advanced encryption and secure data storage practices to protect sensitive documents related to the Department Of Taxation2017 Tax Rate Schedules. You can engage with confidence knowing your information is safeguarded.

Get more for Department Of Taxation2017 Tax Rate Schedules

- 5305 s form

- Form 6729 c rev september fill in capable quality return review sheet

- Form 8810 fill in capable corporate passive activity loss and credit limitations

- Form 8850 rev june fill in capable pre screening notice and certification request for the work opportunity credit

- Form 8915 fill in capable

- Form 9325 rev march fill in capable acknowledgement and general information for taxpayers who file returns electronically

- Form 9661 rev june fill in capable tce program cooperative agreement

- Form 13206 rev august fill in capable volunteer assistance summary report

Find out other Department Of Taxation2017 Tax Rate Schedules

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer